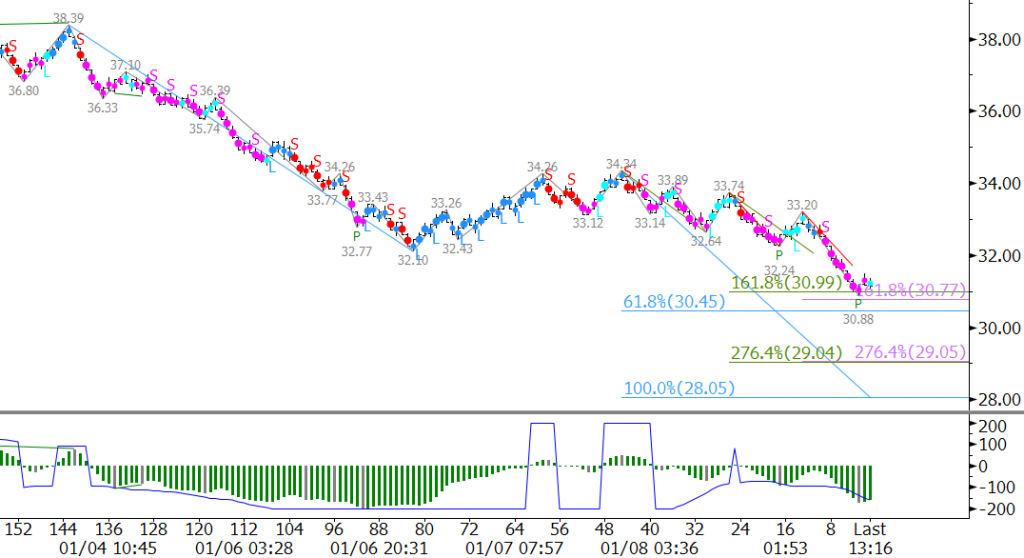

Supply disruptions due to wildfires in Alberta and militant attacks in Nigeria were reportedly offsetting rising stockpiles of crude oil and surging OPEC output. However, those factors seem to be easing, and may not have as much of an impact on supply as originally indicated.

U.S. crude inventories reached their highest level since 1929, but rig counts continue to decline and U.S. output reportedly dropped the most in eight months during the week ended April 29.

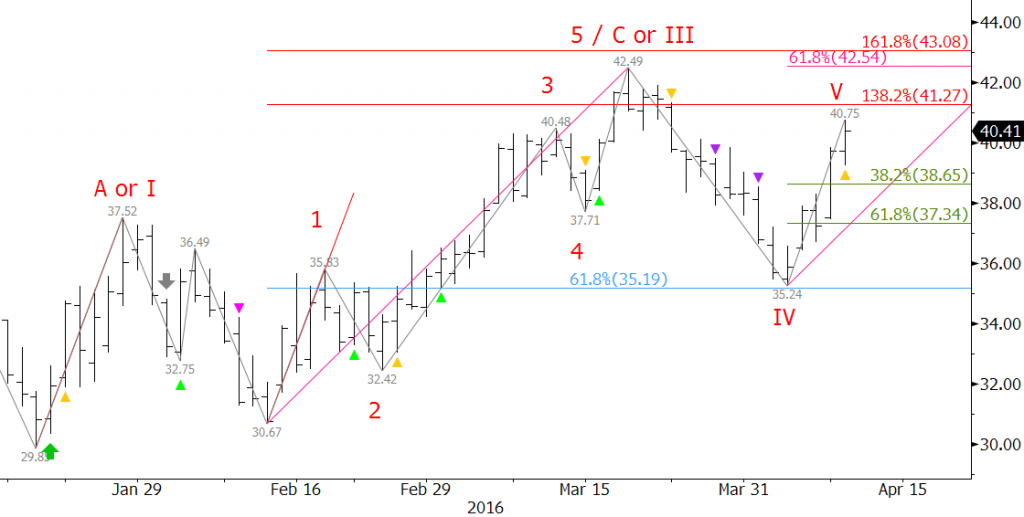

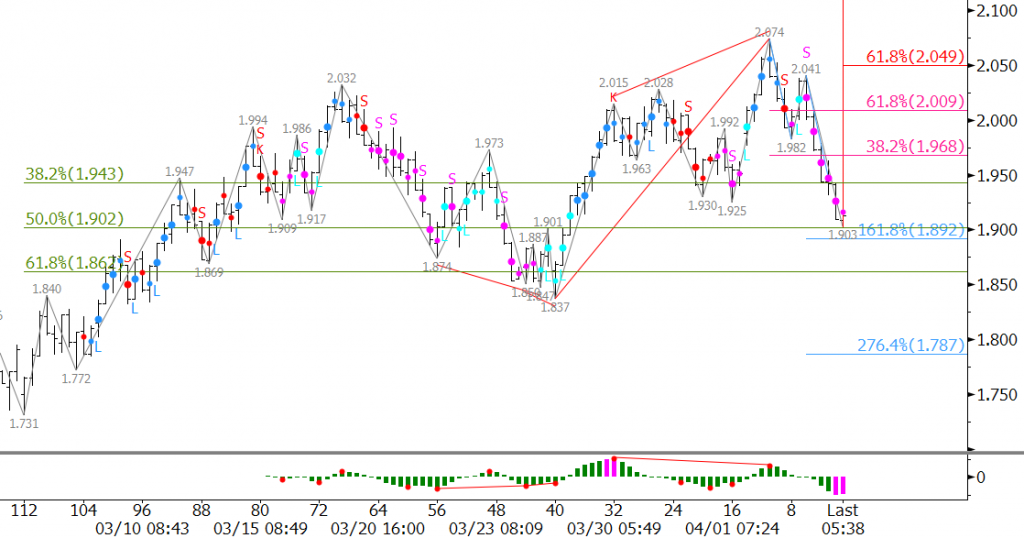

Some analysts and traders believe the move up may have been too much too fast, and that the market is taking a much needed breather after rising four weeks in a row prior to last week. Sentiment is also becoming more negative, indicating the move down should extend.

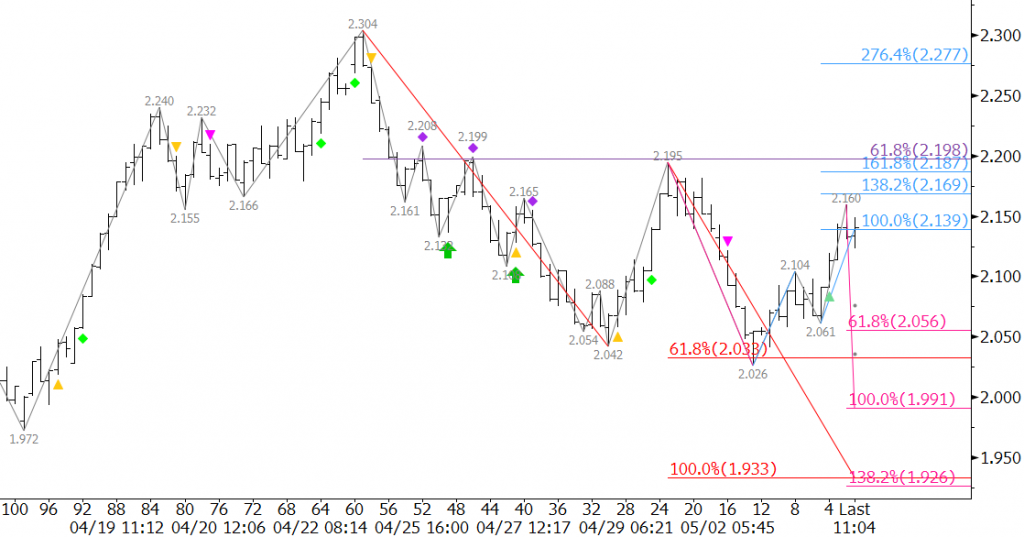

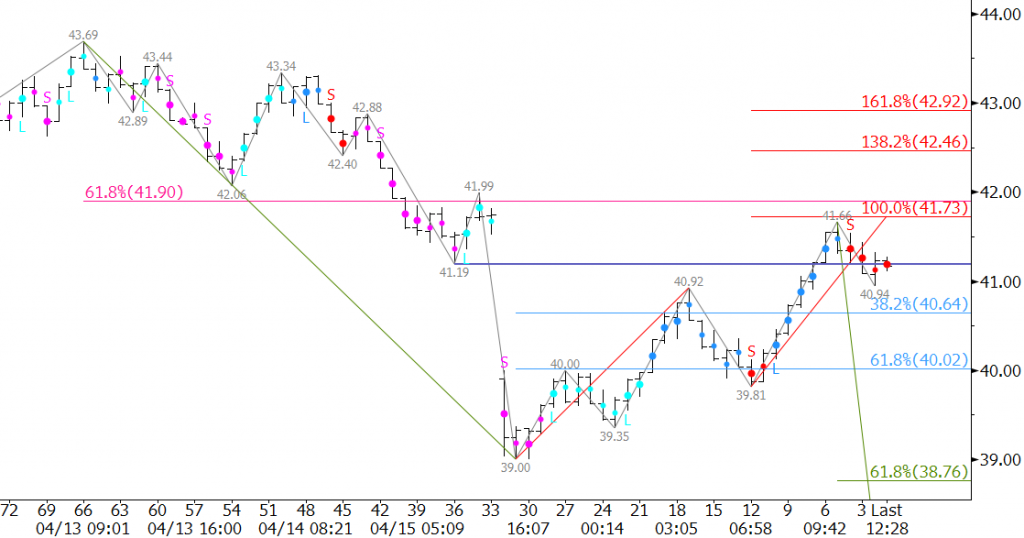

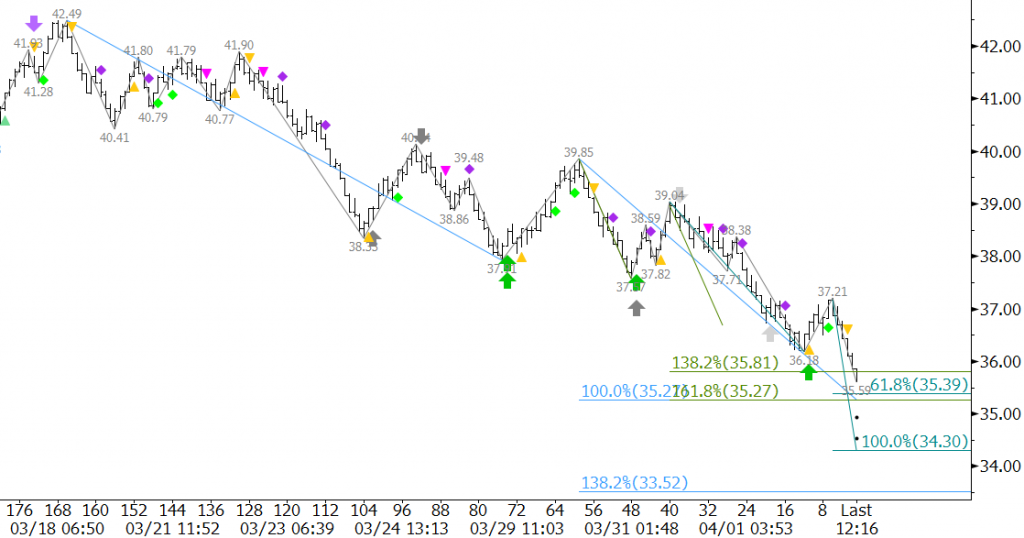

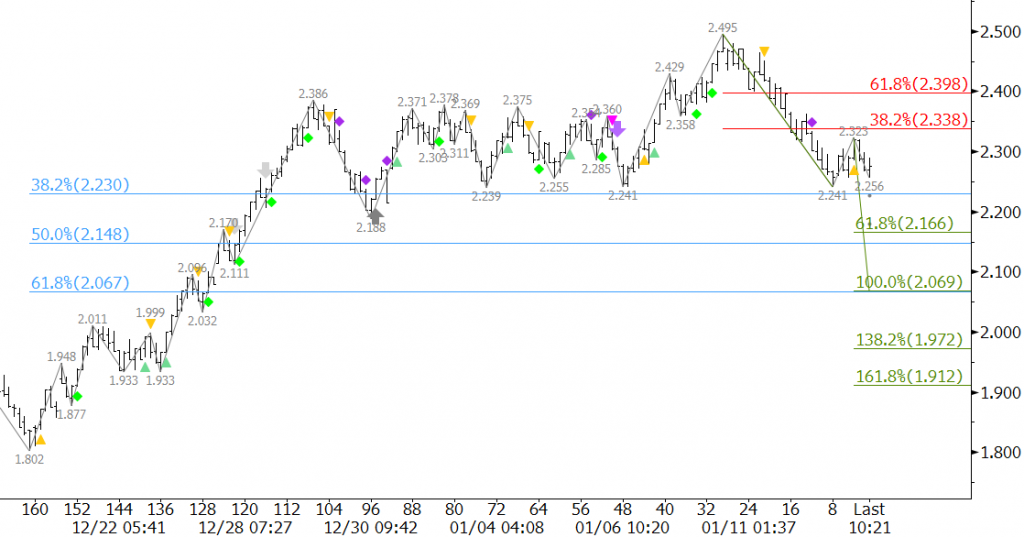

June WTI crude oil challenged key resistance at $46.1 a few times over the past several days. This level has held so far, and should continue to hold as the corrective move down extends. The wave formations down from $46.78 and $46.07 indicate June should decline to at least $42.5. This is a confluent wave projection and the last major swing low. A close below $42.5 would call for $42.0 and lower.

That said, at this point, we do not foresee that prices will fall apart. We expect trading to remain choppy. Look for $44.3 to hold upon a test of resistance early tomorrow before the decline continues. Crucial resistance for tomorrow is $44.9. We doubt prices will rise this high unless spurred by random events. Key resistance remains $46.1. A close above $46.1 would indicate the correction is over, and in turn, open the way for the next leg higher.

This is a brief analysis and outlook for the next day or so. Our weekly Crude Oil Commentary is a much more detailed and thorough energy price forecast. If you are interested in learning more, please sign up for a complimentary four-week trial.