Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

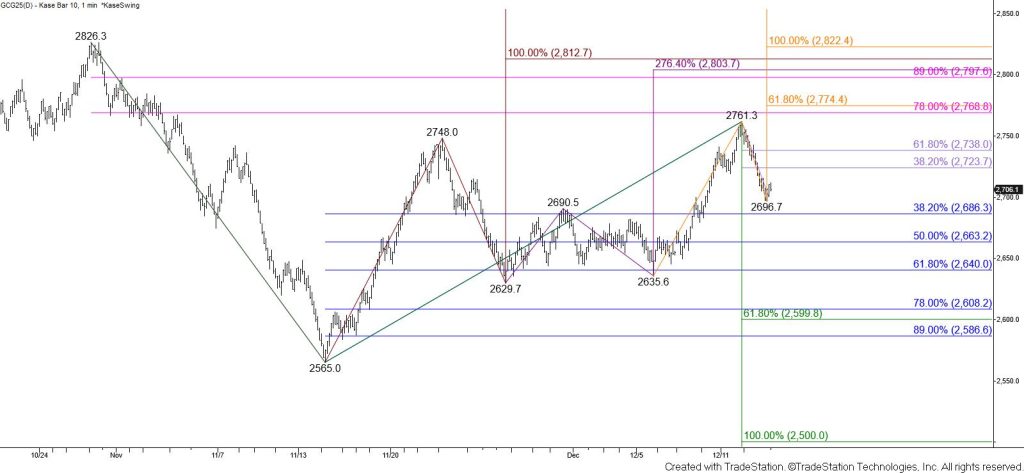

Gold’s move up failed to reach $2772 and stalled at $2761.3. The subsequent pullback and close below Wednesday’s open was bearish for the outlook ahead of the weekend. The decline from $2761.3 is probably a correction that suggests prices may consolidate again because the wave up from $2565 favors an eventual test of its $2808 equal to (1.00) target. However, a test of the 38 percent retracement of the rise from $2565 at $2686 is expected first. Closing below $2686 would warn that the move up is failing and call for the 50 and possibly 62 percent retracement at $2663 and $2640 to be challenged in the coming days.

That said, the move down from $2761.3 lacks a clear wave structure to drive prices much lower. Therefore, there is a reasonable chance for a test of $2724 and even $2738 first. The $2738 level is expected to hold. Overcoming $2738 would imply that the pullback was a short-lived correction and call for a test of key near-term resistance at $2771.