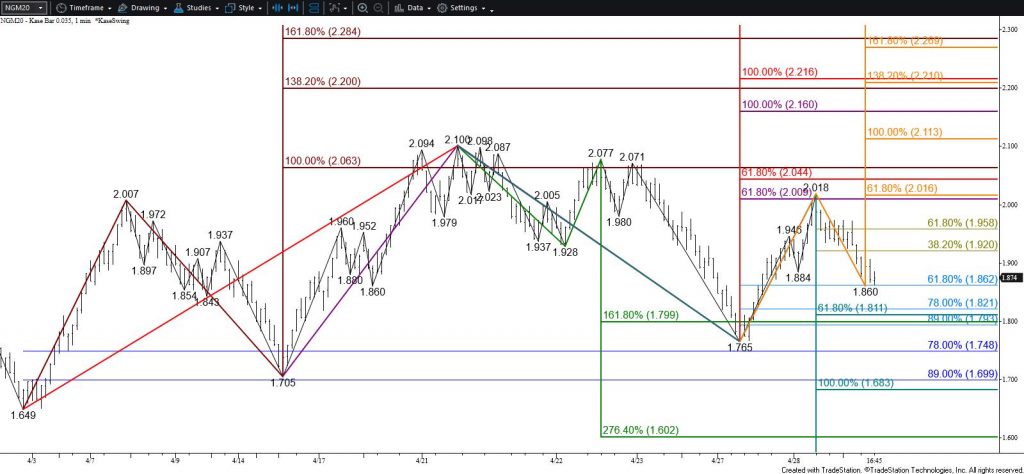

Natural gas is settling into a wide trading range as expected. Today, prices fell to challenge $1.86, the 62 percent retracement of the move up from $1.765. This is a potential stalling point but based on the waves down from $2.100 and $2.018 odds lean in favor of falling to $1.82. A test of resistance is expected before prices close below $1.82. Closing below $1.82 would clear the way for $1.69, which is near the bottom of the trading range for the June contract.

As prices fall toward $1.82 resistance at $1.92 is expected to hold and $1.96 is key. Settling above $1.96 will call for another attempt at $2.03, which then connects to $2.11 and higher. Without help from bullish external factors, it is doubtful that natural gas will overcome $2.03.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.