Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

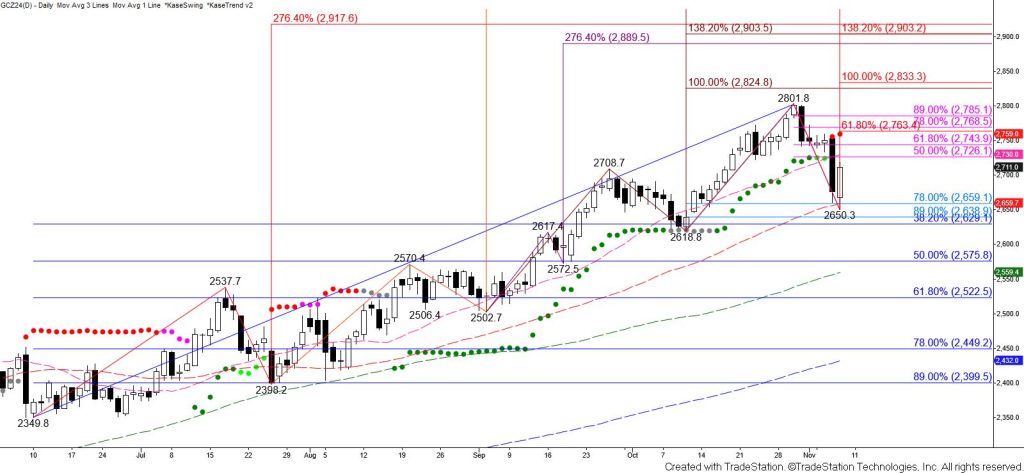

Gold rose after Wednesday’s significant decline. The 78 percent retracement of the rise from $2618.8 and the 50-day moving average were tested early but the move down stalled at $2650.3 before rising to challenge Wednesday’s $2715 midpoint. This level held and prices settled below the 20-day moving average again.

Today’s rise dampens the likelihood of a deeper test of support in the coming days. Even so, the daily Kase Trend indicator is bearish and weekly bearish KaseCD and MACD divergences will likely be confirmed unless gold can overcome the $2801.8 on Friday. Therefore, the near-term outlook continues to lean bearish, and taking out $2672 will call for a test of $2652. Settling below $2652 will call for a key objective at $2626 to be challenged. The $2626 objective is the smaller than (0.618) target of the new primary wave down from $2801.8, the 38 percent retracement of the rise from $2349.8, and the last target protecting the last major swing low of $2618.8. Settling below $2626 will indicate that a major test of support is finally underway.

Nevertheless, there is a good chance for a test of the 20-day moving average at $2730 early Friday. Overcoming this will call for the 62 percent retracement of the decline from $2801.8 at $2744 and possibly a test of key near-term resistance at $2763. The $2763 level is the smaller than target of the wave up from $2618.8. Settling above this will imply that the corrective move down is complete and shift the odds in favor of gold rising to new highs next week.