Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

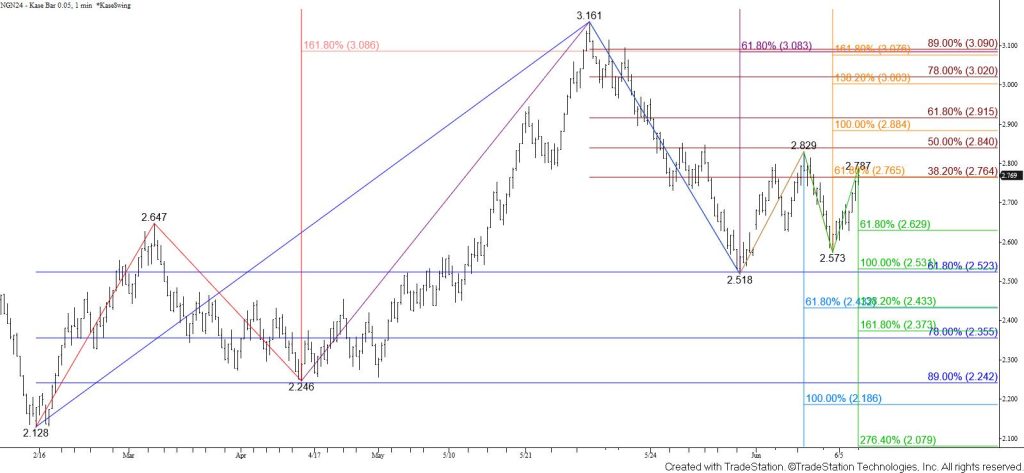

Natural gas may be consolidating into a range after testing and holding major support at $2.52 late last week. Prices have aggressively swung higher and lower for the past few days. These swings reflect near-term uncertainty. Thus the likelihood of a period of consolidation as traders await more information to definitively push prices higher or lower.

Nevertheless, today’s move up fulfilled the $2.77 smaller than (0.618) target of the wave up from $2.518. This level is also the 38 percent retracement of the decline from $3.161. The $2.77 level held on a closing basis, but most waves that meet the smaller than target extend to fulfill at least the equal to (1.00) target, in this case, $2.88. Therefore, during the next day or so odds favor a move above the 50 percent retracement of the decline from $3.161 at $2.84 to test at least $2.88.

That said, so far this week, each day that prices have been poised to rise or fall a move in the opposite direction has taken place the next day. Therefore, caution is warranted. Should prices fall again and take out $2.69 look for a test of the $2.63 smaller than target of the wave down from $2.829. Settling below this will put the near-term odds in favor of testing $2.59 and likely the $2.52 level again.