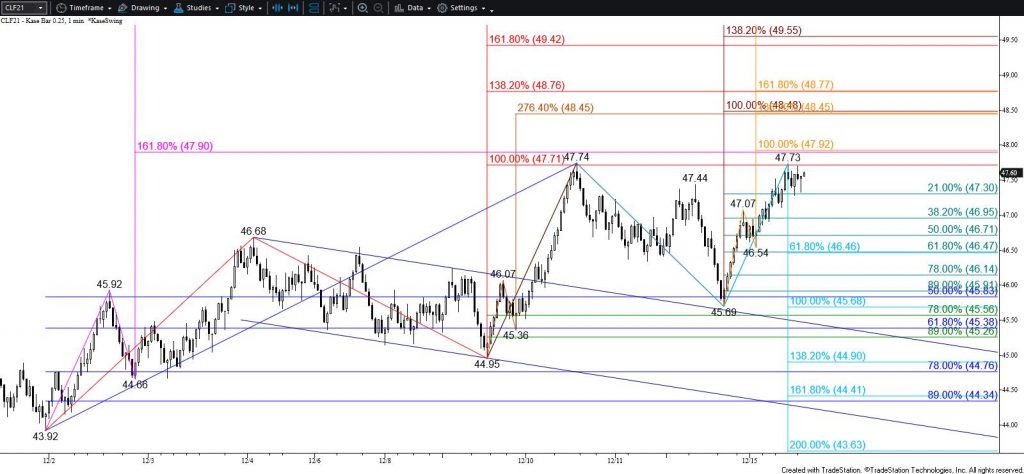

WTI Crude Oil Technical Analysis and Short-Term Forecast

WTI crude oil initially rose as called for today but stalled just short of the crucial $63.2 objective. This is the larger than (1.618) target of the primary wave up from the April contract’s $28.15 low. There is little doubt that the outlook for WTI is bullish in the coming months, but the move up has been due for a significant test of support for a few weeks. The challenge has been that each time WTI has formed bearish patterns or signals the follow-through has been lackluster and WTI rises to new highs shortly thereafter.

Nevertheless, today’s pullback from $63.0 has set up a bearish high wave candlestick, momentum divergence, and a wave formation that calls for a test of $60.7 early tomorrow. Falling below this will clear the way for $59.8, which will take out Monday’s $60.3 midpoint and the 62 percent retracement of the rise from $58.6. Closing below $59.8 would then call for a test of Monday’s $58.9 midpoint and possibly $58.4. The $58.4 objective is the larger than (1.618) target of the wave down from $63.0 and the bearish threshold of the daily Kase Trend indicator. Settling below $58.4 would serve as a strong warning that a much more significant test of support is finally underway.

With that said, caution is warranted because the market is still absorbing information regarding the impact of last week’s cold snap throughout Texas and the Plains states. Should WTI overcome $62.1 before taking out $60.7 look for a test of $62.6, which then connects to key resistance at $63.2. Settling above $63.2 will reaffirm a bullish near-term outlook and open the way for $64.4 and likely $65.1 during the next few days.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.