WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

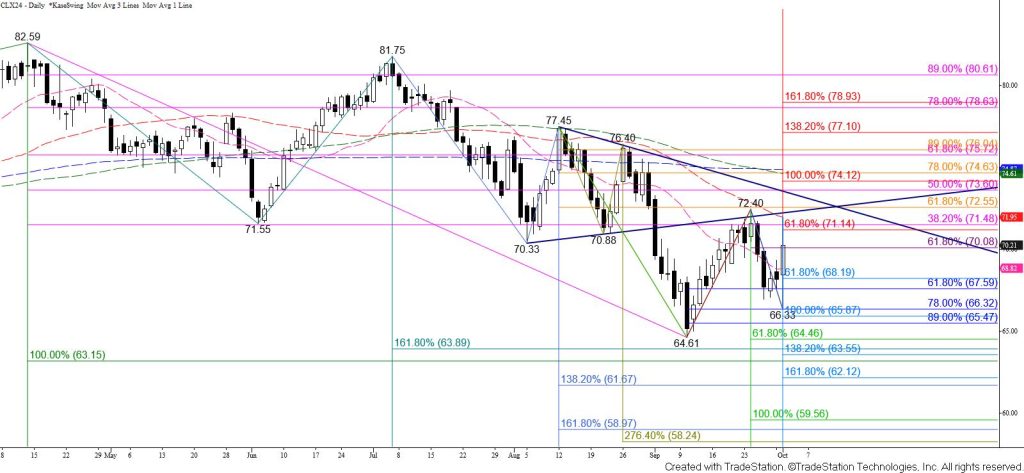

Today’s rally was bullish for WTI crude oil prices in the coming days. The move up overcame the $71.1 smaller than (0.618) target of the wave up from $64.61. This suggests that this wave will eventually extend to its $74.1 equal to (1.00) target. The pullback from $71.94 also held the 38 percent retracement of the rise from $66.33 at $69.8. Another test of $71.1 is anticipated, a close above which will call for targets at $72.6 and $73.3 that connect to the $74.1 objective.

However, this is a tight call. The move up stalled at the 50-day moving average and near the 89 percent retracement of the decline from $72.4. The $72.1 lower trend line of November’s coil pattern that broke lower on September 3 also held and prices are still trading below the lower trend line of a pennant on the continuation chart that broke lower that same day. The pullback from $71.94 was likely profit-taking but serves as a warning that traders may wait on more information before making the next push higher or lower.

To retain a bullish outlook in the coming days WTI crude oil must close above $71.1 and the lower trend lines of November’s coil ($72.1) and the continuation chart’s pennant ($73.3).

Otherwise, should WTI fall below $69.1 look for a test of key near-term support at $68.2. This is the smaller than target of the wave down from $72.4. Settling below this will imply that the move up has failed again and call for a move back below the 62 percent retracement of the rise from $64.61 at $67.6 to fulfill this wave’s $65.9 equal to (1.00) target.