WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

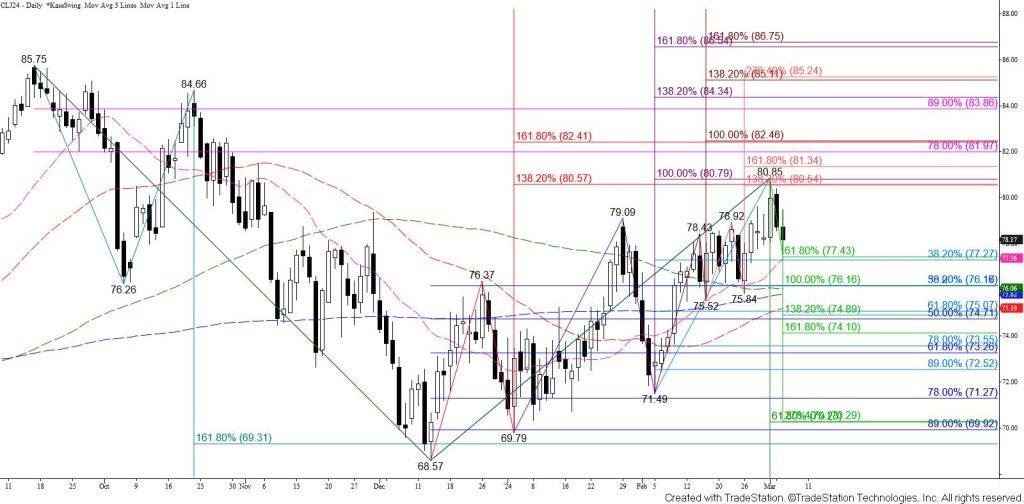

WTI crude oil continued to fall as called for today and settled below the confirmation point of Monday’s bearish dark cloud cover. The new primary wave down from $80.85 is poised to test its $77.3 smaller than (0.618) target. This objective is in line with the 20-day moving average and the 38 percent retracement of the rise from $71.49. Settling below $77.3 might initially prove to be a challenge given its confluence but would open the way for a test of the $76.2 equal to (1.00) target of the wave down from $80.85. This has become the most important level of support for the near-term outlook because $76.2 is also the 50 percent retracement of the rise from $71.49 and the 38 percent retracement from $68.57.

Nevertheless, the move down is likely a correction because all major prior swing lows have held and WTI is still trading above all major daily moving averages. The daily Kase Trend indicator is also bullish. Should WTI rise tomorrow look for initial resistance at $79.0. This is the smaller than target of the wave up from $77.52 and connects to key near-term resistance at $79.7 as the equal to target. The $79.7 level is also near the 62 percent retracement of the decline from $80.85. Therefore, closing above $79.7 would imply that the corrective move down is complete and put near-term odds in favor of retesting major resistance around $80.5.