By Dean Rogers

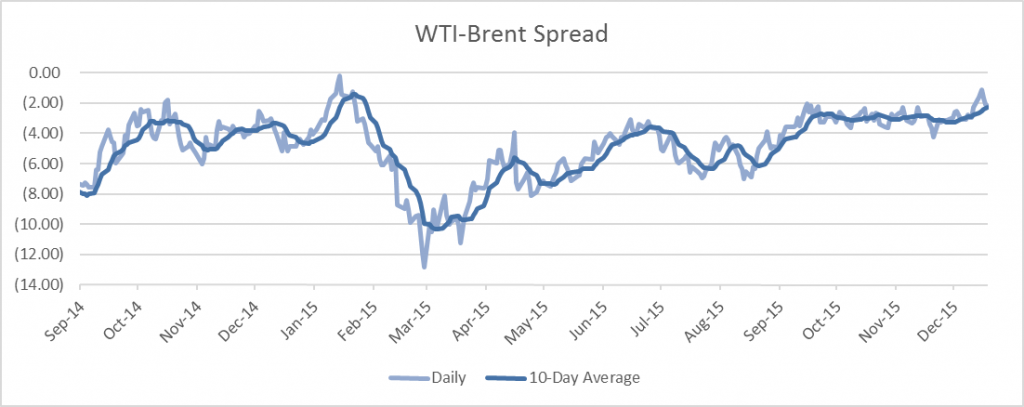

The U.S. rig count rose by 17 last week, and according to the EIA, U.S. crude oil supplies have reached 490.7 million barrels, the highest reported level for this time of year since 1930. In addition, the U.S.’s repeal of the 40-year oil export ban could ultimately encourage more pumping from domestic crude oil producers and narrow the WTI-Brent spread closer to parity in coming weeks. This is possibly good news for domestic producers, though it will take months and perhaps years before we will truly know. Overall, it is being reported that these factors could prolong the supply glut that is projected to last through the end of 2016 and possibly beyond.

The narrowing WTI-Brent spread is a being driven by WTI’s deeper contango versus Brent. In January 2015, the two grades were trading near parity, and it looks like this will be the case again in early 2016. This is encouraging for some U.S. producers as the spread could extend into positive territory where $2.60 is a confluent projection. However, longer-term, a narrow spread would likely lead to increased U.S. production, which would be negative for WTI. Conversely, a positive spread could encourage Brent producers to cutback, thus spurring both grades higher over the course of the longer-term. The key will be seeing whether or not the spread becomes positive and remains that way for the next few months. If so, it could lead to a longer-term shift in production strategies, and ultimately prices, world-wide.

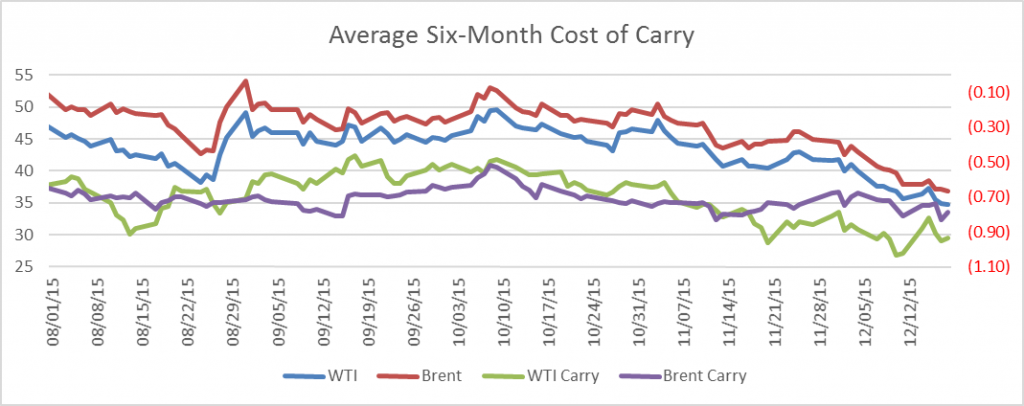

Another factor to watch right now is the calendar spreads and the cost of carry. The six-month average cost of carry narrowed a bit for WTI and Brent last week, but remains volatile. Typically, a carry above approximately ($0.50) encourages those with storage to buy oil now, store it, and then sell it at a later date when prices are higher (due to deep contango). This is fundamentally negative because supply rises. The six-month average costs of carry for WTI was ($0.93) and for Brent ($0.79) as of Friday’s settlement.

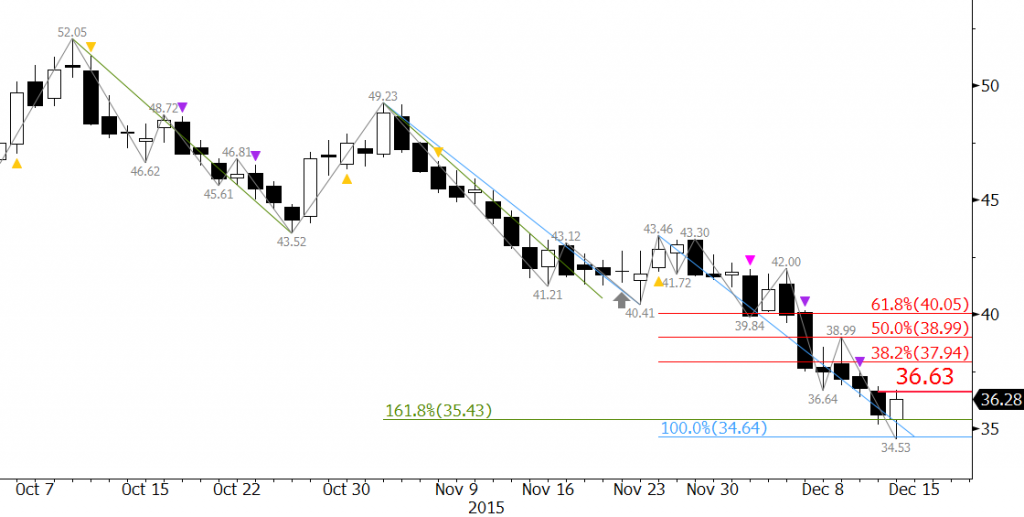

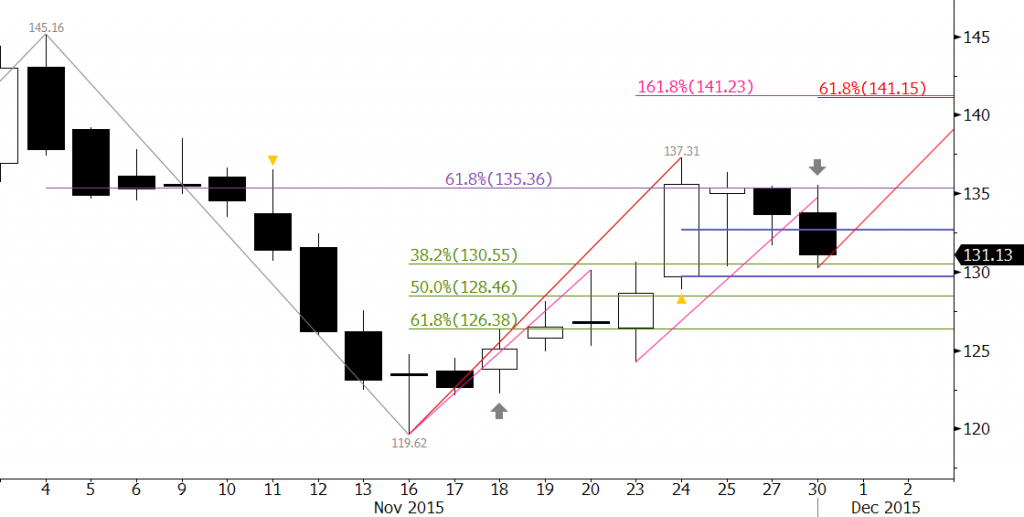

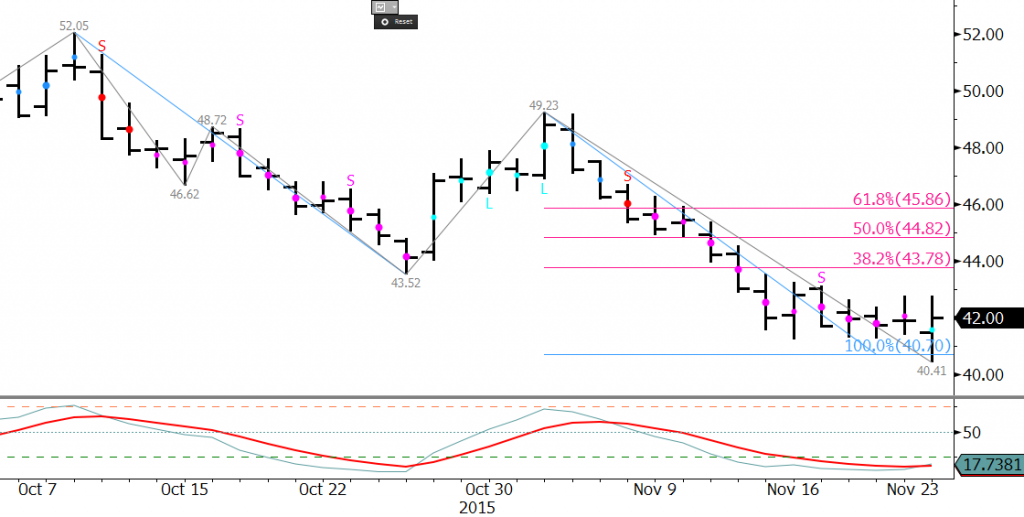

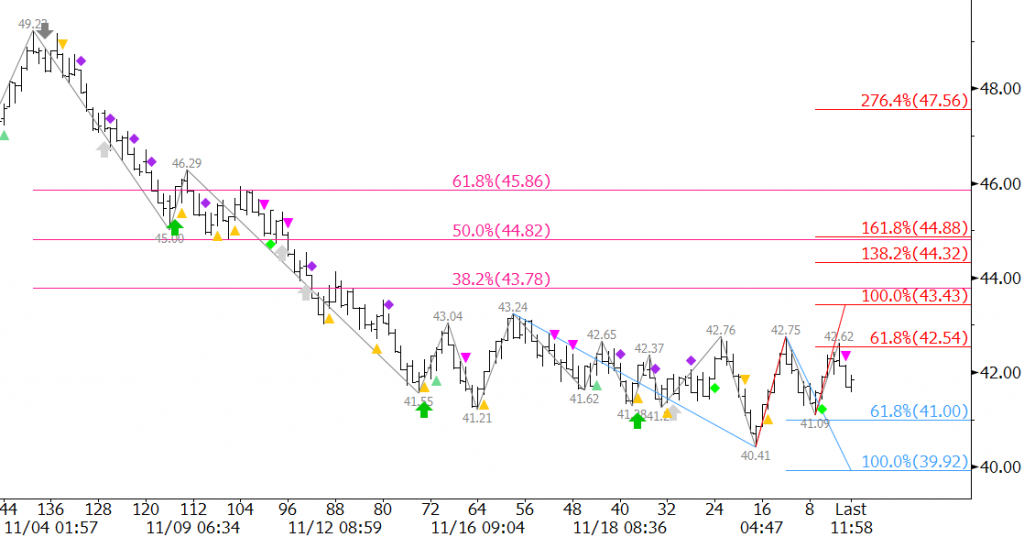

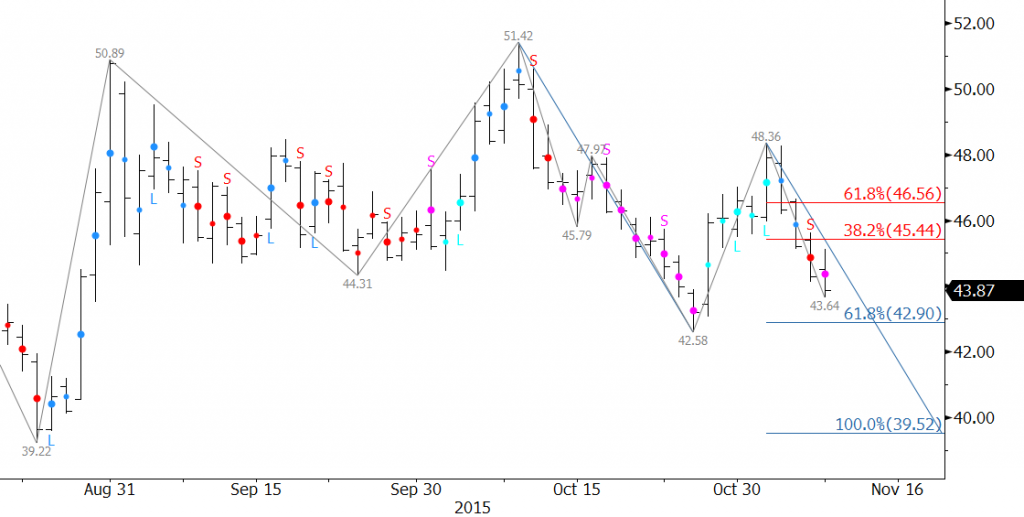

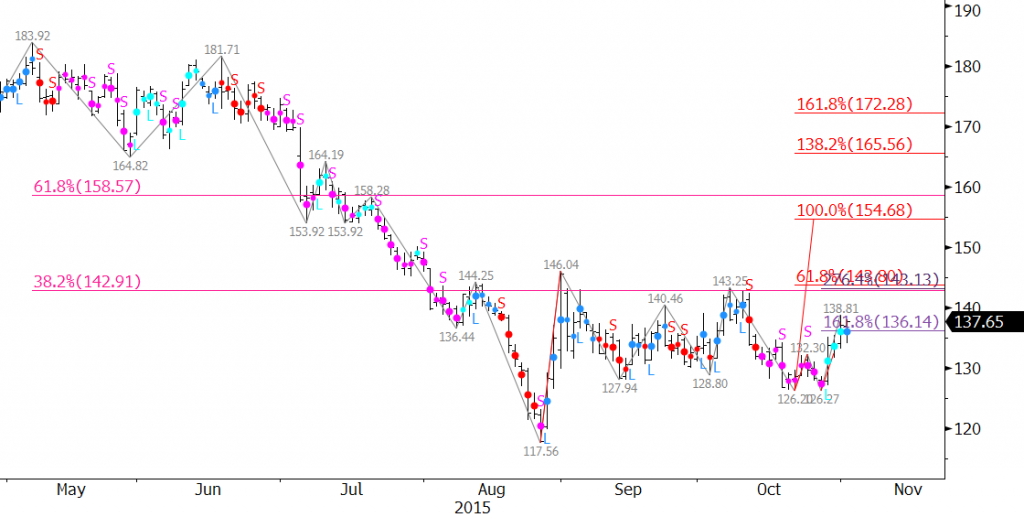

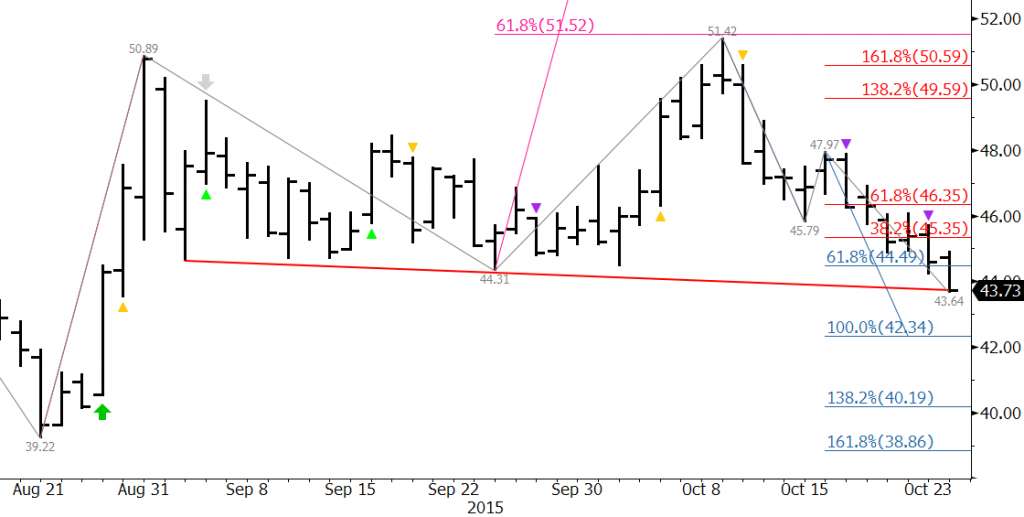

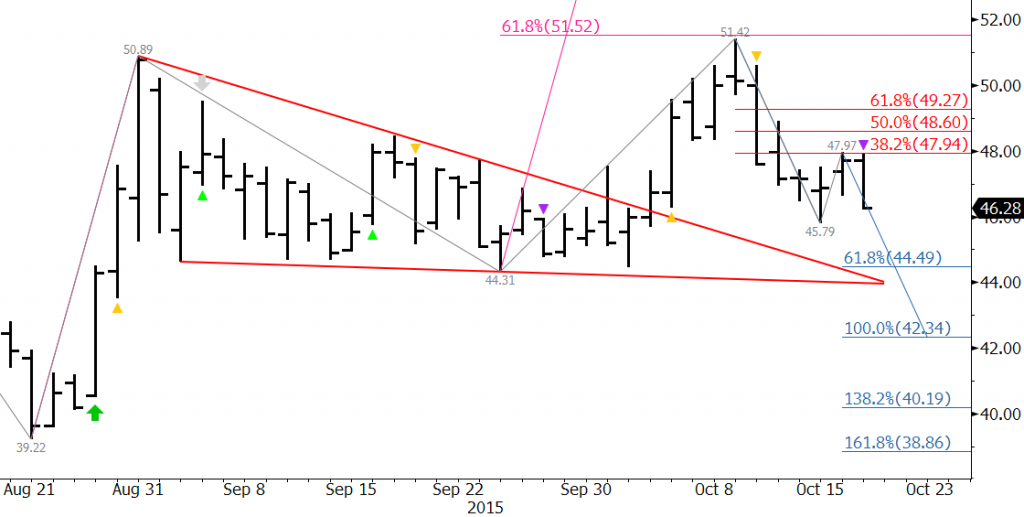

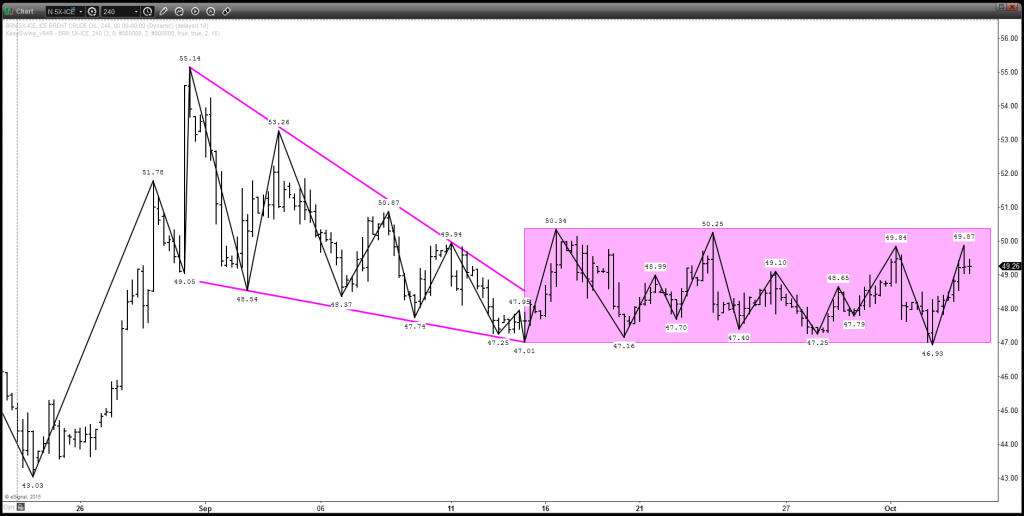

The technical agree with the negative fundamental and spread factors right now. Most momentum indicators are oversold and setup for divergence on the weekly and daily charts. Therefore, a correction might take place soon. However, until a swing low in both price and momentum are made look for the decline to continue. Over the next day or so we expect WTI to fall to $35.0 and for Brent to challenge $35.6. Both are crucial targets to connect to much lower levels as discussed in our full weekly analysis.

This is a brief analysis and outlook for the next day or so. Our weekly Crude Oil Commentary is a much more detailed and thorough energy price forecast. If you are interested in learning more, please sign up for a complimentary four-week trial.