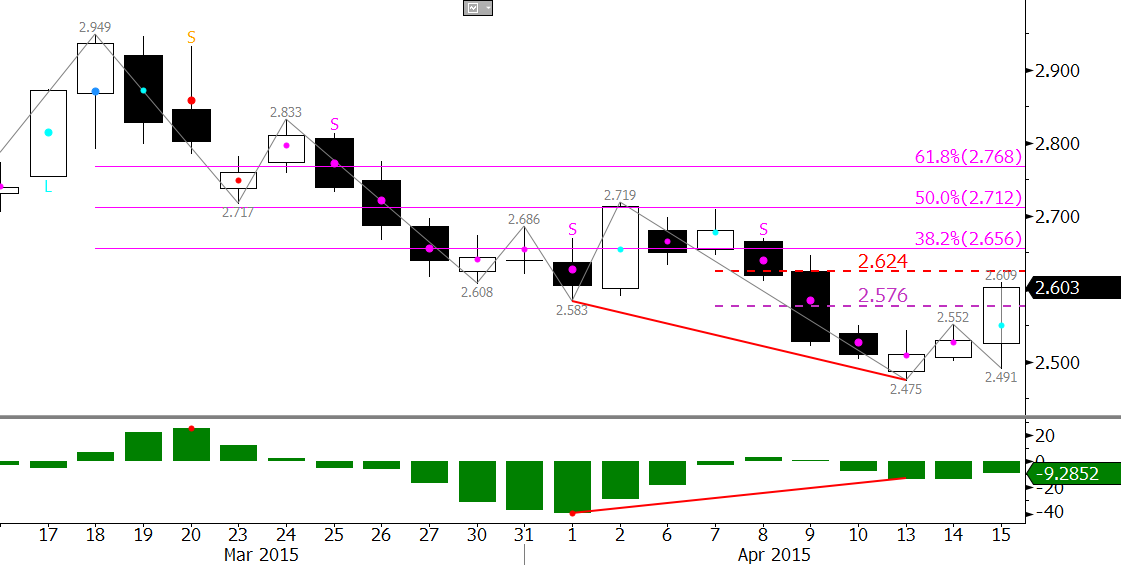

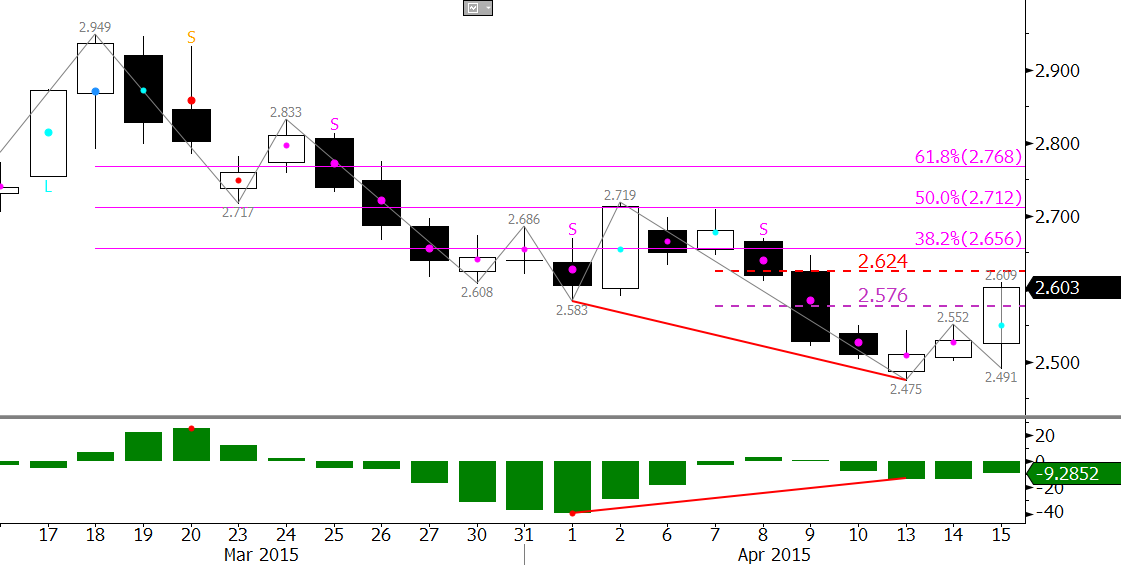

May natural gas futures stalled at $2.475 after meeting the 0.618 target for the wave $2.949 – 2.583 – 2.719. A close over $2.576 will complete the bullish morning star and a close over $2.624 would confirm it. In addition, the confirmed bullish KaseCD divergence and second class long KEES permissions indicate the upward correction should extend. A normal correction will hold the 38 percent retracement from $2.949 at $2.66. An extended correction is expected to hold $2.77, the 62 percent retracement.

Take a four-week trial of the Kase Commentary on Natural Gas.

Published by

Dean Rogers, CMT

Dean Rogers, CMT is the general manager of the Kase Call Center in Albuquerque, New Mexico. He oversees all of Kase and Company, Inc.’s operations including research and development, marketing, and client support. Dean began his career with Kase in early 2001 as a programmer but has developed into Kase’s senior technical analyst. He writes Kase’s award-winning weekly Crude Oil, Natural Gas, and Metals Commentaries. He is an instructor at Kase's classes and webinars and provides all of the necessary training and support for Kase's hedging models and trading indicators for both retail and institutional traders.

View all posts by Dean Rogers, CMT