WTI Crude Oil Technical Analysis and Short-Term Forecast

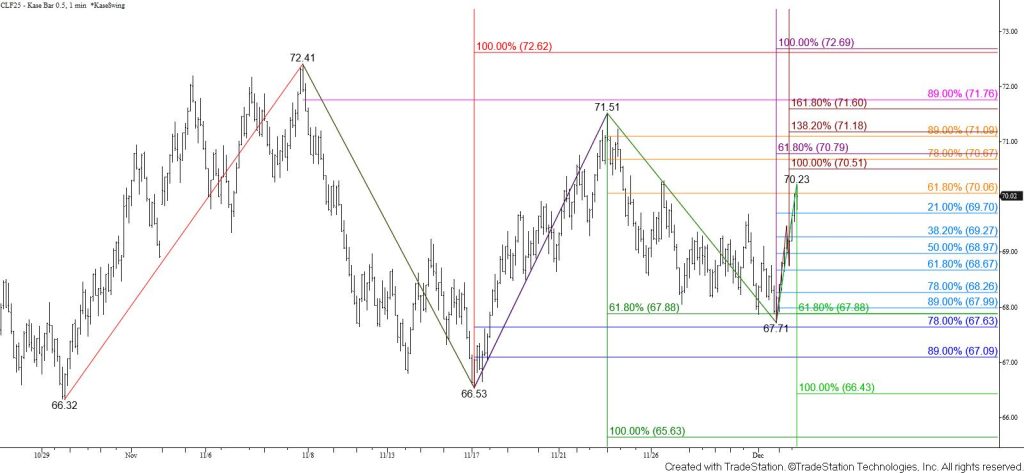

WTI crude oil continues to trade in a weeks-long range. Each time prices have been positioned to break higher or lower out of the range a reversal has taken place. This happened again today. The wave down from $72.41 fulfilled its $67.9 smaller than (0.618) target and favored an eventual test of its $65.6 equal to (1.00) target. Such a move would have resulted in a break lower out of the range. However, prices rallied today and challenged the 62 percent retracement of the decline from $71.51 at $70.1. This level held on a closing basis but today’s rise confirmed Monday’s inverted hammer and the wave up from $67.71 calls for a test of its $70.7 equal to target. This is also the smaller than target of the wave up from $66.53. Closing above $71.7 will put WTI crude oil back in a position to attempt a break higher out of the range by closing above the $72.7 equal to target of this wave and the wave up from $66.32. The $72.7 objective is also in line with the 62 percent retracement of the decline from $77.04 and the $72.41 confirmation point of a $66.4 double bottom.

Nonetheless, caution is still warranted because until the $71.51 swing high is overcome the wave down from $72.41 will have potential to extend to its $65.6 equal to target. Should the $70.1 level continue to hold and prices fall below the 38 percent retracement of the rise from $67.71 at $69.3 look for a test of the 62 percent retracement at $68.7. Taking out $68.7 will warn that the move up is failing again. Settling below the $67.9 smaller than target of the wave down from $71.51 will confirm this is the case and put the odds back in favor of WTI crude oil falling to $66.4 and $65.6.