Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

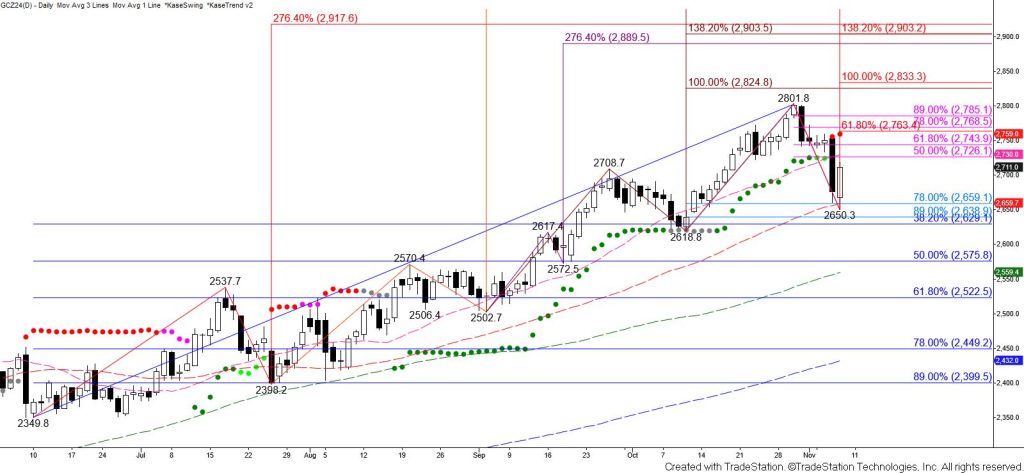

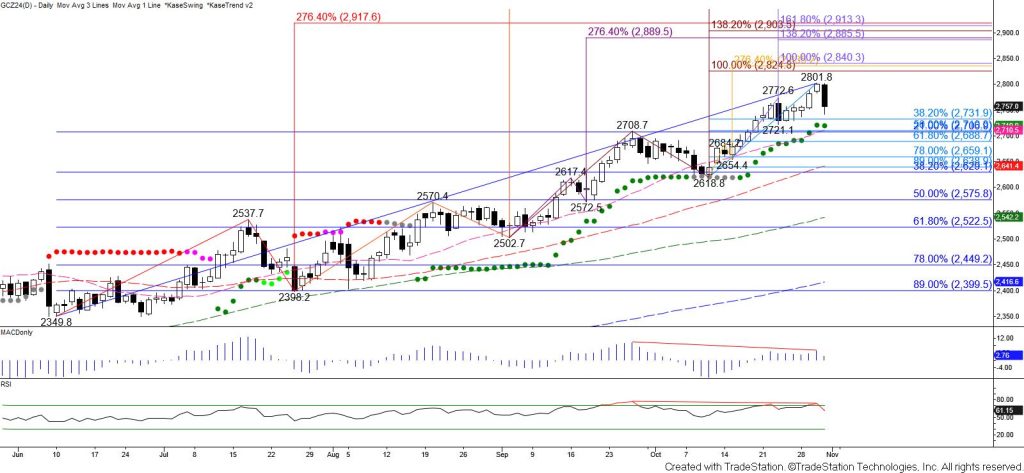

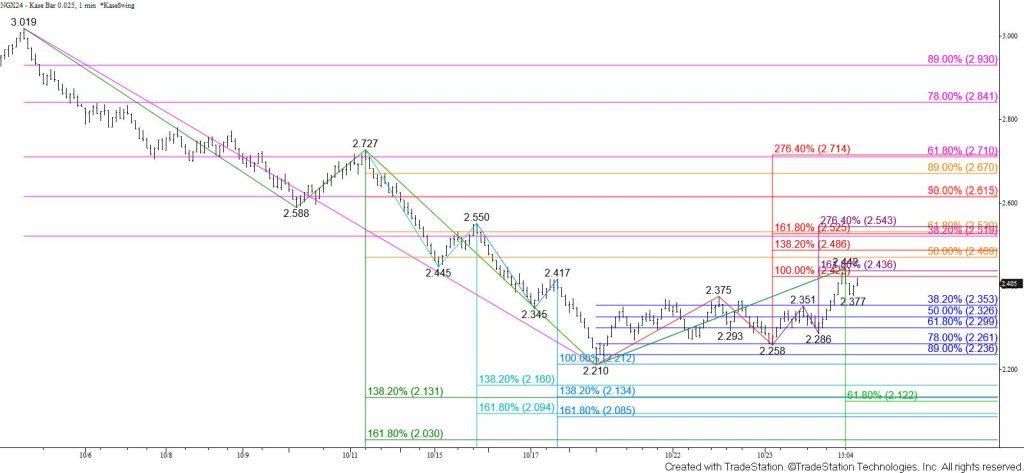

December gold fell below the $2565 equal to (1.00) target of the wave down from $2801.8, the $2549 smaller than (0.618) target of the wave down from $2718.3, the 50 percent retracement of the rise from $2349.8, and the 100-day moving average today. Gold settled below the 50 percent retracement. Otherwise, the other important support targets held on a closing basis and a daily hammer formed. Daily bullish KasePO and KaseCD momentum divergence signals and an oversold KasePO PeakOut signal also formed at the $2541.5 swing low on the $10 Kase Bar chart.

The outlook for gold remains bearish and closing below $2555 will call for a test of the 62 percent retracement of the rise from $2349.8 at $2527. Settling below this will open the way for the next highly confluent target at $2503.

Nevertheless, given the confluence of support in the area tested today, a correction might occur first. Today’s hammer and the confirmation of intra-day bullish momentum signals also suggest that such a move will probably take place first. A move up will likely be a correction but there is a good chance for a test of $2595 first. This is the smaller than target of the current wave up from $2541.5 and overcoming this will call for a test of at least the $2610 equal to (1.00) target. The $2610 level will likely hold. Rising above $2610 would call for key near-term resistance at $2639 to be challenged.