Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

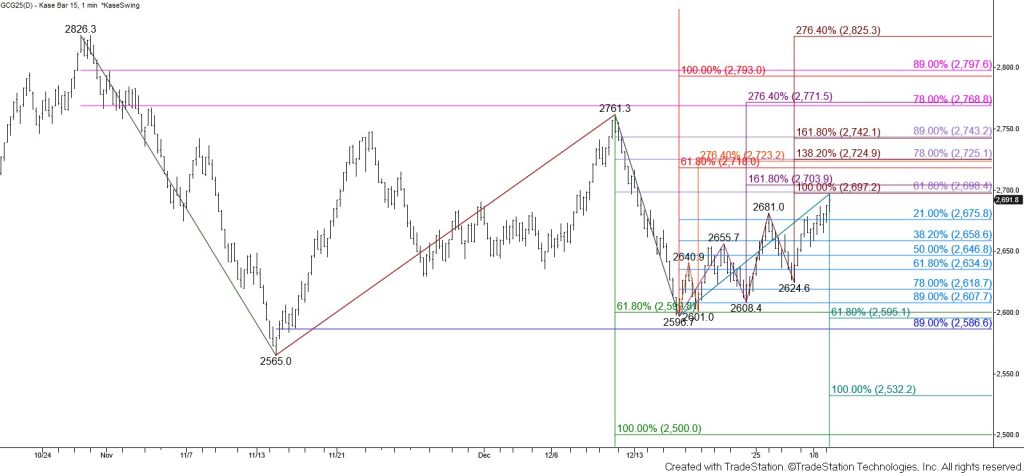

Gold rose today and finally settled above the 50 percent retracement of the decline from $2761.3, the 50-day moving average, and the intermediate (1.382) target of the primary wave up from $2596.7. Tomorrow, look for a test of this wave’s $2704 larger than (1.618) target. Settling above $2704 will call for a test of a $2721 bullish decision point that is in line with the smaller than (0.618) target of the wave up from $2565. Closing above $2721 should initially be a challenge given this target’s confluence and importance but will confirm a bullish outlook for gold and open the way for $2741, $2771, and then a test of the $2795 equal to (1.00) target of the wave up from $2565.

Nevertheless, the equal to (1.00) target of the wave up from $2608.4 and the 62 percent retracement of the decline from $2761.3 were tested and held today. Prices settled just below this level around $2698, but there are no bearish patterns or signals that call for the move up to stall. Even so, $2698 is a potential stalling point. Should prices pull back look for the 38 percent retracement of the rise from $2596.7 at $2659 to hold. Closing below this would call for a test of key near-term support and the 62 percent retracement at $2635.