Most technical factors now indicate that WTI’s upward correction has failed and that the near term WTI price outlook is negative again. Monday’s decline broke the lower trend line of a bullish ascending wedge. Formations like this break higher around 75 percent of the time, so failures like this do not generally bode well for a continued price rise.

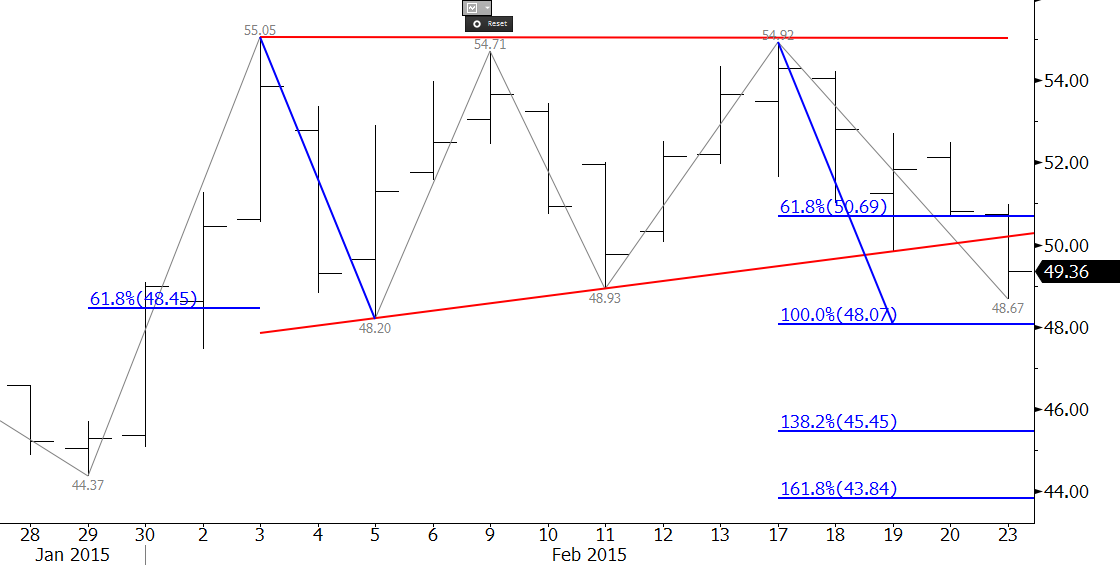

More importantly, WTI prices are about to take out the crucial $48.2 swing low. This level is important because it is the 1.00 projection for the wave $55.05 – 48.2 – 54.92, the 62 percent retracement from $44.37 to $55.05, and the key swing low for the upward wave formation from $44.37. Taking out $48.2 would call for at least $45.5, and very likely to $43.8 and lower.

The only real hope for a continued WTI price rally in the near term would be for prices to hold $48.2. Look for resistance at $51.0 and $52.5. A close over $52.5 would call for another test of the triple top of $55.0.

For a more in-depth analysis, take a free trial of Kase’s weekly crude oil price forecast.