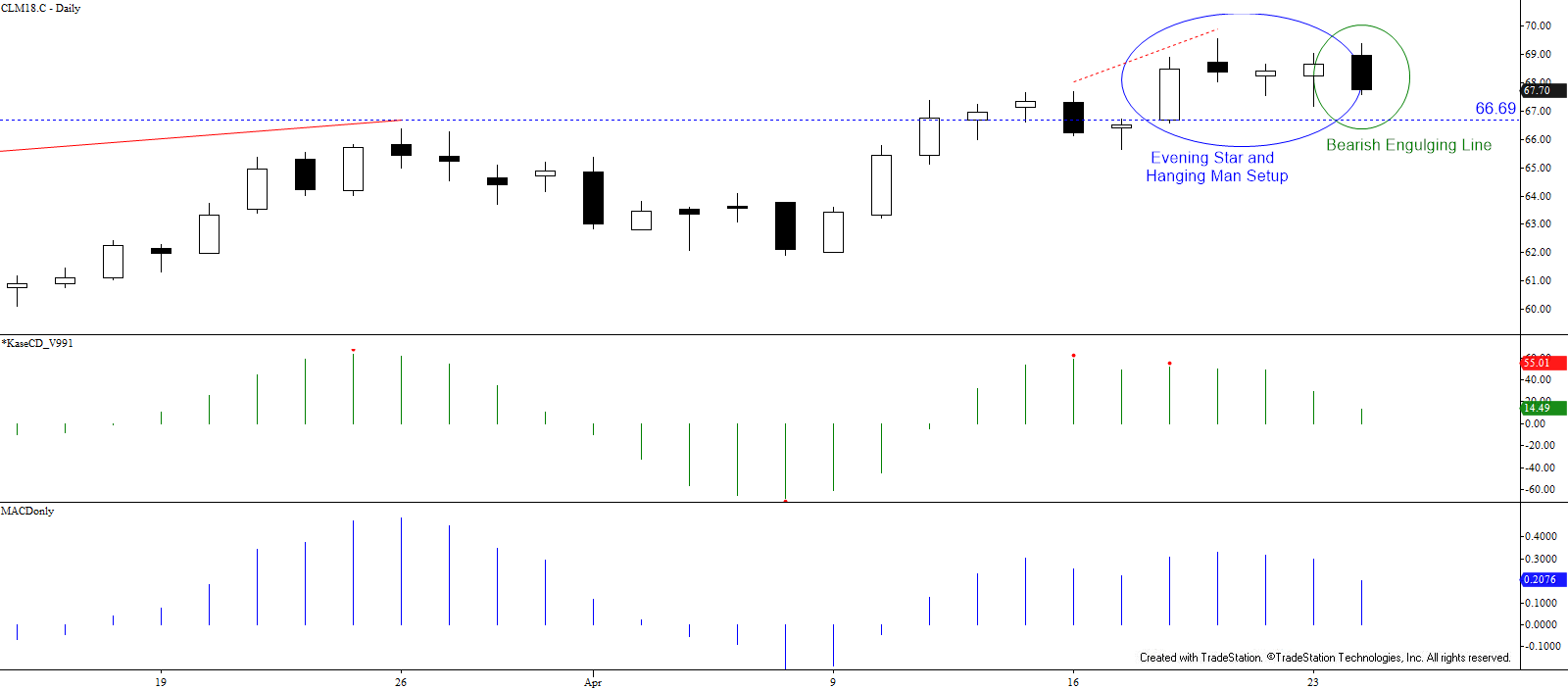

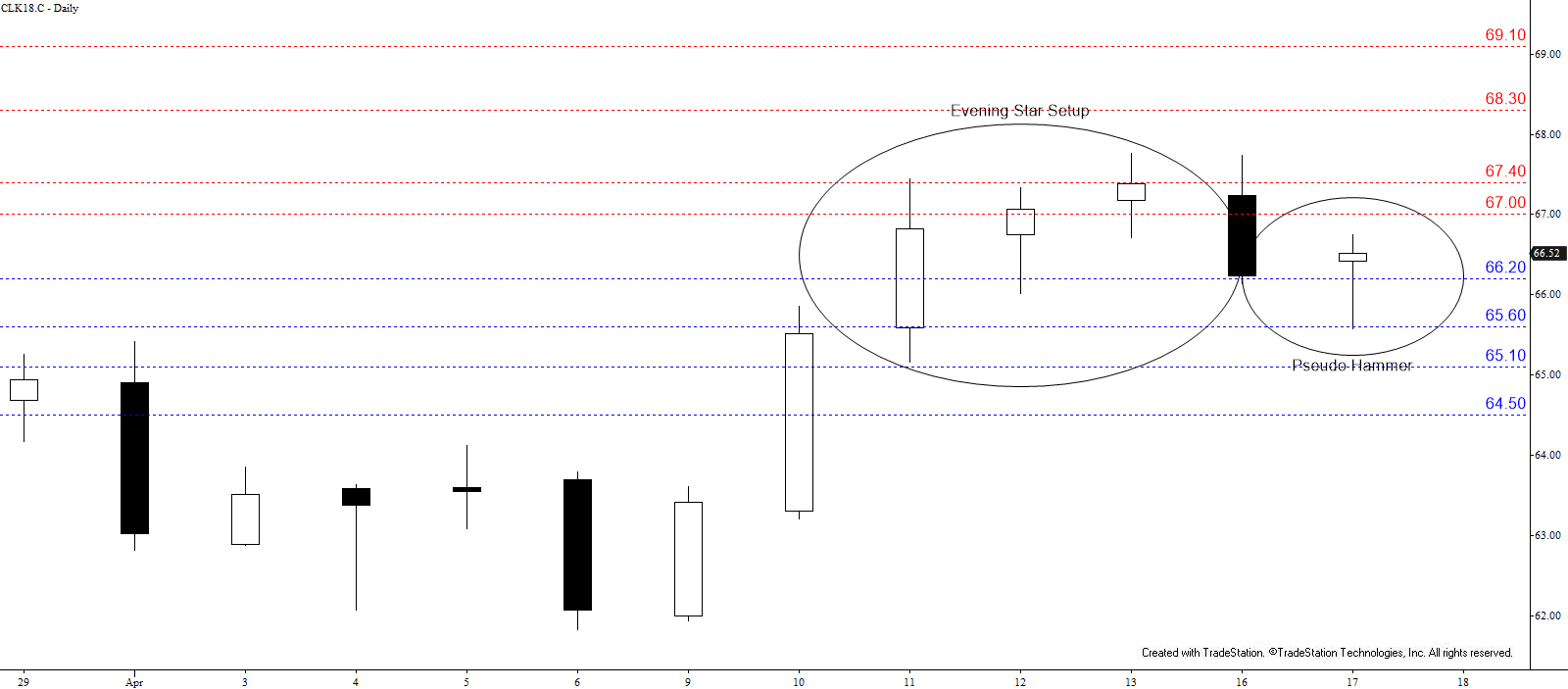

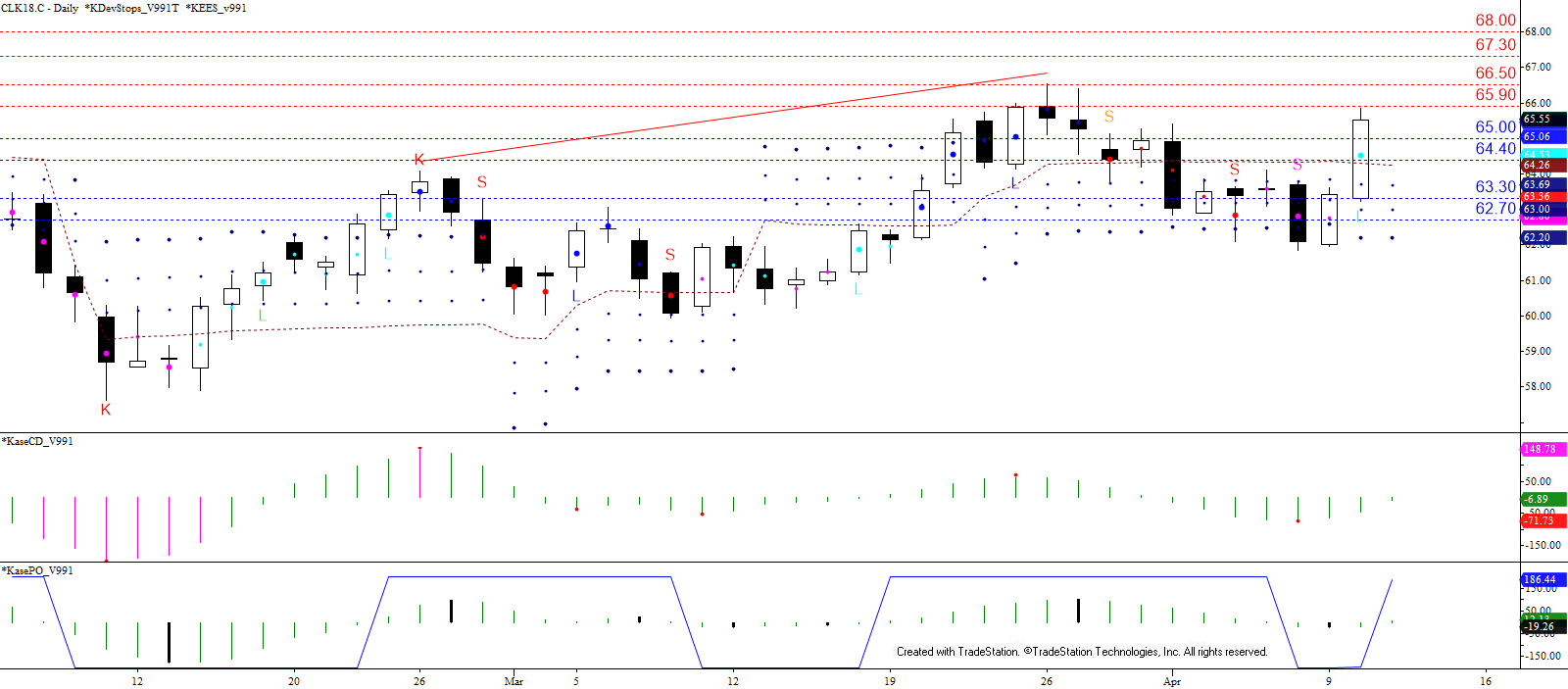

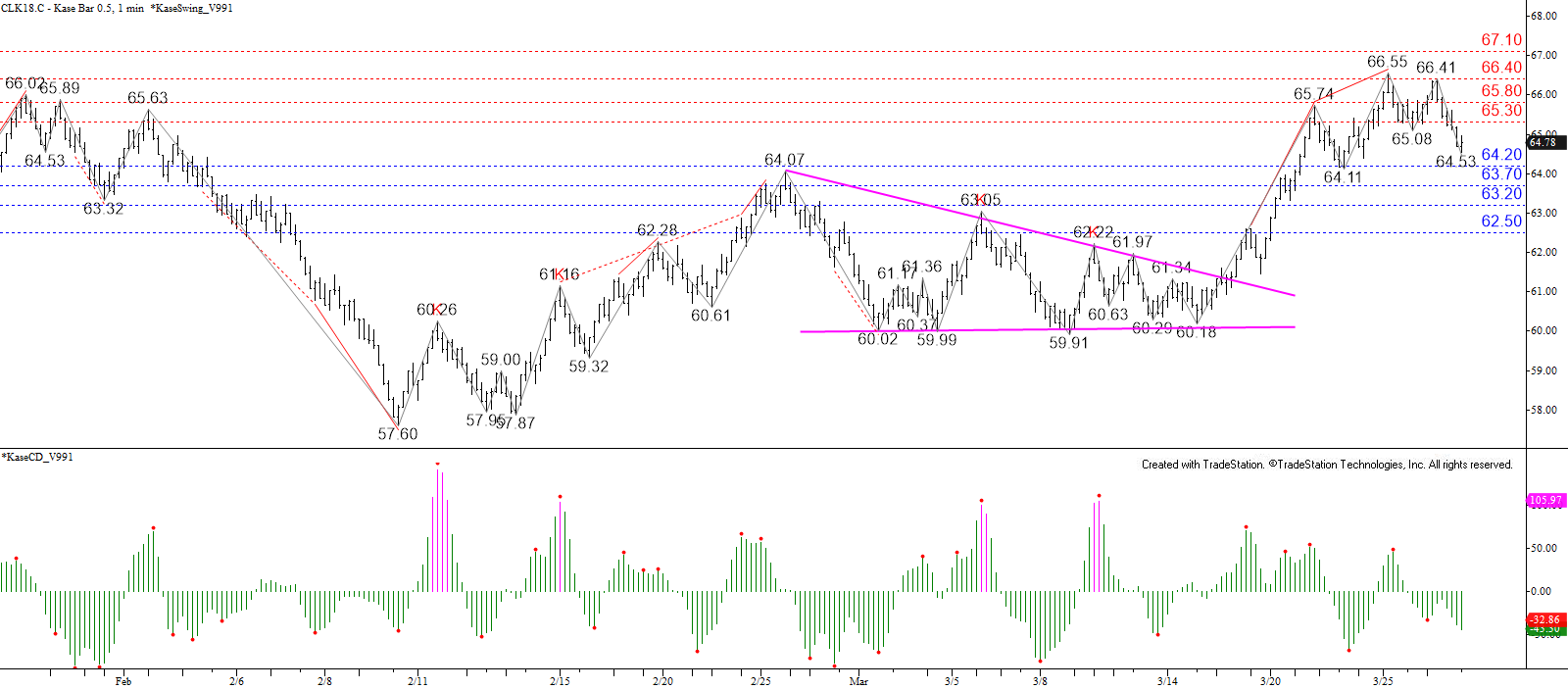

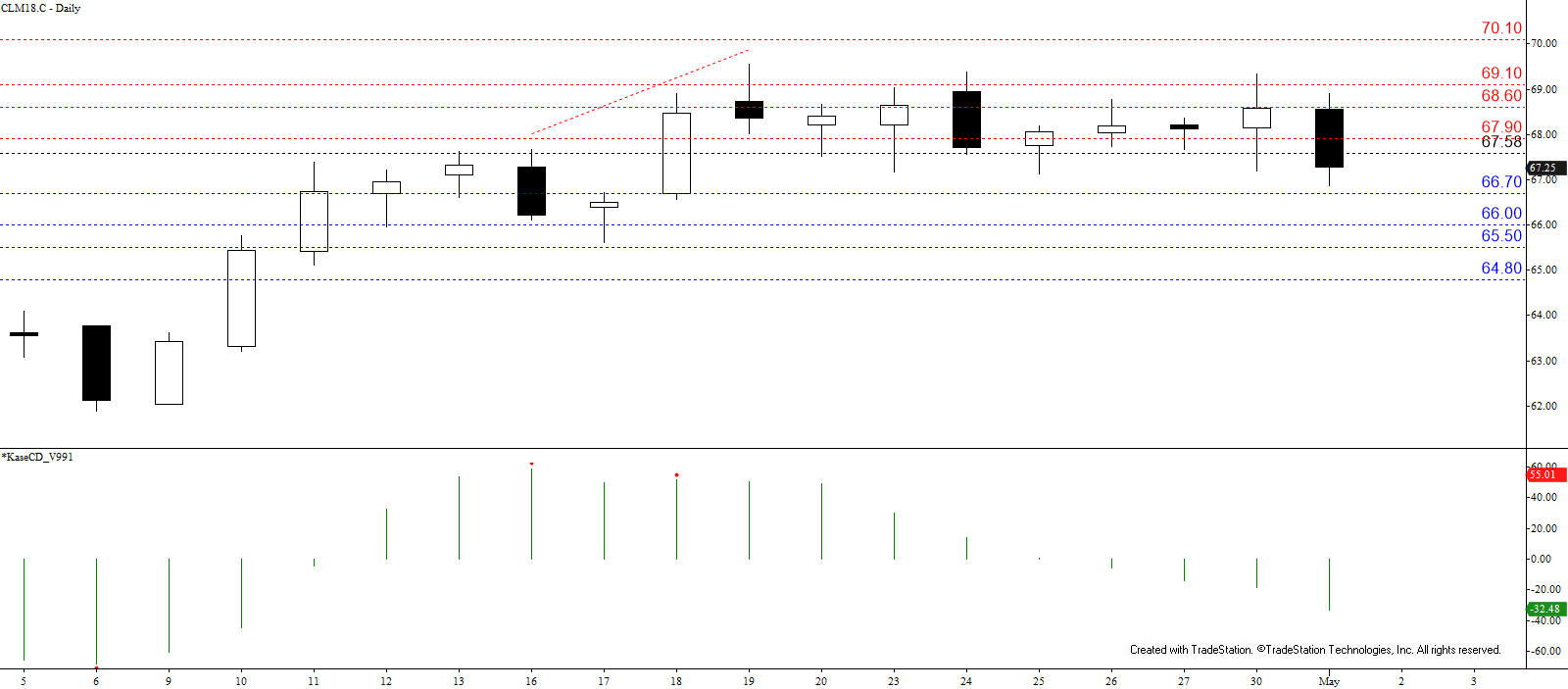

June WTI crude oil briefly broke lower out of the recent sideways trading range between nominally $67.1 and $69.5 when it fell to $66.85 today. The settle below April 18’s $67.58 midpoint indicates the near-term outlook is negative, though at this point prices will likely have to settle below $66.7 to confirm the downward correction is going to extend before prices eventually challenge the next major objective at $70.1.

Tomorrow, look for a test of $66.7, a close below which would open the way for $66.0 and lower. Even then, WTI crude oil still has a long way to go before the long-term outlook becomes bearish, so any move down right now will most likely be corrective.

That said, prices settled just above the bottom of the recent trading range and the small wave formation up from $66.85 indicates a test of today’s $67.9 midpoint might take place first. A close above this would call for key near-term resistance at $68.6. For the downward correction to extend to $66.0 and lower this week $68.6 must hold. A close above this would shift near-term odds back in favor of $70.1.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial