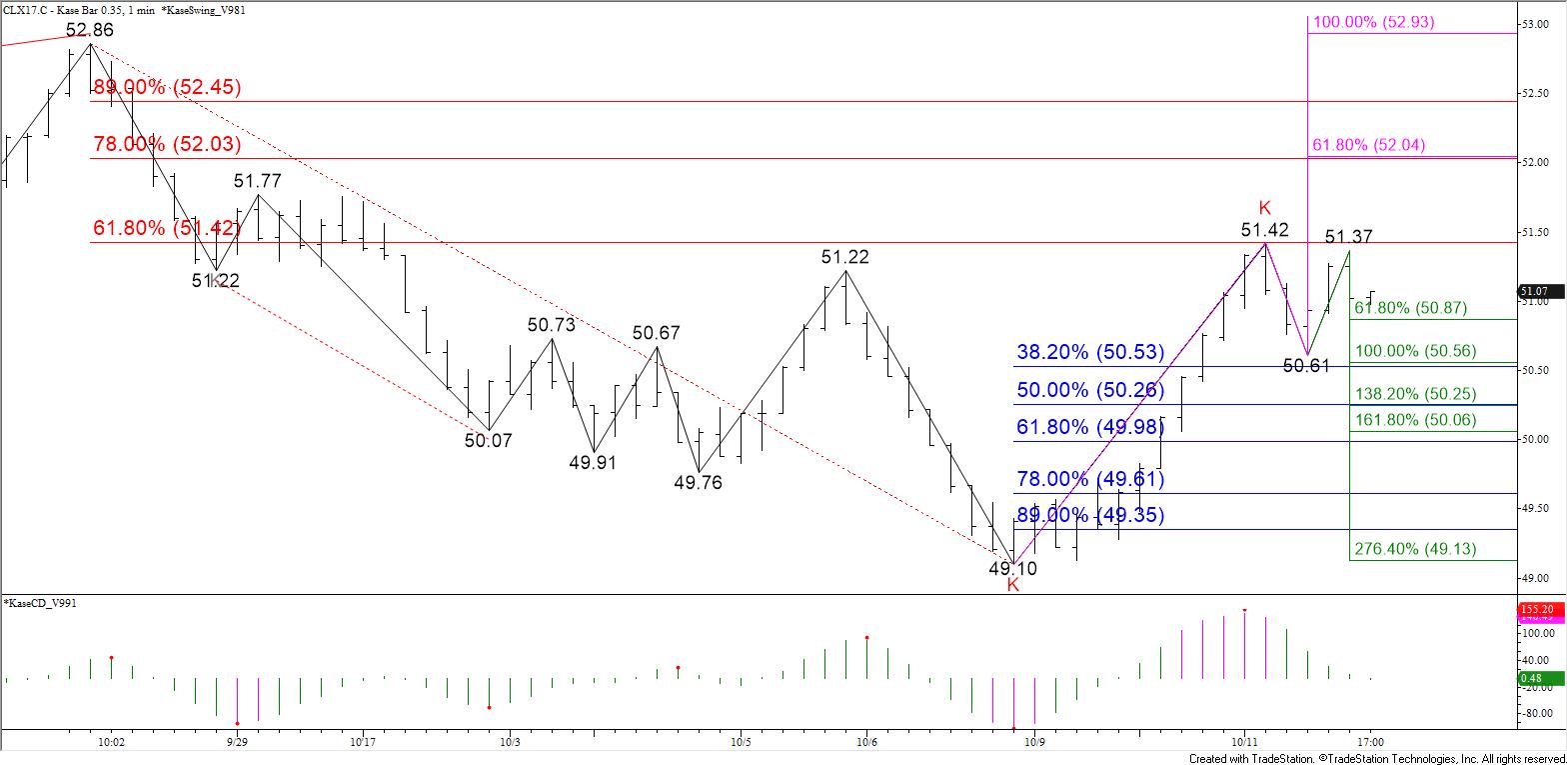

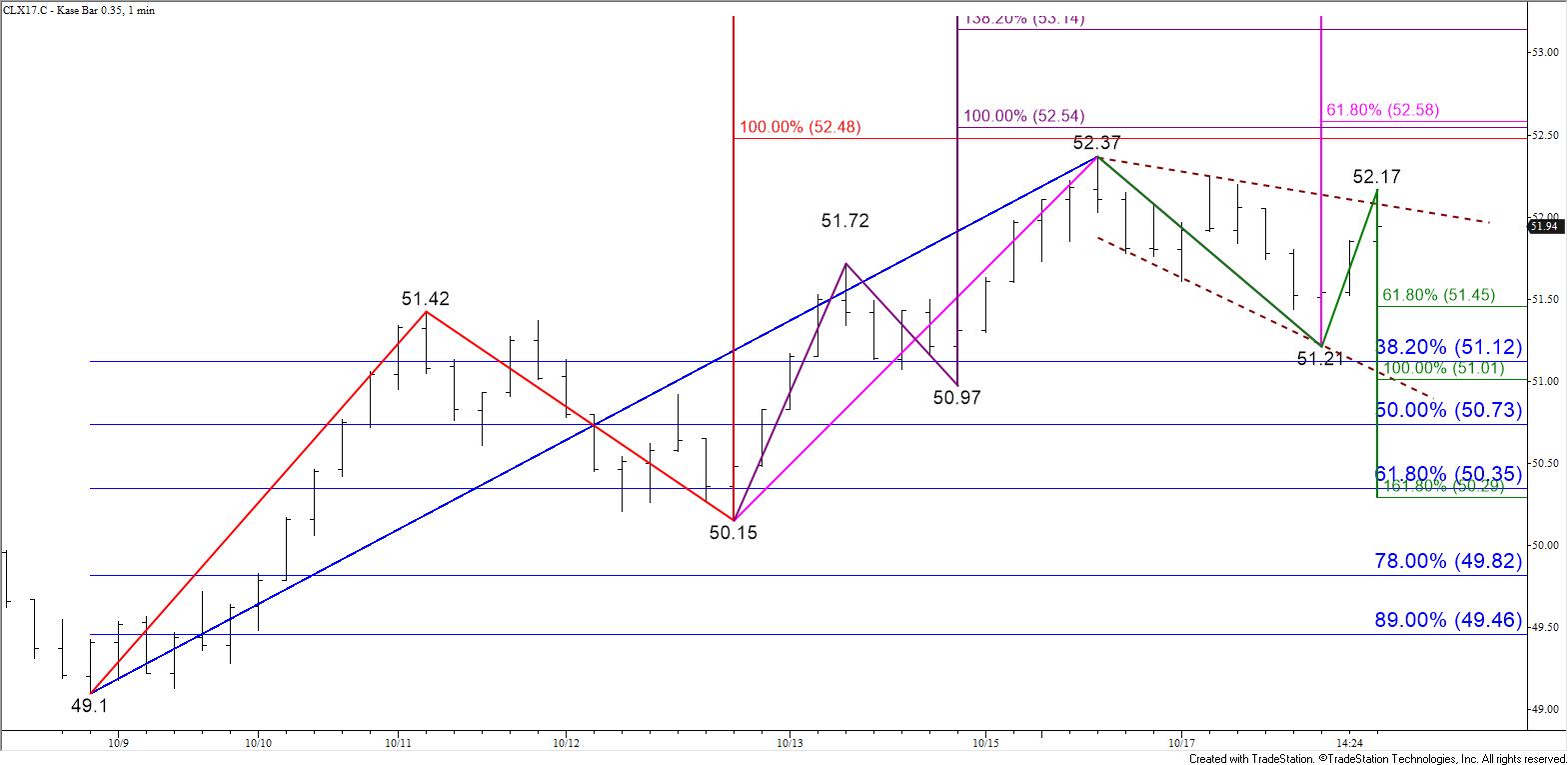

WTI crude oil met support at $51.3 before stalling at $51.21. The move down has been choppy and forms a bullish wedge on the $0.35 Kase Bar chart. The move up from $51.21 was aggressive and is poised to break higher out of the wedge and challenge key resistance at $52.5 again tomorrow. A close above this would open the way for $53.0, $53.5, and ultimately $54.2, the next major objective.

That said, prices pulled back a bit this afternoon, therefore a test of $51.4 might take place first, but support is expected to hold. A move below $51.4 before $52.5 is met would call for $51.1 and possibly $50.3. The near-term outlook becomes negative again upon a close below $50.3, the 62 percent retracement of the move up from $49.1 and the 1.618 projection of the wave $52.37 – 51.21 – 52.17.

This is a brief analysis for the next day or so. Our weekly Crude Oil Commentary and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.