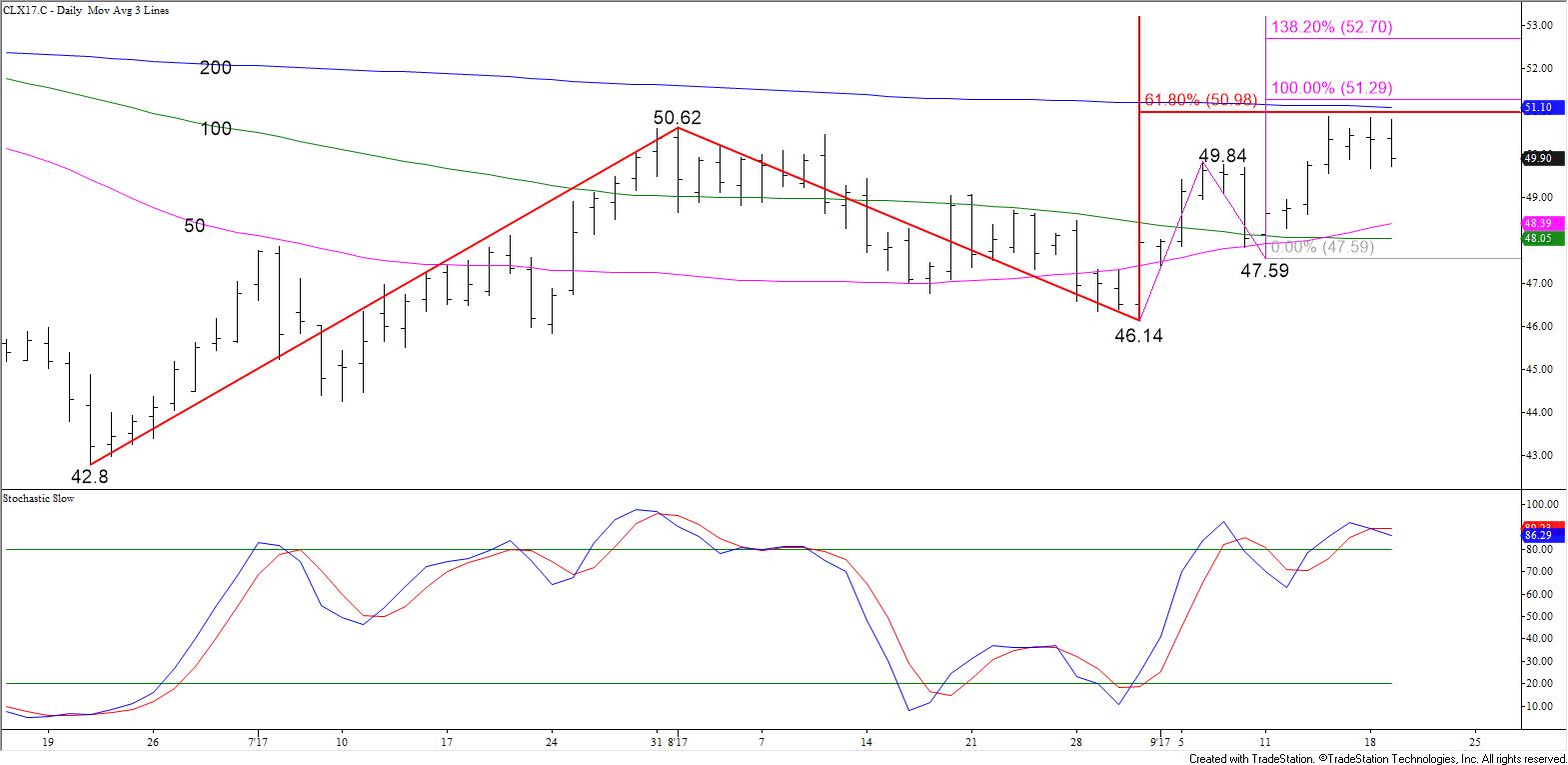

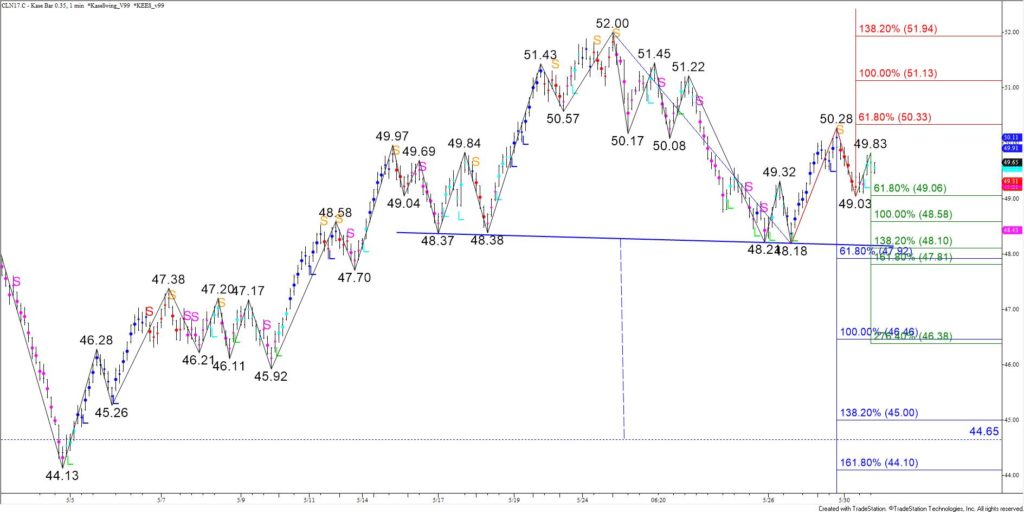

November WTI crude oil met the 62 percent retracement of November’s decline from the 2017 $58.37 swing high to $42.8 at $52.42 when it rose to $52.43 early this morning. This is major resistance because it is also a confluent wave projection. Settling above $52.6, the upper end of the confluence range around $52.42, would be bullish for the long-term.

For now, the long-term outlook remains positive. However, normally, when such an important target is met a significant correction will take place before that objective is overcome on a sustained closing basis. Today’s pullback from $52.42 formed a bearish Harami line and star, which is a reversal pattern. These patterns are not highly reliable, but the overbought daily Stochastic, RSI and nearly overbought KasePO indicate a pullback should take place soon.

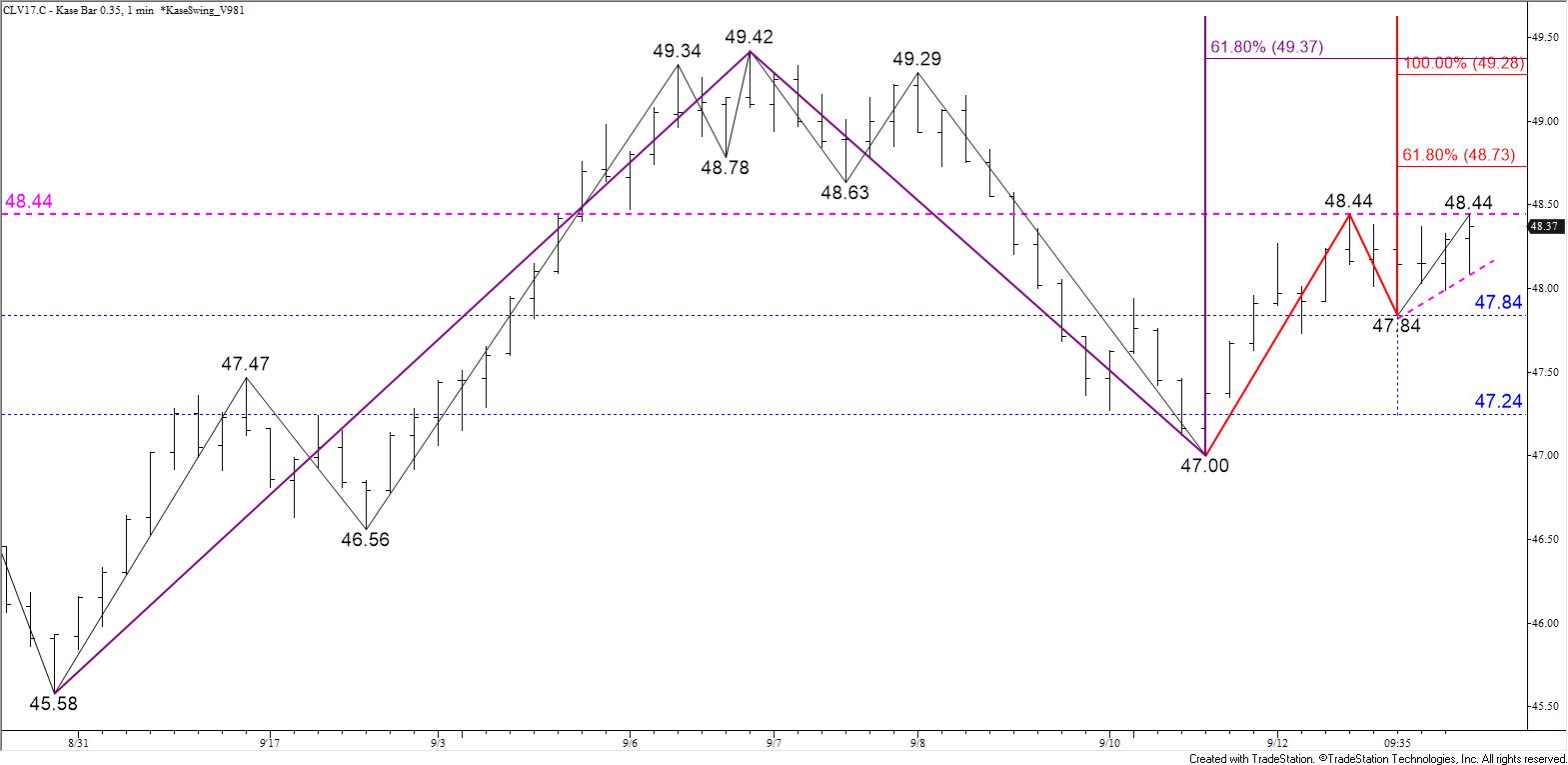

This afternoon’s move up after the API Petroleum Inventories report was released indicates $52.6 might be tested early tomorrow. However, we expect this level to hold and for the downward correction to extend to at least $51.4 tomorrow, which is in line with Monday’s $51.45 midpoint. A close below this would open the way for $51.0 and possibly lower.

At this point, even a normal correction of the move up from the $46.14 swing low could drop prices to $50.0 should the corrective pullback extend as expected.

This is a brief analysis for the next day or so. Our weekly Crude Oil Commentary and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.