Gold Technical Analysis and Near-Term Outlook

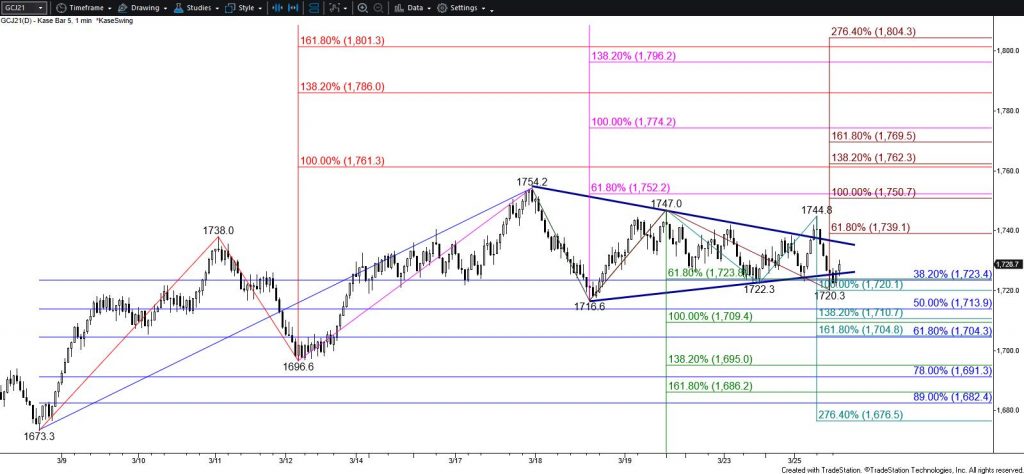

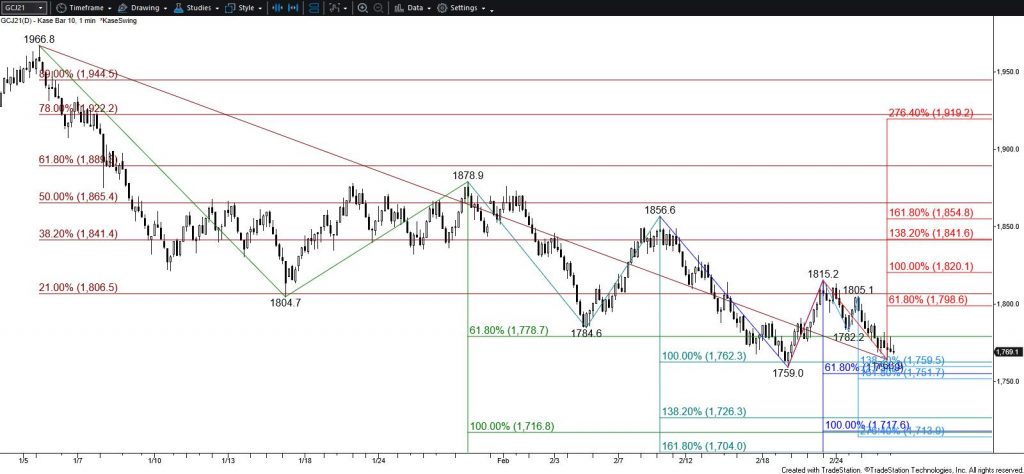

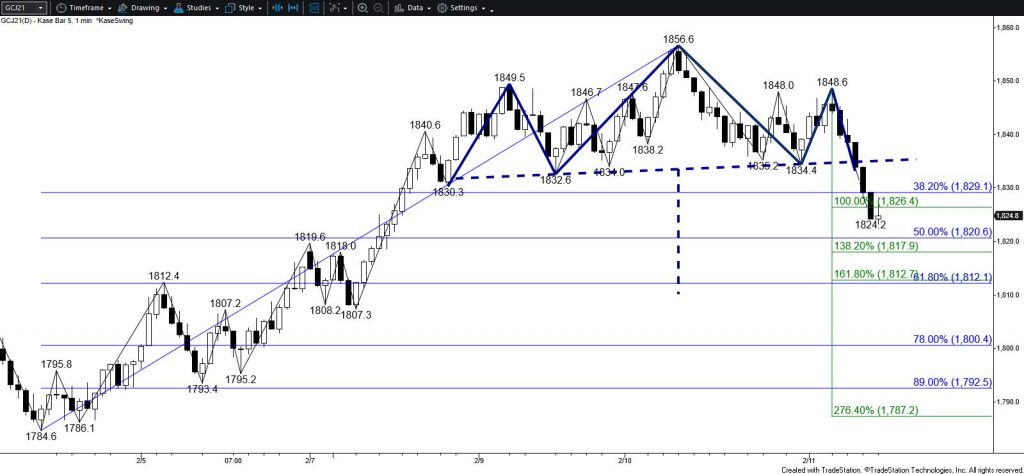

Gold’s pullback from $1798.4 has been shallow and choppy compared to the prior move up. So far, the pullback has held $1752. This is the 38 percent retracement of the rise from $1677.3 and the equal to (1.00) target of the primary wave down from $1798.4. This means the decline is most likely corrective. Therefore, near-term odds favor a continued rise.

There is immediate resistance at $1881 but closing above $1791 would overcome the $1789.9 swing high and invalidate the primary wave down from $1798.4. Given the resilience of the pullback, settling above $1791 would also be a strong indication that the correction is complete, clearing the way for the next major targets at $1806 and $1837.

With that said, downside risk is increasing. Closing below $1752 would call for a test of $1738 and possibly key support at $1724. The $1738 level is expected to hold due to its confluence. The $1724 threshold is key because it is the 62 percent retracement of the rise from $1677.3. Settling below this would imply that the move up is over and shift longer-term odds back in favor of a continued decline.

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.