WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

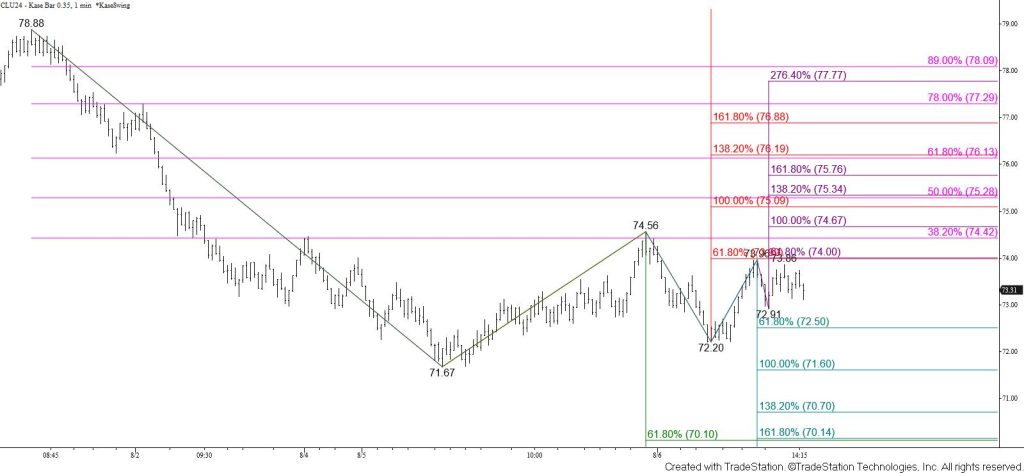

WTI crude oil tested and held major support and a bearish decision point for the coming months at $71.5 on Monday. This is an area where the move down could stall and a bullish reversal occurs. However, the move up from $71.67 has been shallow and choppy so far and looks like a simple correction.

Today’s candlestick reflects a bit of near-term uncertainty, but the outlook continues to lean bearish for WTI crude oil. Taking out the $72.5 smaller than (0.618) target of the wave down from $74.56 will call for another test and attempt to close below $71.5. Settling below $71.5 will open the way for tests of $70.7 and then another confluent and psychologically important target at $70.1 in the coming days.

Nevertheless, there is still a reasonable chance for a larger test of resistance first. Should WTI crude oil overcome the $74.0 smaller than target of the waves up from $71.67 and $72.2 look for a test of $74.7 and key near-term resistance at $75.2. Settling above $75.2 would call for an extended correction to challenge $76.1 and possibly higher.