Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

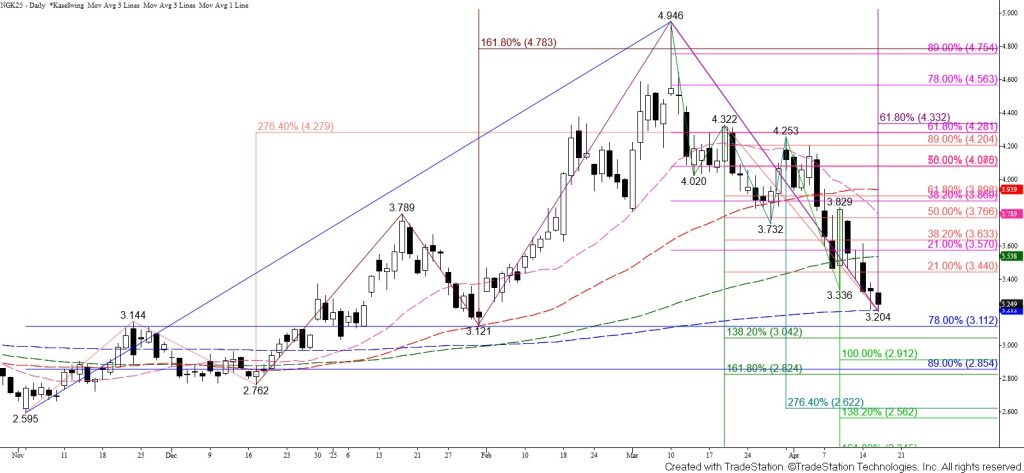

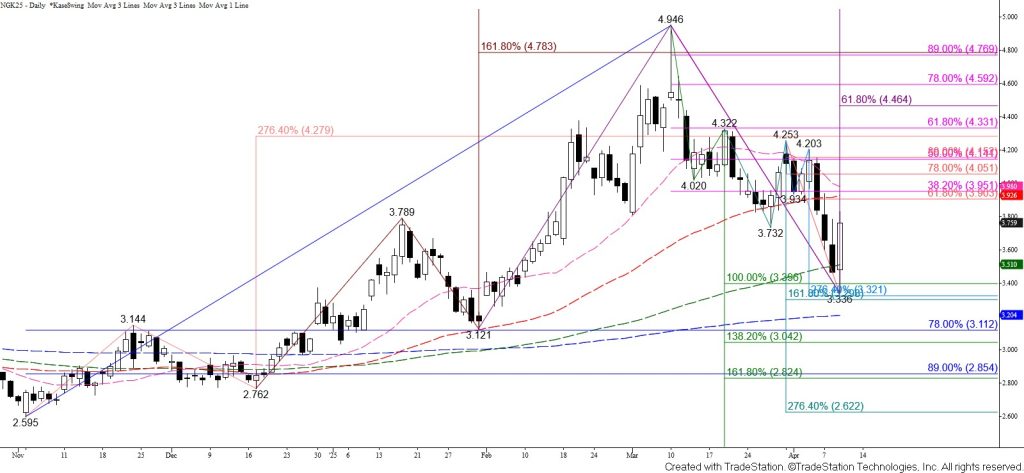

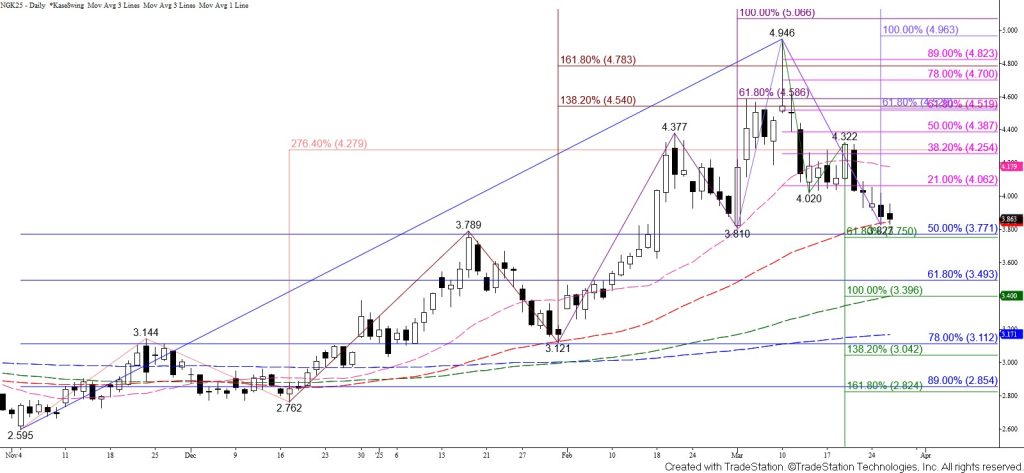

Natural gas continued to decline but is struggling to settle below the 200-day moving average at $3.21. Even so, today’s move down negated Tuesday’s hammer, and the primary wave down from $4.946 favors a test of its $3.04 intermediate (1.382) target. Therefore, the outlook remains bearish. The connection to $3.04 is made through a confluent but structurally minor target at $3.14. The $3.04 objective is a key target and probable stalling point for both the May contract and the continuation chart. Once $3.04 is met, a test of resistance is anticipated.

There are no bullish patterns or signals that call for a reversal. Even so, should the 200-day moving average continue to hold and prices overcome $3.32, look for a test of $3.38 and possibly key near-term resistance at $3.44.