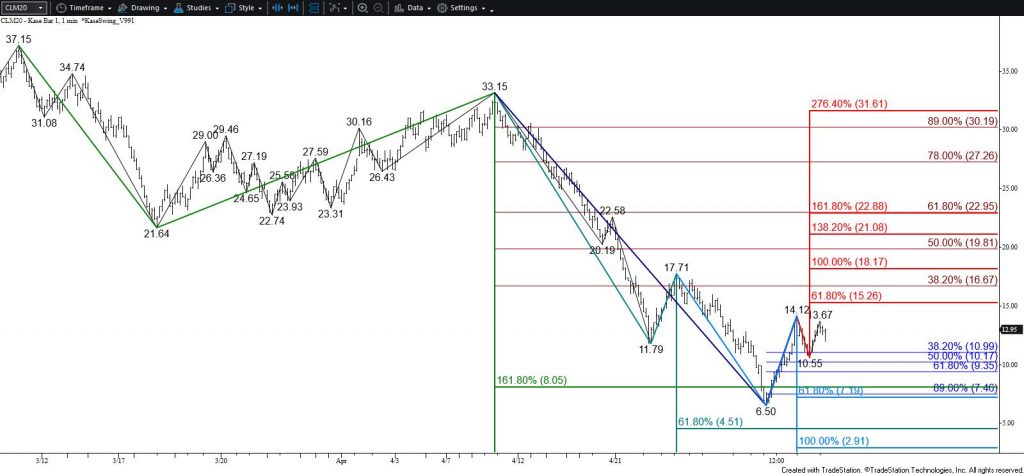

WTI Crude Oil Price Forecast

WTI crude oil held crucial support at $11.0 on a closing basis and formed a bullish hammer today. Sentiment remains firmly bearish, but today’s prices action suggests a test of $15.0 will probably take place before prices fall below $10.0. Closing above $15.0 will complete the hammer and clear the way for a test of the pattern’s $16.7 confirmation point. Key resistance and the barrier for a more positive outlook is $17.5, the smaller than (0.618) target of the primary wave up from $6.50. Closing above this would call for WTI to rise toward $21.8.

Without help from bullish external factors, the move up from $10.07 will likely prove to be corrective. Should WTI close below $11.0 before overcoming $15.0, near-term odds will shift back in favor of $9.9, $8.6, and possibly lower.

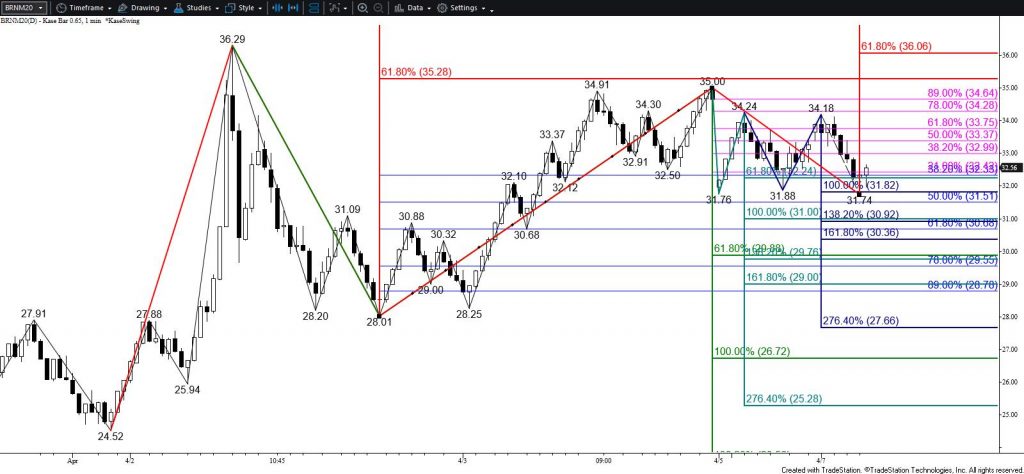

Brent Crude Oil Price Forecast

Brent’s held the 62 percent retracement of the move up from $19.99 on a closing basis. In addition, today’s formation of a bullish morning star setup suggest prices will rise to at least $24.0 before the move down continues. Closing above $24.0 will complete the morning star and call for crucial resistance and the pattern’s confirmation point at $24.9. Above this, the barrier for a more positive outlook is $26.2, the smaller than (0.618) target of the wave up from $19.99.

Like WTI, Brent will need help from external factors to overcome $24.9 and eventually $26.2. Sentiment remains bearish, so this will likely prove to be difficult. Should Brent close below $21.7, look for the move down to extend to $20.8 and then $19.9 and lower.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.