Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

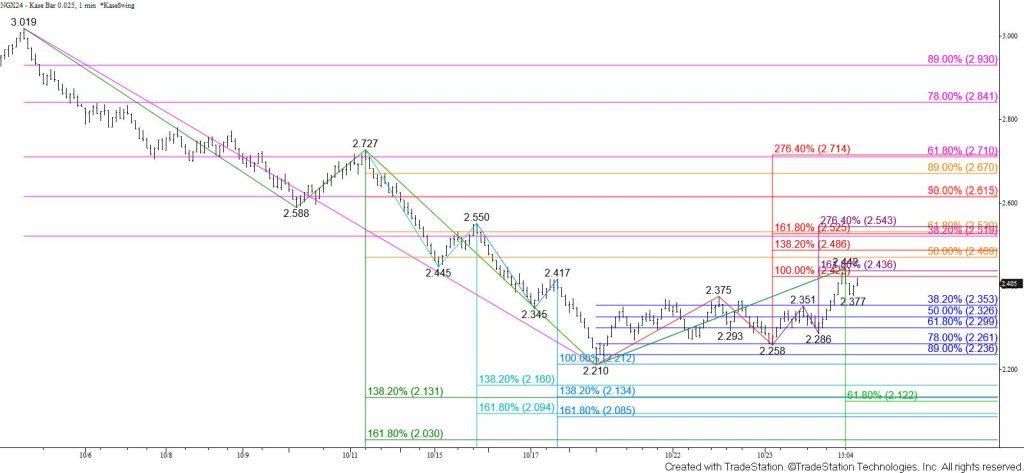

November natural gas rallied late this afternoon to challenge the $2.42 equal to (1.00) target of the wave up from $2.210 and the $2.44 larger than (1.618) target of the wave up from $2.258. Weak daily bullish KasePO PeakOut and RSI oversold signals suggest a bullish reversal, or at least a solid test of resistance, is underway. Tomorrow, look for a test of $2.48 and possibly a key objective at $2.53. Settling above $2.53 will reflect a bullish shift in sentiment and provide more substantial evidence that a reversal will continue to unfold.

That said, until this afternoon’s late rally, the move up from $2.210 had been shallow and choppy. This suggests that the move up may still be a simple correction and that this afternoon’s rally could be a bull trap before the move down extends. Even so, falling to a new low has become doubtful within the next few days and the 38 percent retracement of the rise from $2.210 at $2.35 is expected to hold. Falling below this will call for a test of the 62 percent retracement at $2.30 and possibly key support at $2.26. Taking out $2.26 (more specifically, the $2.258 swing low) will invalidate the wave up from $2.210 which projects to $2.48 and $2.53. In this case, look for prices to fall to $2.21 and lower.