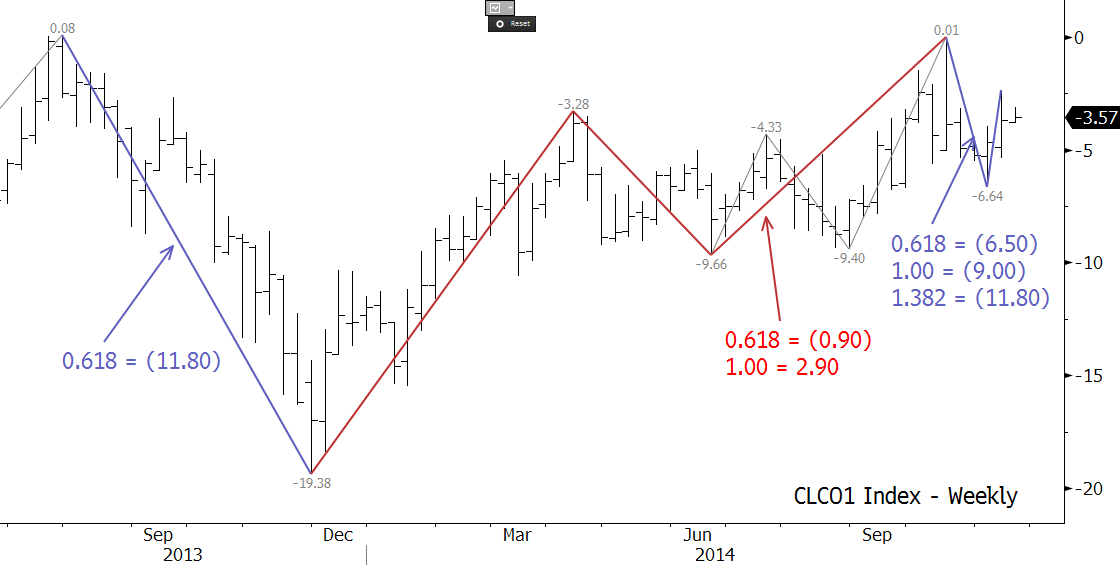

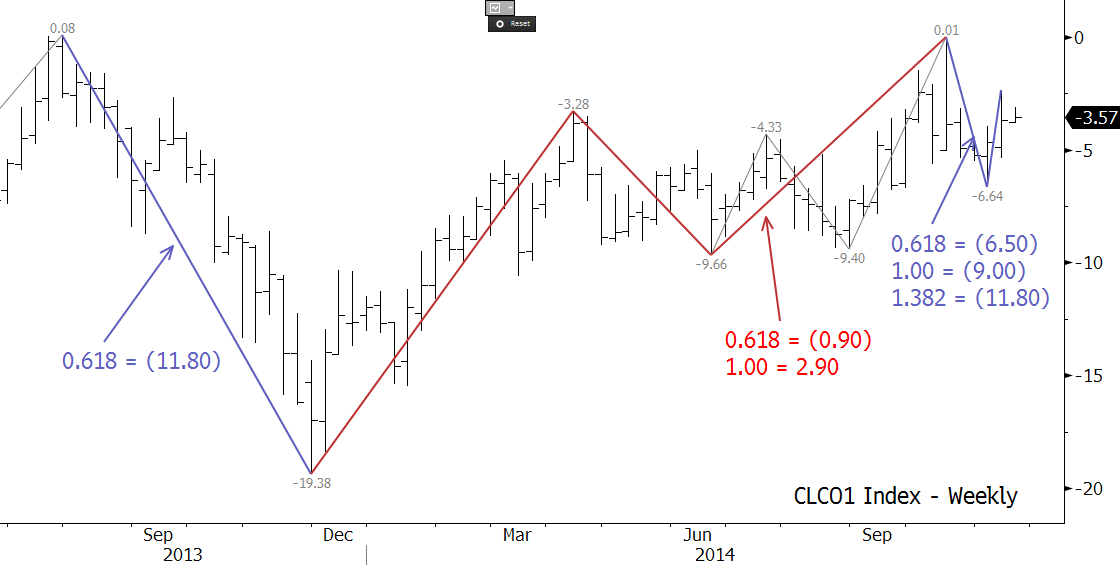

The WTI-Brent spread narrowed last week, but the move looks corrective. The spread will likely oscillate for the near-term, but ultimately odds favor a widening spread. The first target is (5.00), and a close below this would call for (6.50) and (9.00). Key long-term support is (11.80). This is a confluent wave projection and the 62 percent retracement from (19.38) to (0.01). Resistance at (0.90) should hold. A sustained close over (0.90) would open the way for 1.30 and 2.90.

For more information and to take a trial of Kase’s weekly energy forecasts please visit the Energy Price Forecasts page.

Published by

Dean Rogers, CMT

Dean Rogers, CMT is the general manager of the Kase Call Center in Albuquerque, New Mexico. He oversees all of Kase and Company, Inc.’s operations including research and development, marketing, and client support. Dean began his career with Kase in early 2001 as a programmer but has developed into Kase’s senior technical analyst. He writes Kase’s award-winning weekly Crude Oil, Natural Gas, and Metals Commentaries. He is an instructor at Kase's classes and webinars and provides all of the necessary training and support for Kase's hedging models and trading indicators for both retail and institutional traders.

View all posts by Dean Rogers, CMT