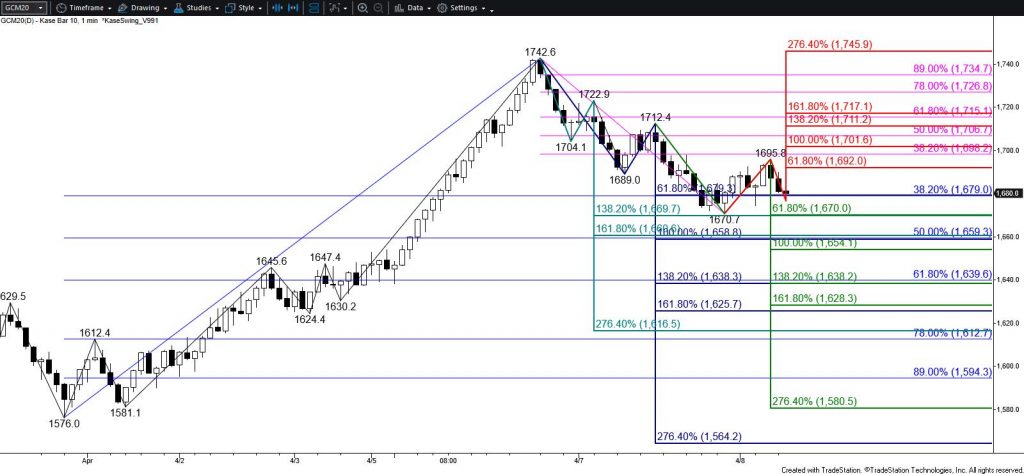

There is little doubt that gold’s decline from $1742.6 is corrective of the larger scale move up. So far, prices have fallen to $1670.7 but have not been able to close below $1679. This is the smaller than (0.618) target of the primary wave down from $1742.6 and the 38 percent retracement of the rise from $1576.0. Nonetheless, there is still a good chance for the correction to extend to $1660 first, especially upon a move below $1670 early tomorrow. The $1660 objective is the equal to (1.00) target of the primary wave down from $1742.6 and the 50 percent retracement of the rise from $1576.0. Support at $1660 is expected to hold. Closing below this would call for a test of key near-term support at $1639.

The corrective move down will likely be short-lived, and once $1660 is met odds for a move back up will increase substantially. There is also a reasonable chance that the move down has already stalled and that prices will press higher before reaching $1660. Should gold overcome $1698 first look for a test of $1716. Settling above $1716 would strongly imply the corrective move down is over and would clear the way for $1479 and higher.

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ration, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.