Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

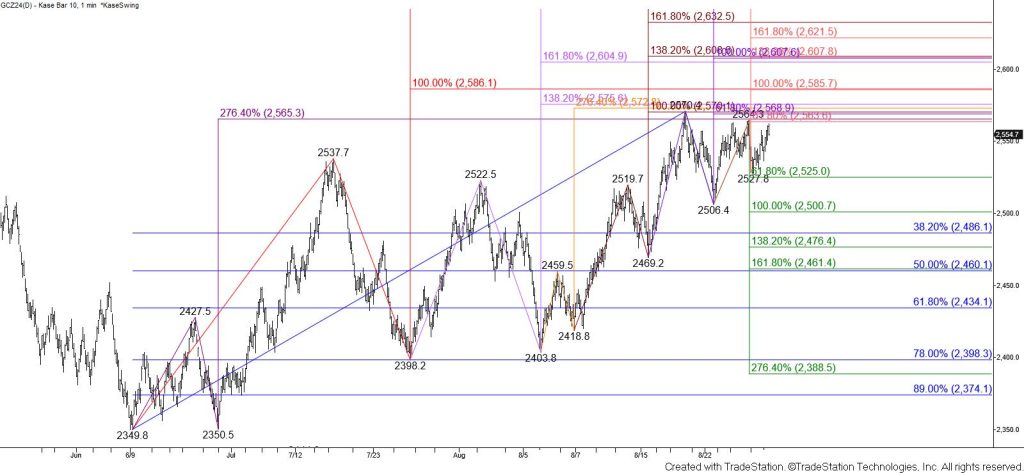

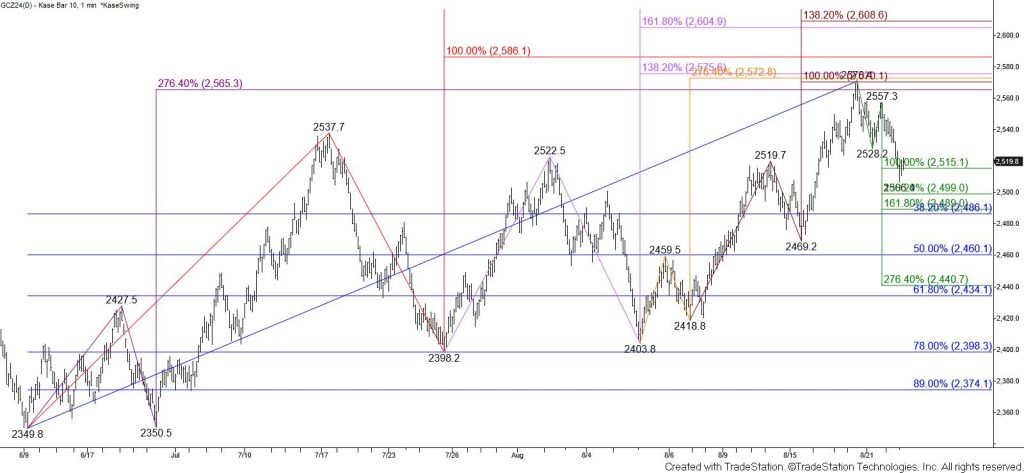

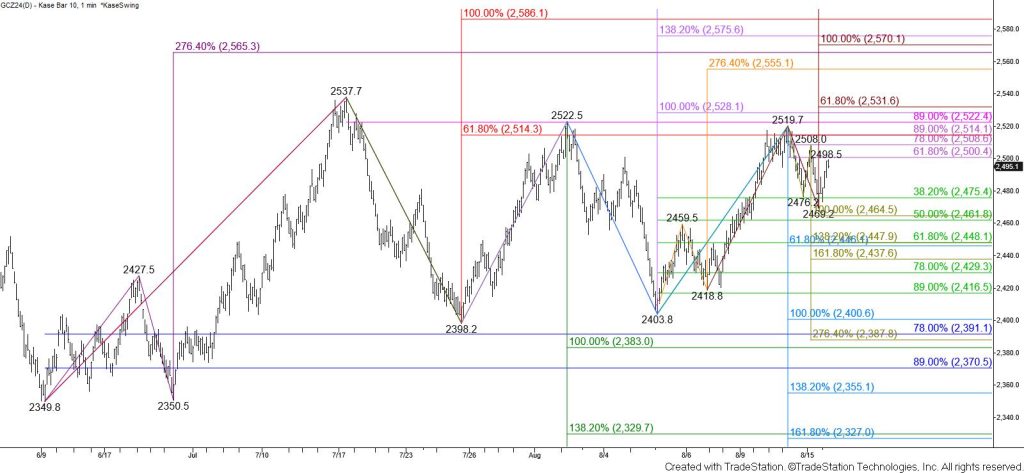

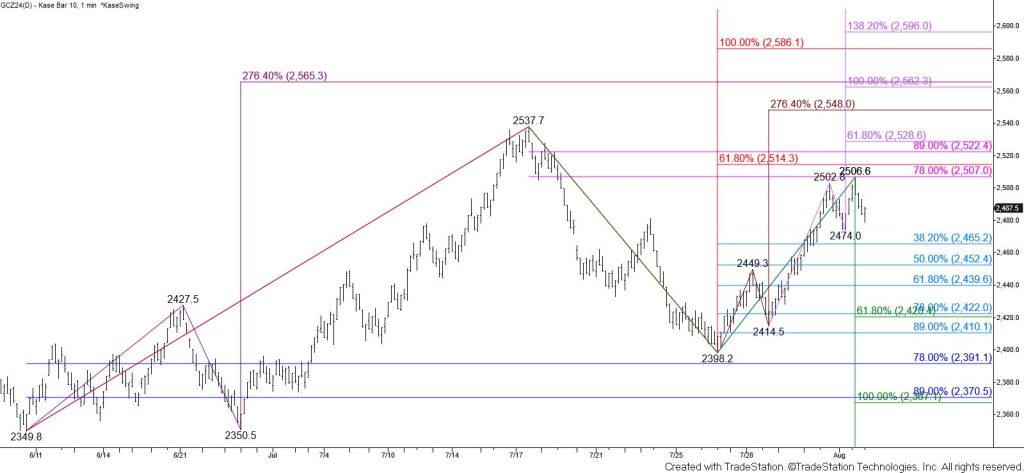

December gold finally broke higher out of a bullish wedge after forming a shortfall within the pattern last Friday. Gold also settled above an important area of resistance between $2565 and $2570. The $2586 equal to (1.00) target of the wave up from $2349.8 was also tested and held on a closing basis. Even so, today’s break higher out of the wedge was bullish for the outlook in the coming days and weeks.

The move up is now poised to reach another confluent objective at $2605. This is the most confluent target on the chart and might prove to be a temporary stalling point. Closing above $2605 will clear the way for a push to $2630 and higher.

Should a throwback occur after testing and holding $2586 look for the upper trend line of the wedge at $2554 to hold. A throwback to test the breakout point of a bullish pattern is somewhat common. Taking out $2554 would warn of a false breakout. Settling below $2535 would confirm this is the case and put the near-term odds in favor of testing $2521 and $2497 in the coming days.