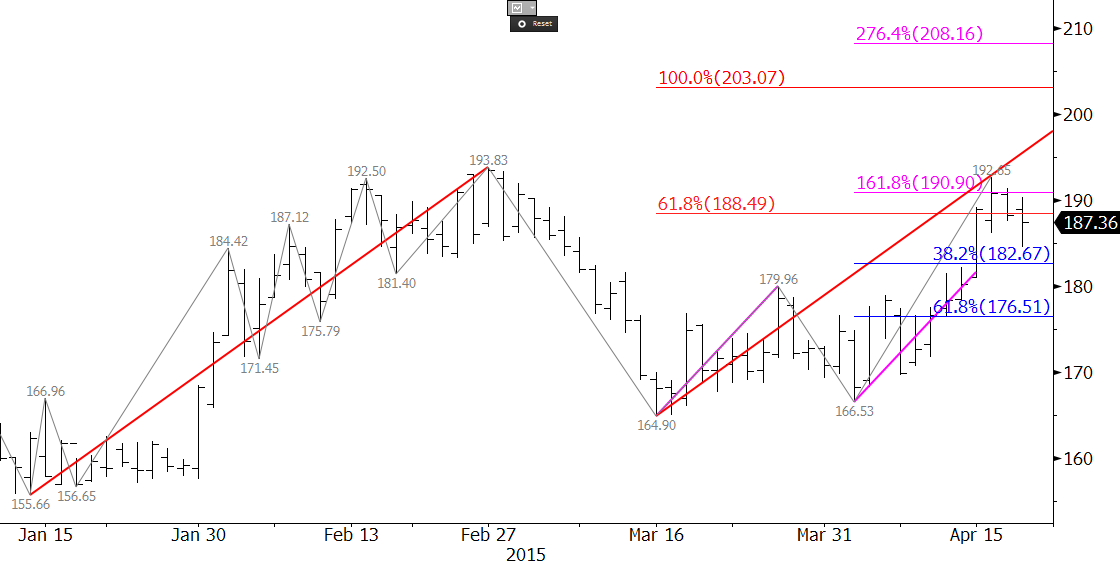

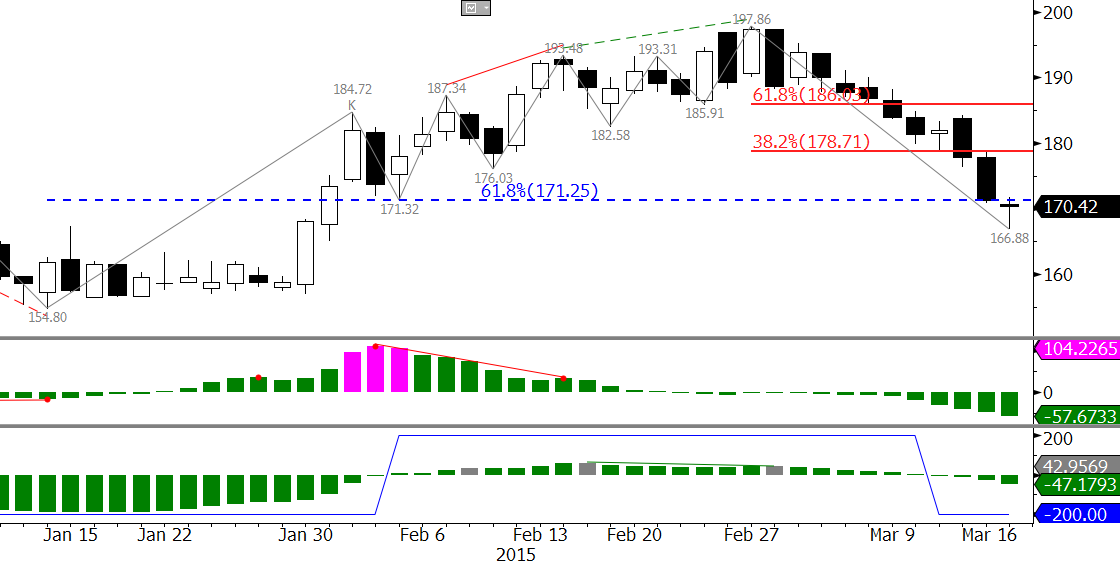

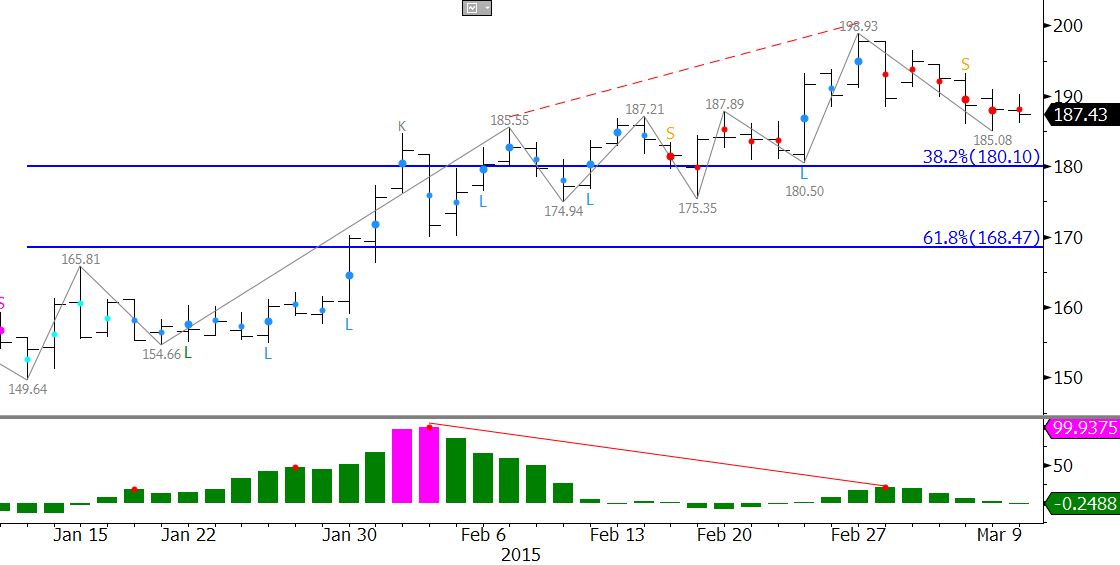

Brent crude oil prices will likely test a key decision point at $68.0 this week. This is the 1.00 projection for the wave up from $50.1, and a confluent projection for the sub-waves up from $53.63. A close over $68.0 would confirm that a long-term bullish recovery is underway. Narrowing calendar spreads support the move up, but are still wide by historic standards. First class long permissions (blue dots) on the KEES indicator also confirm the positive tone.

That said, momentum is waning on the KaseCD and is setup for a bearish divergence (higher high in price with lower high in momentum). The KasePO is quickly nearing overbought territory. There are also a daily bearish hanging man and evening star setup. These and a few other negative factors tell us that Brent will likely stall at $68.0. We expect to see a significant correction take place to test the mettle of the market before the move up extends much higher than $68.0.

To learn more, take a trial of Kase’s weekly crude oil forecast.