Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

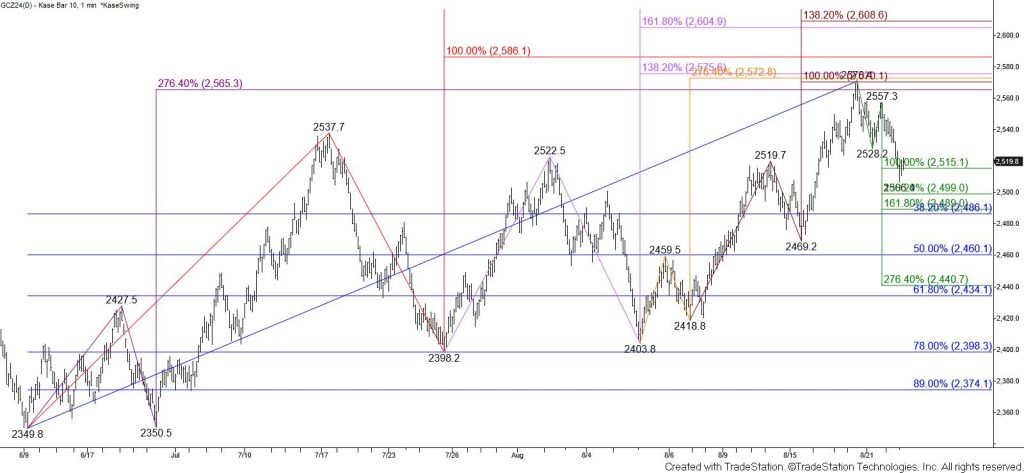

Gold pulled back after testing and holding major resistance at $2570. The pullback is likely a correction and held the $2515 equal to (1.00) target of the wave down from $2570.4 on a closing basis today. The $2515 level is also in line with the completion point of daily bearish hanging man and shooting star patterns that formed Monday, Tuesday, and Wednesday.

Nevertheless, today’s decline confirmed bearish daily RSI, Stochastic, and MACD divergences and a daily KasePO PeakOut (overbought) signal. Therefore, the near-term outlook is bearish for gold and a test of $2499 and likely $2487 will take place within the next day or so. For the move up to retain a reasonable chance at extending again in the coming days $2487 must hold. Closing below $2487 will take out the larger than (1.618) target of the wave down from $2570.4, the 38 percent retracement of the rise from $2349.8, and confirm the daily bearish candlestick patterns.

Should gold rally and overcome $2538 look for a test of the $2557.3 corrective swing high of the wave down from $2570.4. Overcoming $2557 will invalidate this wave and negate the projections to $2499 and lower. Such a move would also call for another test and attempt to close above the $2570 threshold.