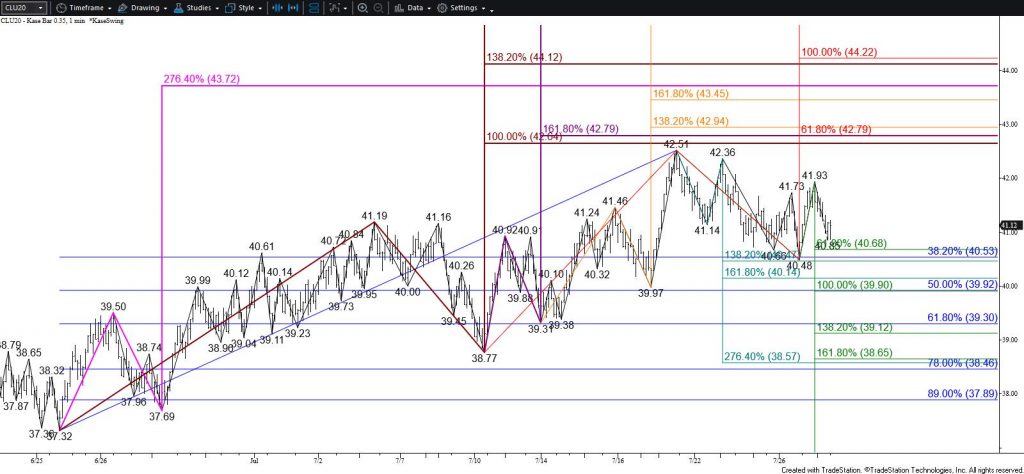

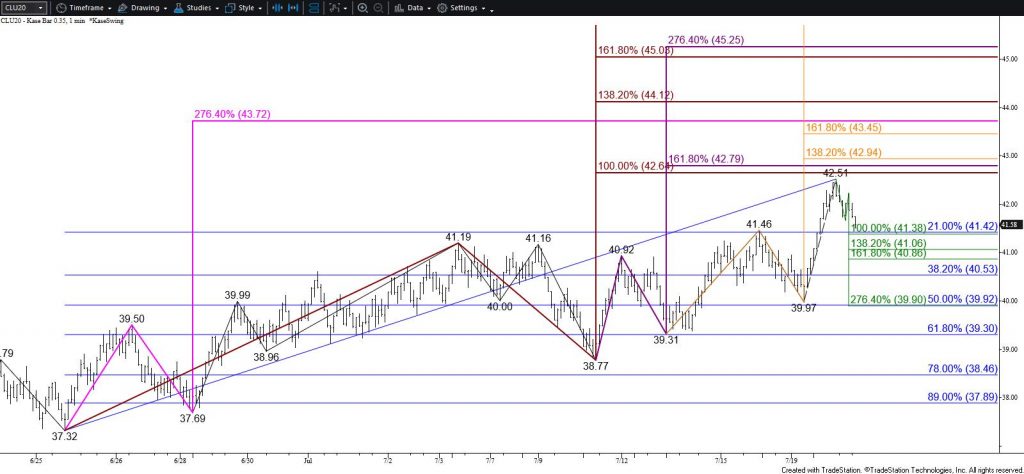

WTI Crude Oil Price Forecast

The near-term outlook for WTI crude oil is bullish again after today’s move up overcame the 62 percent retracement of the decline from $42.51 and the $41.93 swing high. Most importantly, WTI challenged the smaller than (0.618) target of the primary wave up from $37.32. Waves that meet their smaller than target typically extend to their equal to (1.00) target, in this case, $44.0. Therefore, odds now favor a continued rise toward $44.0, which is also the 200-day moving average. Once $44.0 is met another test of support is anticipated.

Nevertheless, the $42.0 area is a highly confluent technical objective. Therefore, WTI should test support early tomorrow. There is immediate support at $41.4, but the more important level is $40.8. This is the 38 percent retracement of the move up from $38.72 and is expected to hold.

Falling below $40.8 will call for a test of key support at $39.9. This is split between the 62 percent retracement and the smaller than target of the wave own form $42.51. For the move up to extend to $44.0 during the next few days as expected $39.9 must hold. Closing below this will clear the way for $39.0 and likely $38.3.

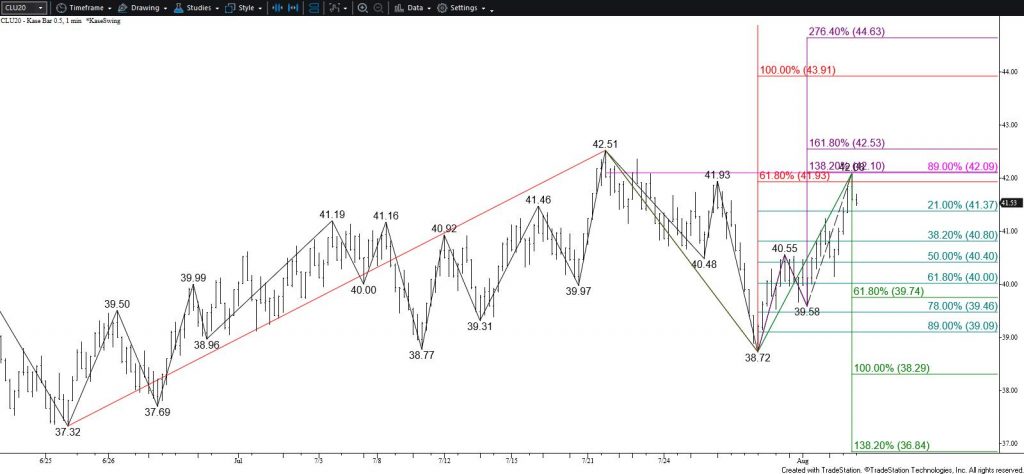

Brent Crude Oil Price Forecast

Brent crude oil is poised to reach $45.0. This is the smaller than (0.618) target of the wave up from $39.94 and the equal to (1.00) target of the first wave up from $41.72. This is a potential stalling point because it is also in line with the $45.07 swing high. Nonetheless, based on larger waves, once $45.0 is met odds will favor an eventual move to $46.9 before another major test of support.

Immediate support for tomorrow is $44.2 and then $43.7. The latter is expected to hold. Key support is $42.9. This is the 62 percent retracement of the rise from $41.72 and the smaller than target of the wave down from $45.07. Closing below $42.9 will shift near-term odds back in favor of a deeper test of support before the move up continues.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial