Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

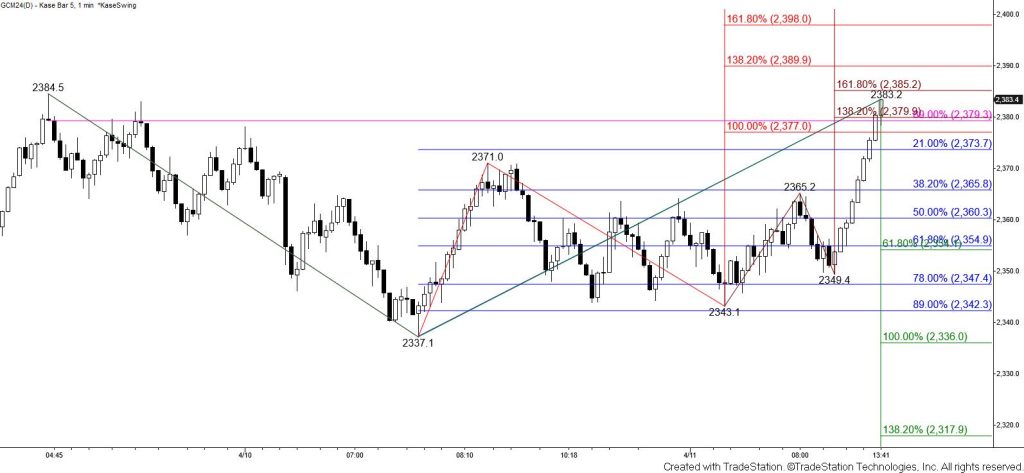

Gold rallied to settle above Wednesday’s open. The move up also overcame the $2378 equal to (1.00) target of the waves up from $2016.3 and $2337.1 as well as the intermediate (1.382) target of the wave up from $2343.1 and the 89 percent retracement of the decline from $2384.5 during post-settlement trading hours. Today’s rise implies that the corrective pullback from $2384.5 is complete. Tomorrow, look for a test of $2394. Settling above this will open the way for $2410 and then a test of the next major uptrend objective at $2446 in the coming days.

Because the $2384.5 swing high held, bearish daily divergences that were confirmed at that high are still intact. It is doubtful that $2384.5 will continue to hold. Even so, should prices turn lower and take out $2365 look for a test of $2354 and possibly key near-term support at $2335.