Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

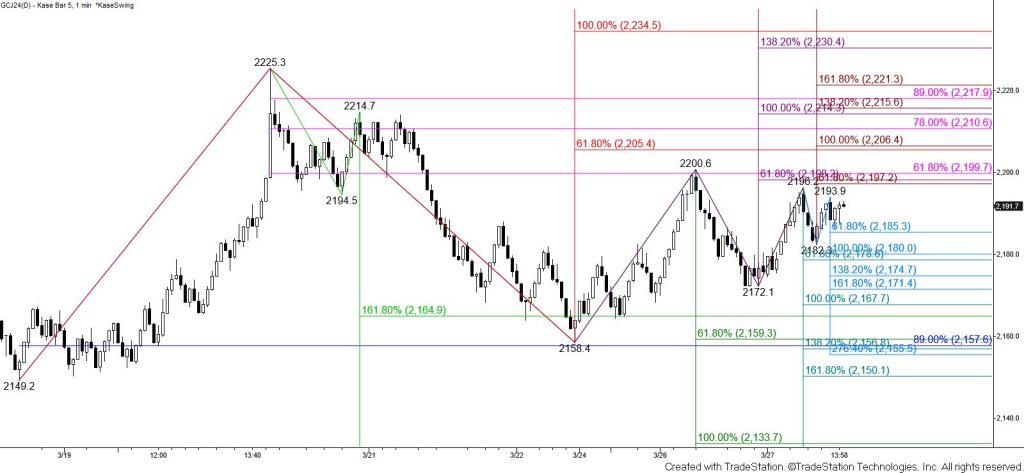

Gold rose today and settled above the 62 percent retracement of the decline from $2200.6 at $2190. The uptrend is intact but this is a tight call for the near term because the corrective move down from $2225.3 still shows potential to extend upon a close below key support at $2159. Even so, today’s rise has positioned gold to challenge key near-term resistance at $2203. This is in line with the 62 percent retracement from $2225.3 and the smaller than (0.618) target of the wave up from $2158.4. Settling above $2203 will strongly imply that the correction is complete and open the way for $2218 and then a test of this wave’s $2233 equal to (1.00) target.

Nevertheless, trading has been erratic for the past week and the close above $2190 was nominal. Should gold fall again look for initial support at $2179 and then $2168. Closing below $2168 would warn that the move up is failing again and call for a test of key support and the smaller than target of the wave down from $2225.3 at $2159. Settling below this will call for the corrective move down to extend to $2136 and possibly lower.