Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

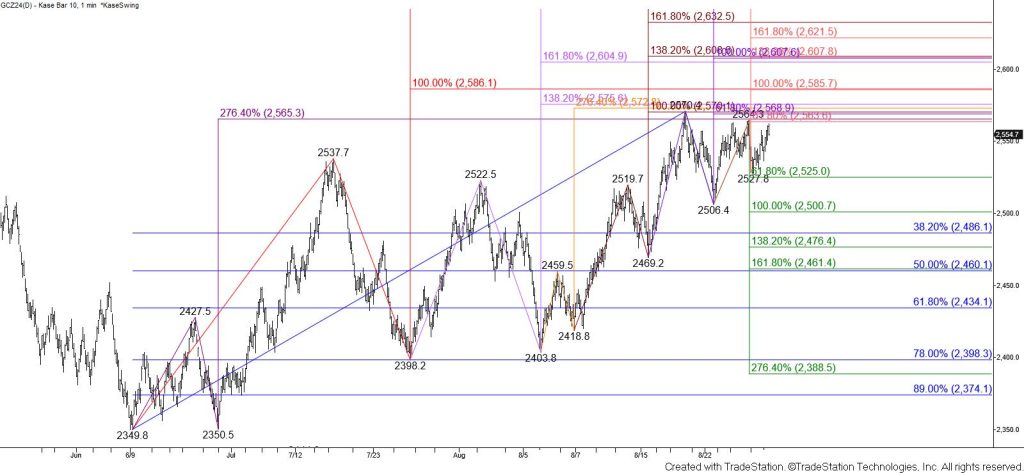

December gold’s lackluster follow-through after Wednesday’s decline was bullish for the near-term outlook. Gold is poised to challenge a highly confluent and key target at $2570 again. Settling above $2570 will open the way for the $2586 equal to (1.00) target of the wave up from $2349.8 to finally be fulfilled.

That said, the $2570 target has been resilient in recent weeks and each time gold has approached this objective prices have pulled back. The potential for a second straight weekly bearish doji also warns that the move up may be exhausted. Should gold turn lower and take out the $2525 smaller than (0.618) target of the wave down from $2570.4 look for a test of key near-term support at $2500.