Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

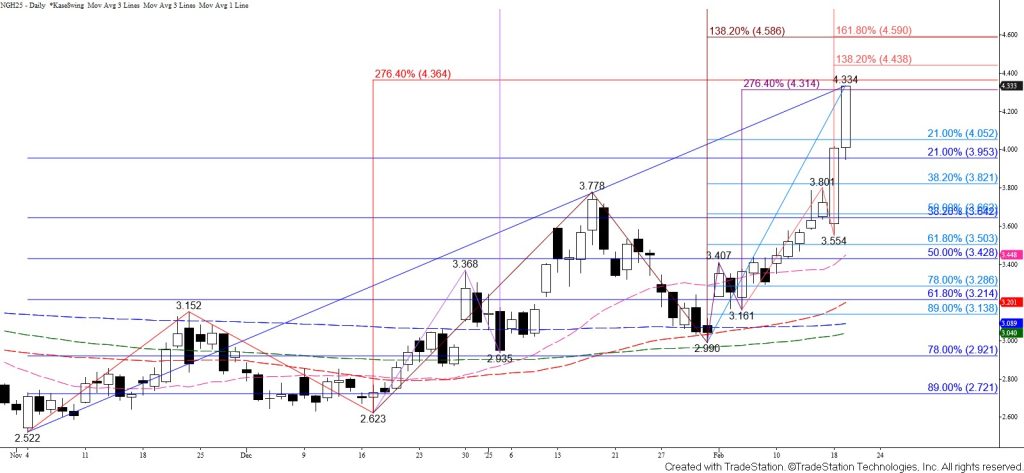

Natural gas continued to rise and overcame a confluent $4.14 target with ease. The move up is now poised to fulfill the $4.36 XC (2.764) projection of the wave up from $2.522. The move up is due for a correction and is rising at a rate that will not be sustainable for long. The $4.36 target would normally be a probable stalling point, but this is the type of move that will likely overshoot resistance. Overcoming $4.36 will call for $4.43, $4.48, and then a test of another confluent target at $4.59.

The daily RSI is overbought and the $4.36 target is in line with the continuation chart’s mid-January $4.369 swing high. However, there are no bearish patterns or confirmed signals that call for the move up to stall. Even so, should prices pull back look for today’s $4.15 midpoint to hold. Key support is today’s $4.01 open.