Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

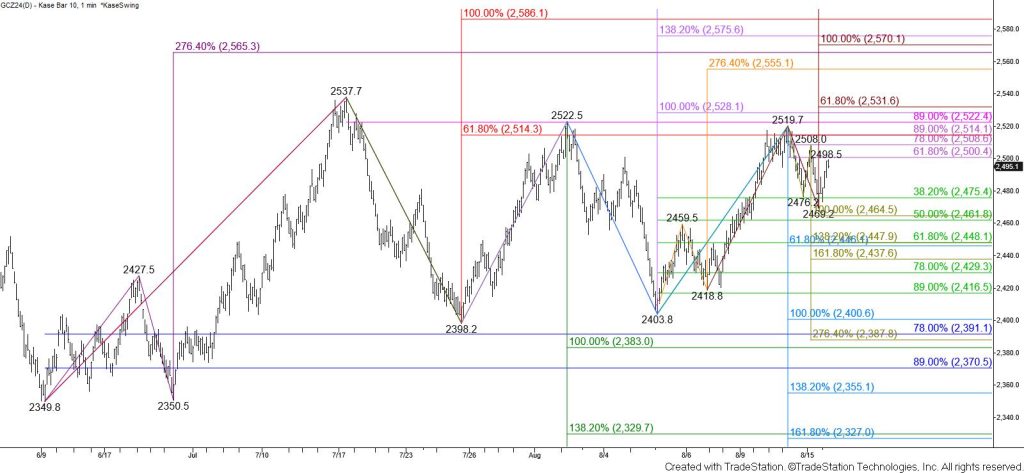

December gold has been trading in a range between approximately $2400 and $2430 since mid-July. Prices are trading near the top of the range and a break higher out of the range is ultimately expected.

Gold will need to close above key resistance at $2530 to confirm that a break higher is finally underway. Such a move will open the way for $2560 and $2581. Overcoming the $2514 smaller than (0.618) target of the wave up from $2349.8 will clear the way for a test of $2530 within the next few days.

The pullback from $2519.7 looks like a correction based on today’s trading. However, the move down took out the smaller than (0.618) target of the wave down from $2519.7 and should test the $2464 equal to (1.00) target first. The move up from $2469.2 also held the 62 percent retracement of the decline from $2519.7 at $2500.

Closing below $2464 now looks as though it will be a challenge but would call for a test of key near-term support at $2447. This is the intermediate (1.382) target of the wave down from $2519.7, the smaller than target of the wave down from $2522.5, and the 62 percent retracement of the rise from $2403.8. Settling below this would put the near-term odds in favor of gold falling to test the $2401 equal to (1.00) target of the wave down from $2522.5.