Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

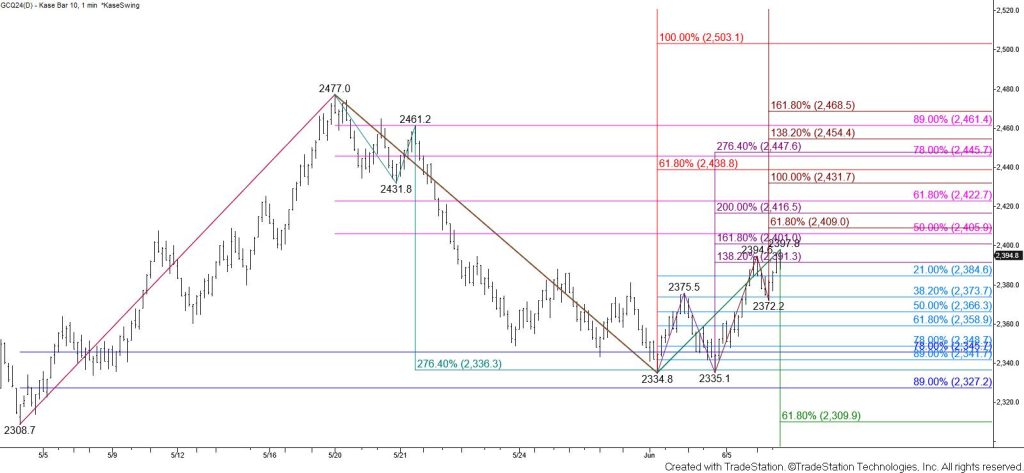

Gold could not close below the 78 percent retracement of the rise from $2308.7 at $2346 after testing and holding the $2336 XC (2.764) projection of the prior primary wave down from $2477. Prices have risen for the past couple of days and have broken higher out of a period of consolidation. Today’s close above the 38 percent retracement of the decline from $2477 and the $2375.5 confirmation point of a $2335 double bottom warns that the move down might be complete. This move up also suggests that gold will fail to confirm a double top around $2474 by closing below the $2308.7 swing low.

Tomorrow, look for a test of $2408, a close above which will call for $2420. The $2420 objective is split between the $2417 target of the double bottom and the 62 percent retracement of the decline from $2477 at $2423. Settling above $2420 would provide more evidence that the move down is complete. This would also call for a test of the $2439 smaller than (0.618) target of the wave up from $2308.7 in the coming days.

Should prices turn lower again and take out $2373 look for a test of $2359 and possibly another attempt to take out $2346. Settling below $2346 would shift near-term odds back in favor of gold falling to $2327 and eventually $2309.