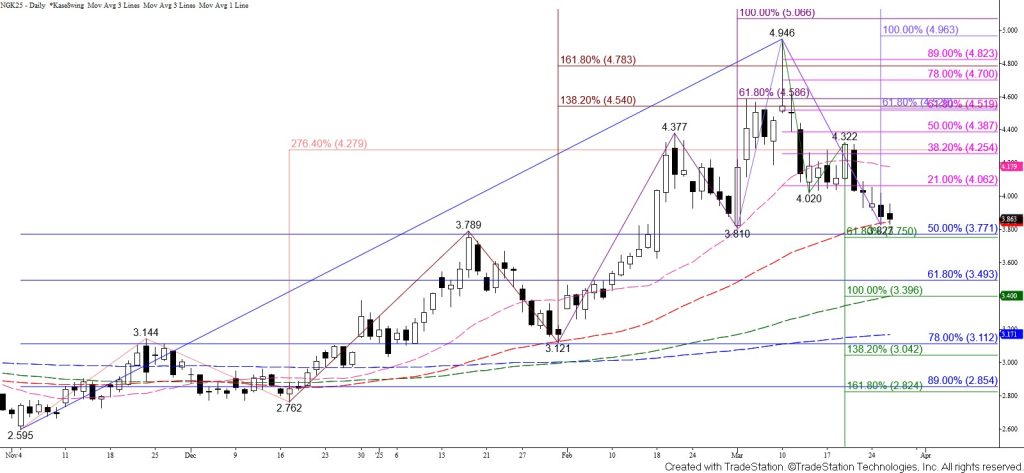

Natural Gas Technical Analysis and Near-Term Outlook

May natural gas broke through support at $4.05 late last week and has continued to grind its way lower for the past few days. Prices are struggling to close below the 50-day moving average at $3.85. Even so, the wave formation calls for a test of the $3.76 smaller than (0.618) target of the primary wave down from $4.946. This is also the 50 percent retracement of the rise from $2.595. The $3.76 target is a decision point. Settling below $3.76 will open the way for the eventual fulfillment of this wave’s $3.40 equal to (1.00) target, with a test of the crucial 62 percent retracement at $3.49 along the way.

Daily momentum is working it was lower too and the 10-day DMI had a bearish crossover on Tuesday. The ADX is below 25 and declining though, so there is currently not a trend reflected by these indicators on the daily chart. There are no bullish patterns or signals that call for the move down to stall before reaching $3.76, but support around the 50-day moving average has been resilient for the past two days. Should May natural gas rally and overcome $3.96 look for a test of $4.02 and possibly key near-term resistance at $4.07.