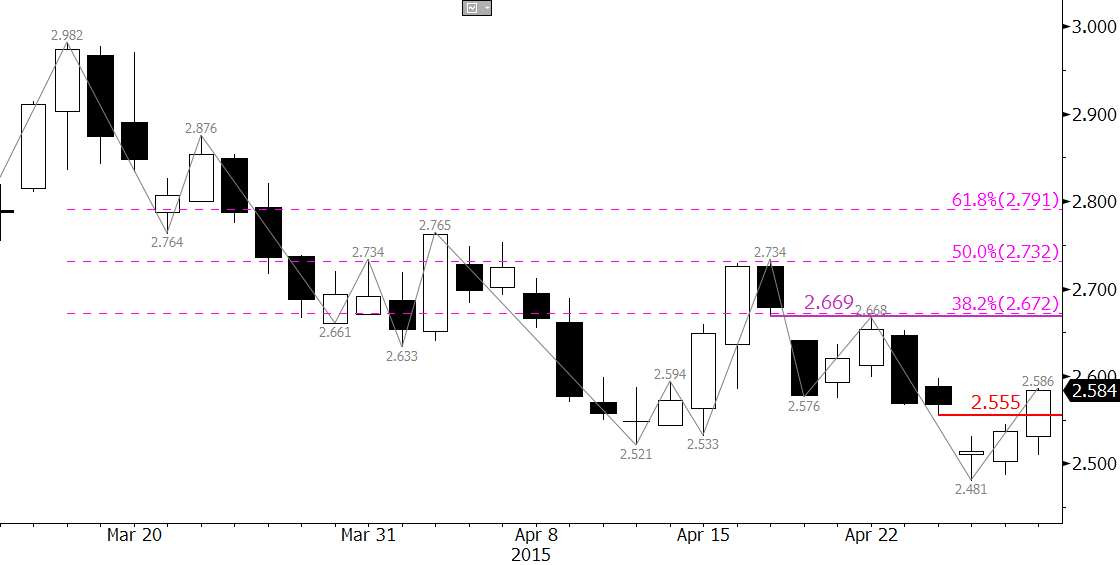

For the second week in a row natural gas futures gapped lower on Monday. This might be an exhaustion gap, which in many cases signals the end of a long and drawn out trend. The top of the gap at $2.555 has been overcome as of Wednesday midday, and a close over this would call for an extended correction to at least $2.67, the top of last week’s gap and the 38 percent retracement from $2.982. These technical factors could be an early warning that a bottom has finally been made.

That said, we think it is premature to definitively state the bottom has been made. We will hold off on delving too deeply into that conversation until at least $2.67 is overcome. Most technical and fundamental factors are still negative, and while we do think the market is nearing a bottom, most evidence points to a target about 10-15 cents lower. The June contract met confluent support at $2.48, but the key objective that we have identified for weeks in our detailed natural gas forecast has not been met yet. A close back below $2.555 before the end of the week would signal that the upward correction has failed again.

Request a trial of our weekly energy forecast on natural gas to learn more.