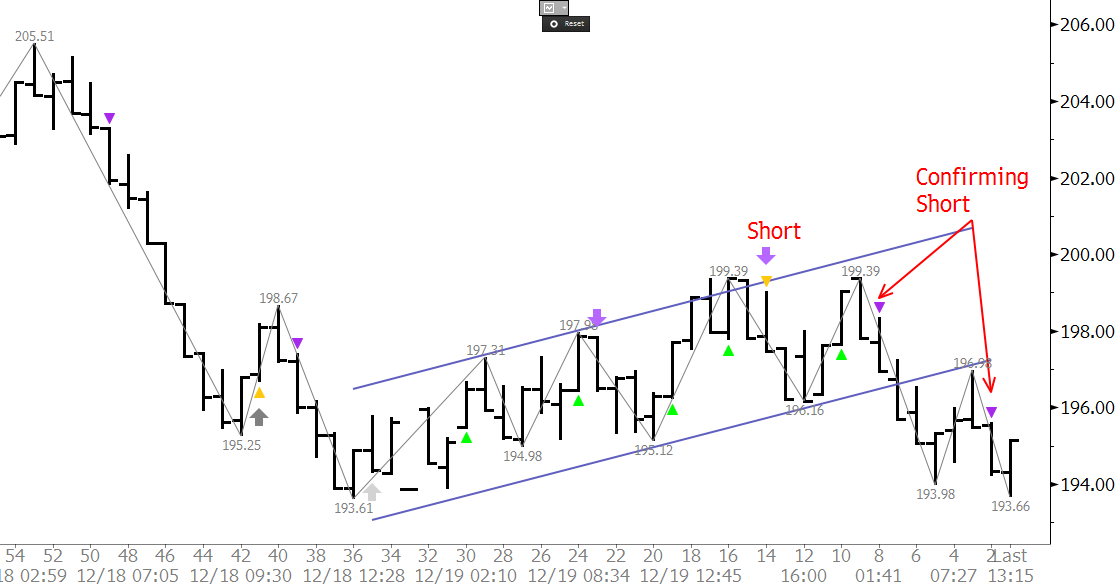

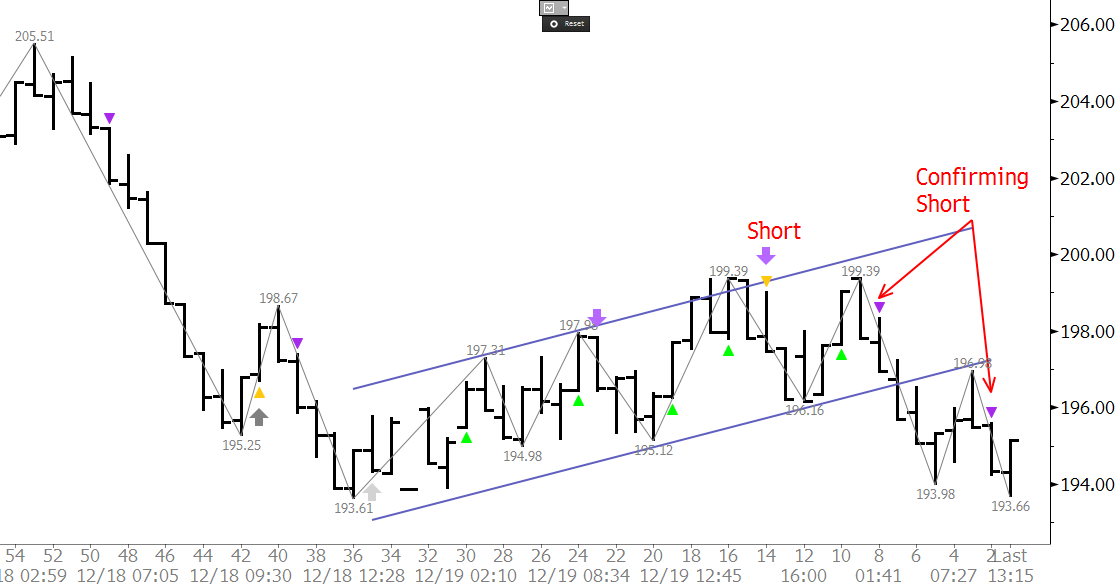

The NY Harbor ULSD futures broke lower out of a bearish flag formation on Monday. The break lower was anticipated and then confirmed by KaseX short signals. The decline is now poised to extend to at least 188.9 and then 177.9. The latter is crucial because a close below this would call for 164.1 and 151.9. Initial resistance is the small intraday double top at 199.39. A close over this would open the way for an extended correction to 210.9 and possibly 226.0.

For more information about KaseX please click here.

For more information about Kase’s weekly energy forecasts please click here.

Published by

Dean Rogers, CMT

Dean Rogers, CMT is the general manager of the Kase Call Center in Albuquerque, New Mexico. He oversees all of Kase and Company, Inc.’s operations including research and development, marketing, and client support. Dean began his career with Kase in early 2001 as a programmer but has developed into Kase’s senior technical analyst. He writes Kase’s award-winning weekly Crude Oil, Natural Gas, and Metals Commentaries. He is an instructor at Kase's classes and webinars and provides all of the necessary training and support for Kase's hedging models and trading indicators for both retail and institutional traders.

View all posts by Dean Rogers, CMT