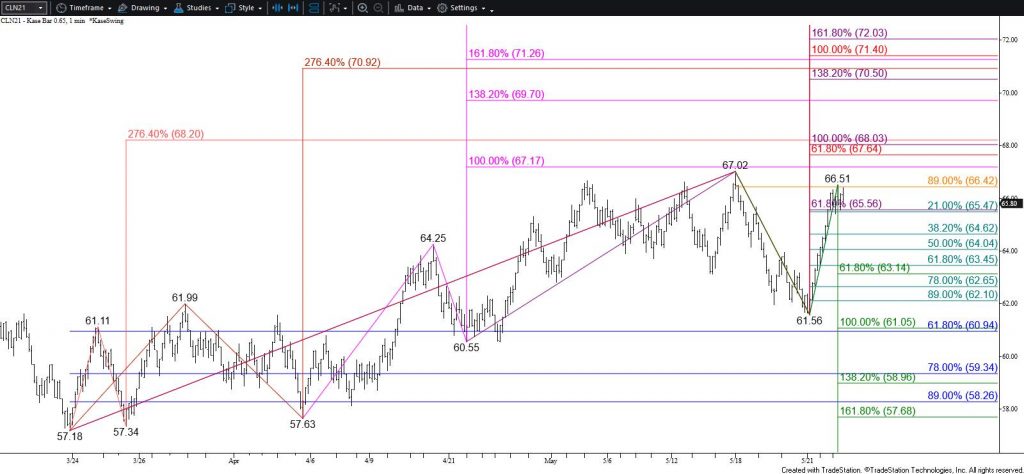

WTI Crude Oil Technical Analysis and Short-Term Forecast

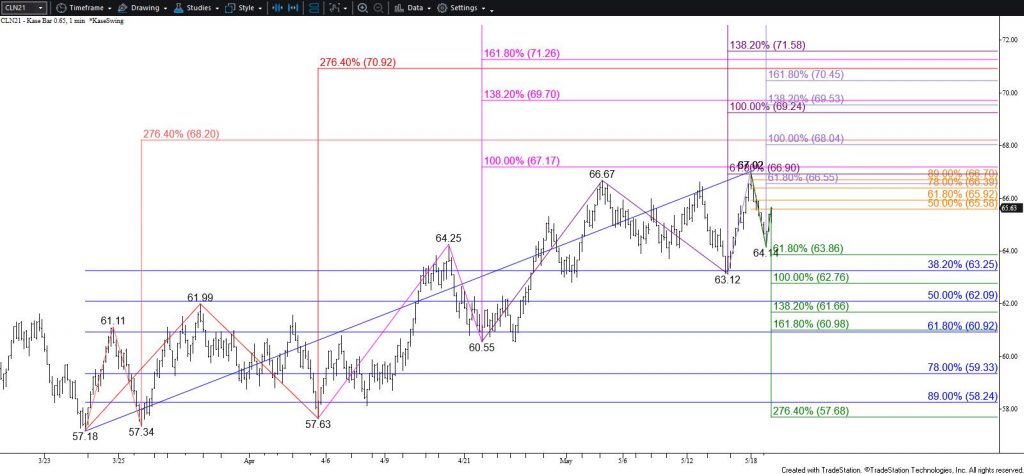

The near-term outlook for WTI crude oil is bullish due to the sustained close above the 62 percent retracement of the decline from $67.02 and the $65.56 smaller than (0.618) target of the compound wave up from $60.55. This wave calls for a test of $68.1, the connection to which is made through $67.4. Closing above $67.4 would also indicate that WTI has definitively overcome $67.0, which has been strong resistance for several weeks.

Nevertheless, today’s formation of a bearish doji dampens odds for reaching $67.4 and $68.1 tomorrow. This pattern also suggests a test of $64.8 might take place first. This level is expected to hold. Closing below $64.8 would complete the doji and call for a test of key near-term support at $63.3. This is in line with the 62 percent retracement of the rise from $67.02 and the smaller than target of the wave down from that same swing high. Closing below $63.3 is doubtful but would call for a deeper test of support before the move up continues.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.