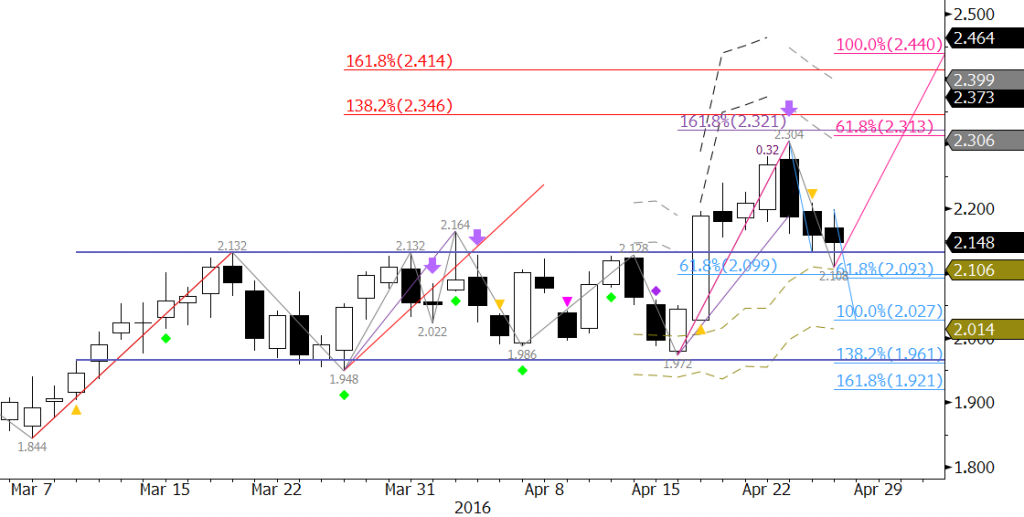

After breaking higher out of the recent trading range between nominally $1.96 and $2.13, June natural gas stalled at $2.304. This was just below important resistance at $2.33, which connects to $2.43.

Monday’s bearish engulfing line and confirmed divergence (purple down arrow on KaseX) called for a test of $2.13. This was strong resistance between March 18 and April 18 and has now become support. So far, this level has held on a closing basis.

Tomorrow’s EIA Natural Gas Storage Report is expected to show around a +70 Bcf build. This is higher than the +52 Bcf five-year average, and could aid in dropping prices below $2.13 again. A sustained close below $2.13 would call for $2.03 and $1.96 where range bound trading may again ensue.

That said, the small move up from $2.108 late Wednesday may extend in early trading before the EIA report is released. Unless there is a much smaller than expected build reported by the EIA tomorrow, there is a cluster of resistance between $2.18 and $2.23 that should hold. A close over $2.23, the 62 percent retracement from $2.304 to $2.108, would call for $2.33 to be attempted again.

This is a brief natural gas forecast for the next day or so. Our weekly Natural Gas Commentary is a much more detailed and thorough analysis. If you are interested in learning more, please sign up for a complimentary four-week trial.