WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

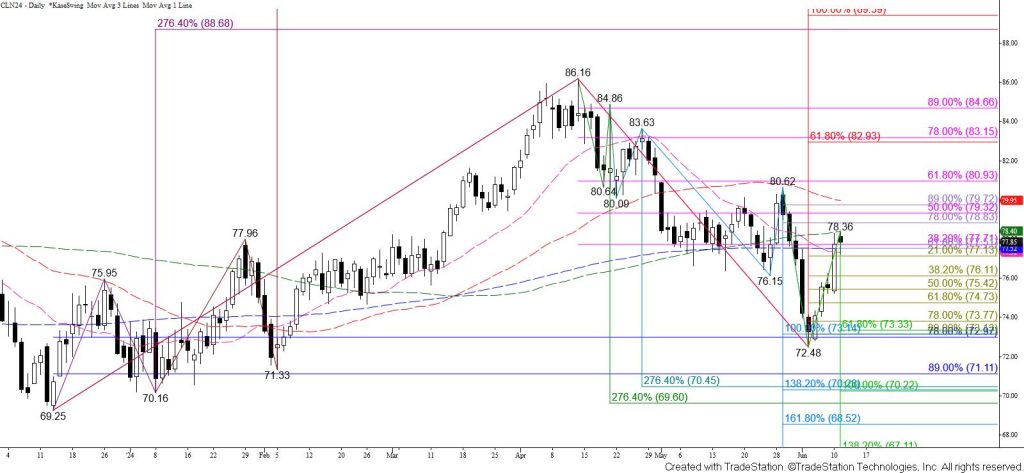

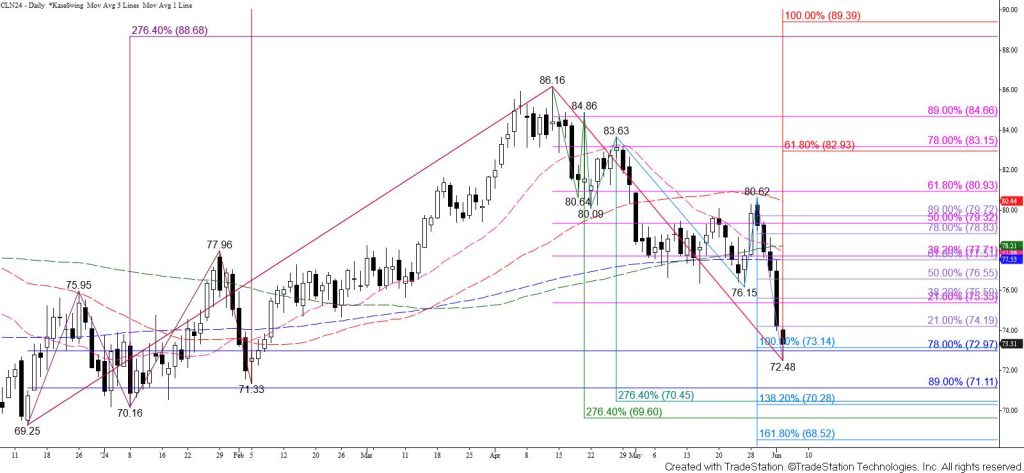

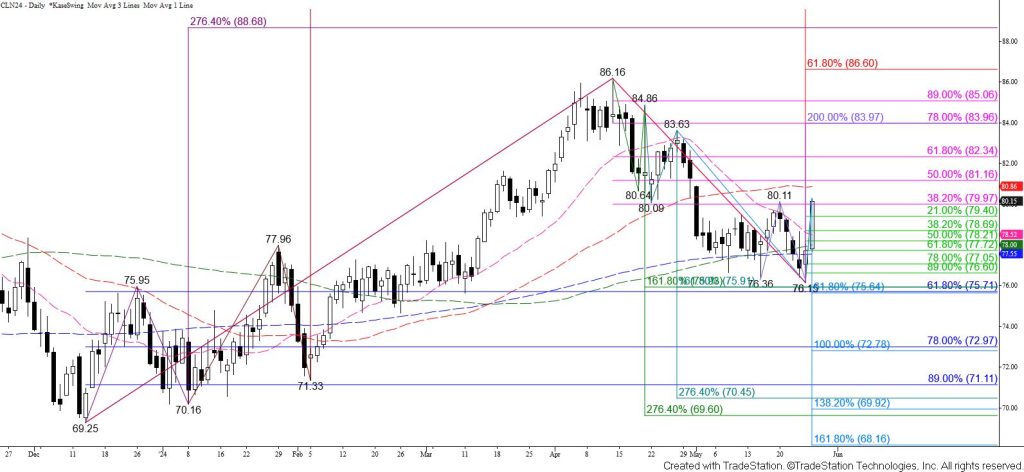

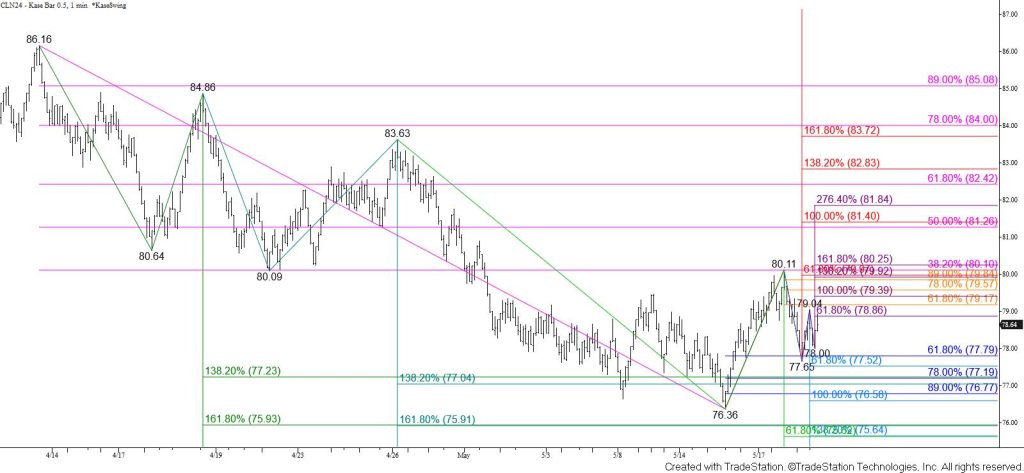

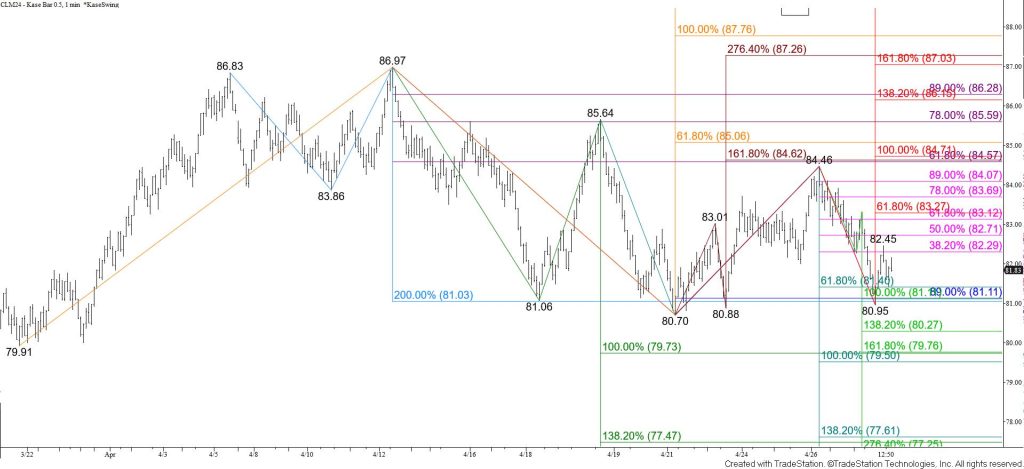

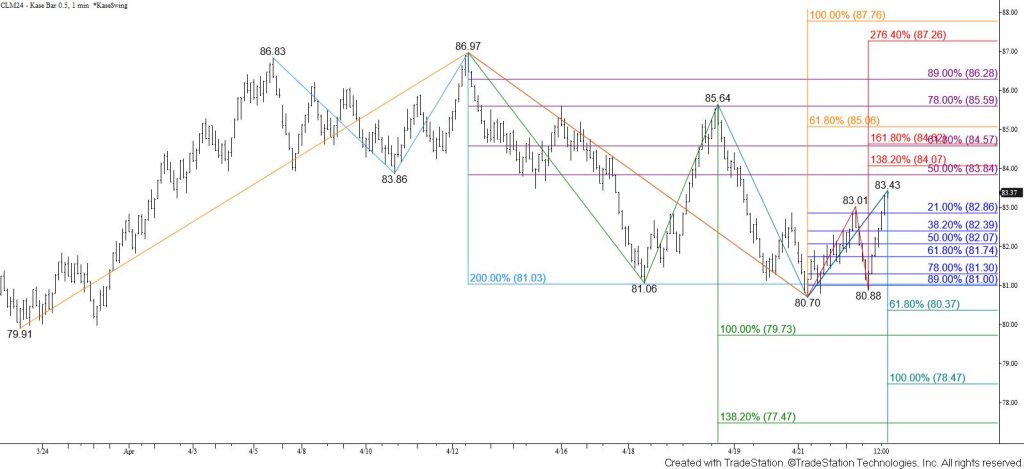

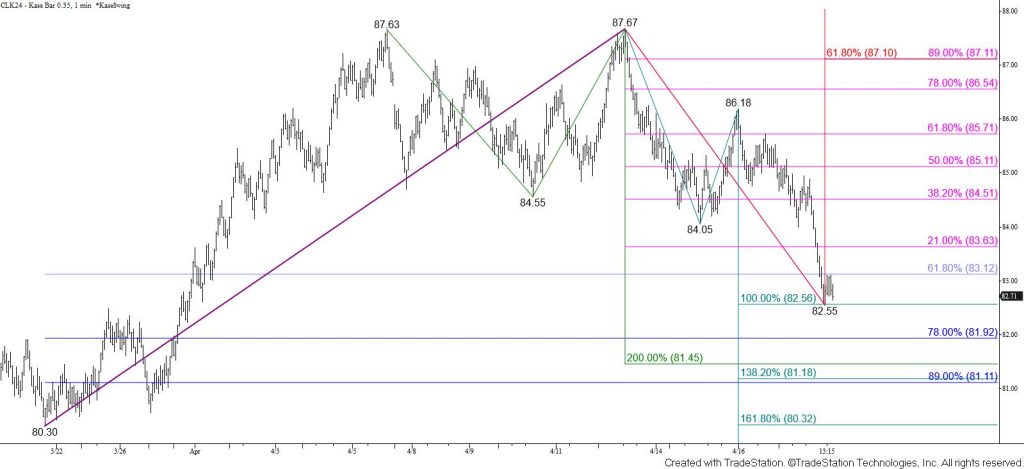

WTI crude oil overcame the $80.11 swing high and settled above the 62 percent retracement of the decline from $85.27. The daily Kase Trend indicator is bullish, the 10-day DMI and ADX reflect increasing bullish sentiment, and prices are trading above all major daily moving averages. These factors confirm a bullish reversal and trend.

The move up is now poised to test the $81.4 smaller than (0.618) target of the largest wave up from $72.44. Closing above this will call for a longer-term bullish decision point at $82.4, which is the smaller than target of the wave up from $69.22, to be challenged.

The move up is due for a correction. Overbought daily KaseCD and Stochastic oscillators warn that such a move might take place soon. Even so, there are no bearish patterns or confirmed signals that call for the move up to stall. Furthermore, any move down will likely be a correction.

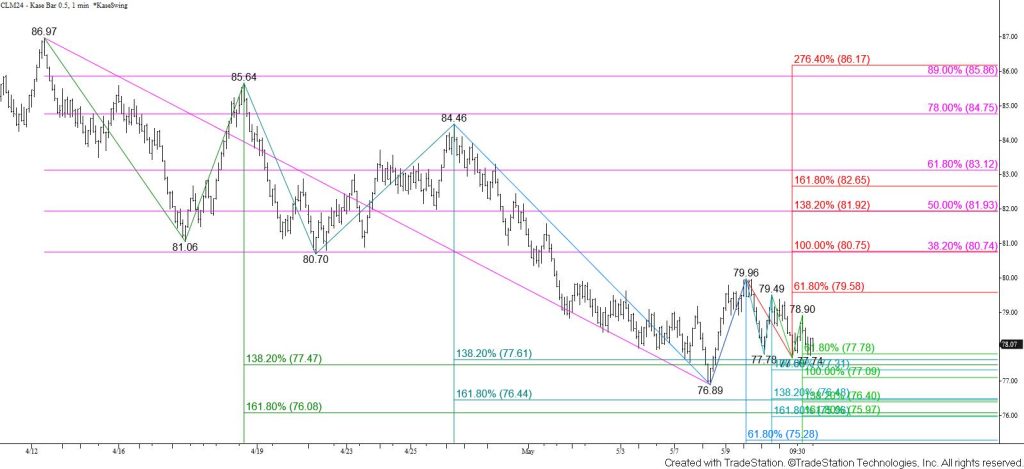

Should prices turn lower tomorrow, look for initial support at $79.9 and key near-term support at $79.0. Settling below $79.0 will call for a deeper test of support where $77.6 is most important.