WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

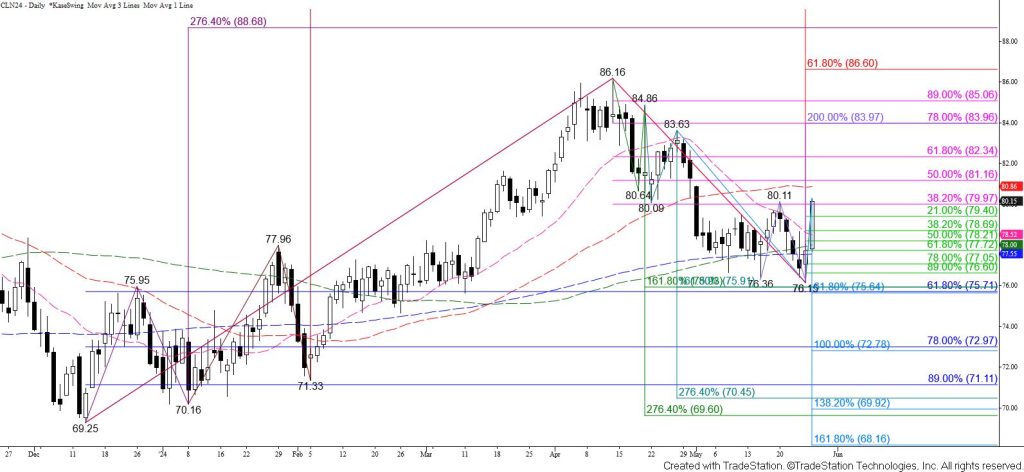

WTI crude oil surged higher today, overcoming the $80.11 swing high and the 38 percent retracement of the decline from $86.16 late Monday afternoon. The $80.0 level held on a closing basis, but the post-settlement move above $80.0 implies that a break higher out of the recent trading range is taking place. The $80.11 swing high is also the confirmation point of a double bottom that formed between the $76.36 and $76.15 swing lows. The target for this pattern is $84.0. Today’s rise also confirmed daily bullish KasePO, RSI, and Stochastic divergences.

Tomorrow, look for a test of the 20-day moving average and 50 percent retracement around $81.1. Settling above this will call for a test of the important 62 percent retracement at $82.3. Closing above $82.3 for a few days will imply that the corrective move down from $86.16 is complete and that WTI crude oil is adopting a longer-term bullish outlook again.

Should $80.0 continue to hold on a closing basis and WTI crude oil takes out the 38 percent retracement of the rise from $76.15 and today’s midpoint at $78.7 look for a test of the 62 percent retracement, today’s open, and the 200-day moving average around $77.7. Settling below $77.7 would imply that the move up was an overreaction to external factors. This is doubtful but would put the odds back in favor of WTI crude oil falling below $76.6 to challenge a longer-term bearish decision point at $75.8.