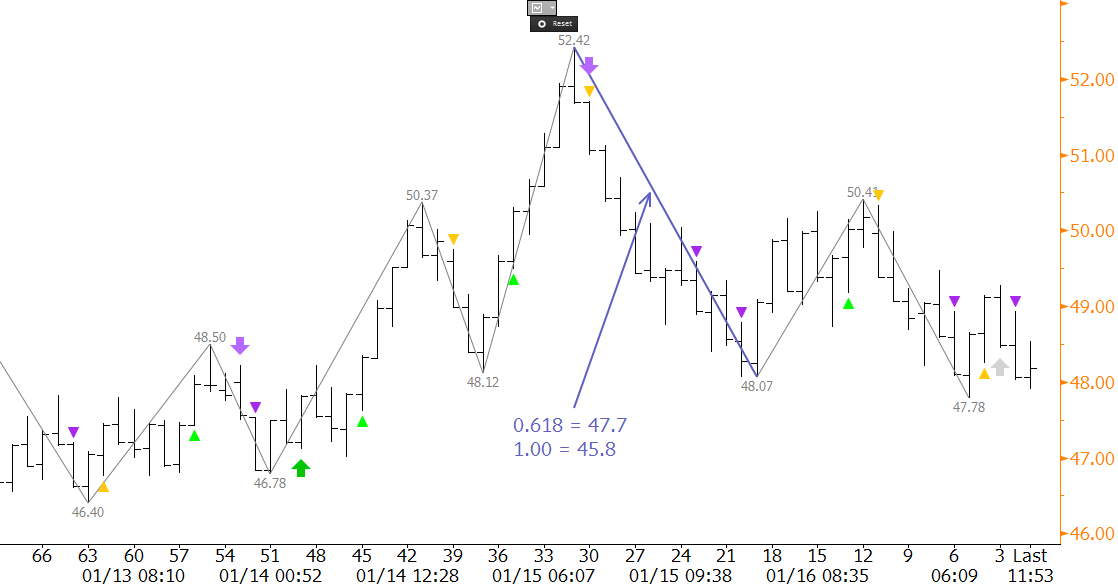

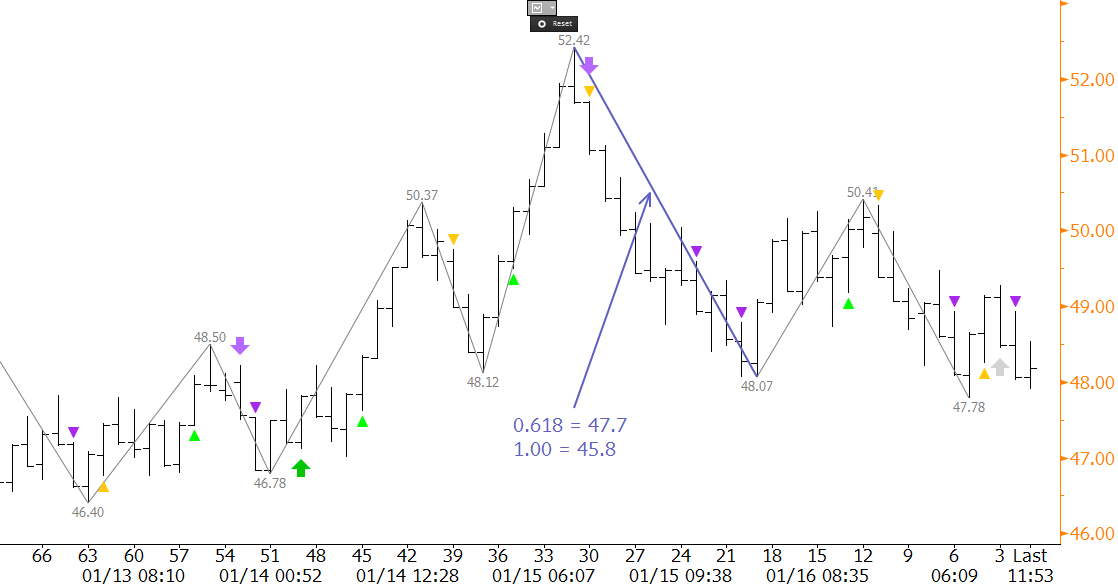

Brent has been trading in a corrective range for the past several days, but fell to major support at $47.7 on Tuesday. This is the 0.618 projection for the wave $52.42 – 48.07 – 50.41. The $47.7 projection connects to a major target at $45.8 as the 1.00 projection. This is also the 1.618 projection for the largest and most important wave down from the $111.38 contract high. KaseX confirms the negative call with confirmed short signals (purple triangles) on the 120-minute equivalent Kase Bar chart.

For more information about KaseX please visit our trading indicators page. The learn about our forecasts please visit our energy forecasts page.

Published by

Dean Rogers, CMT

Dean Rogers, CMT is the general manager of the Kase Call Center in Albuquerque, New Mexico. He oversees all of Kase and Company, Inc.’s operations including research and development, marketing, and client support. Dean began his career with Kase in early 2001 as a programmer but has developed into Kase’s senior technical analyst. He writes Kase’s award-winning weekly Crude Oil, Natural Gas, and Metals Commentaries. He is an instructor at Kase's classes and webinars and provides all of the necessary training and support for Kase's hedging models and trading indicators for both retail and institutional traders.

View all posts by Dean Rogers, CMT