Brent Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

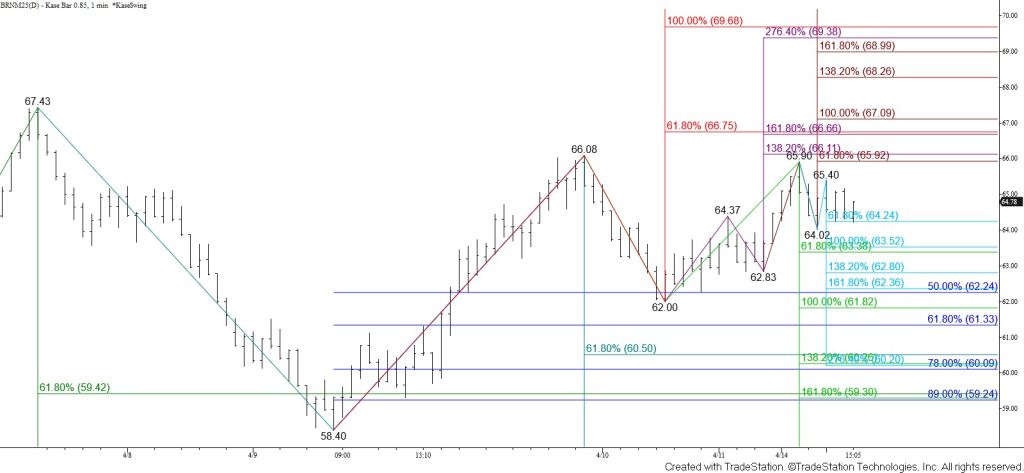

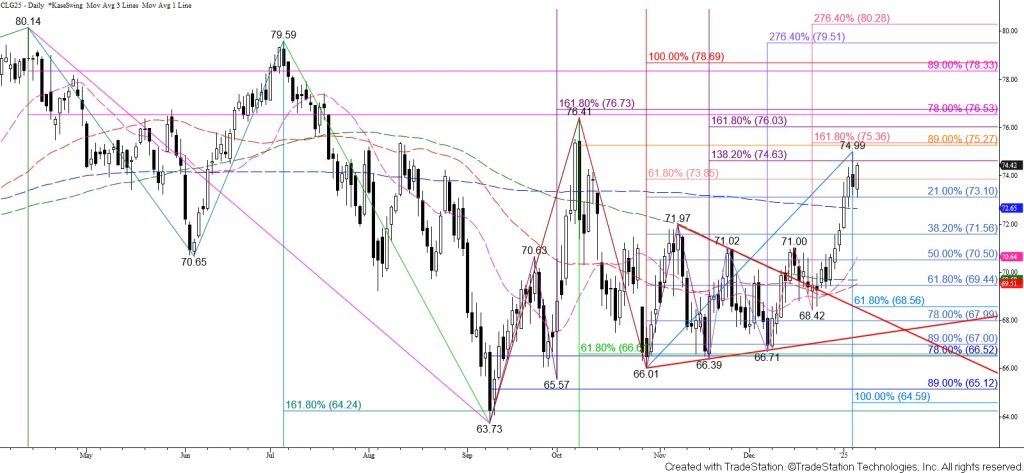

Brent crude oil formed another daily doji. So far, trading this week has reflected uncertainty, suggesting that traders are awaiting further information. The near-term outlook leans bullish because the waves up from $62.0 call for a test of $66.0, a close above which will clear the way for the $66.8 smaller than (0.618) target of the wave up from $58.4 to be challenged. Settling above $66.8 will confirm a bullish outlook for the coming days and open the way for a push to fulfill the $69.7 equal to (1.00) target of the wave up from $58.4. The connection to $69.7 is made through targets at $68.3 and $69.2.

Nonetheless, there is some evidence that suggests another test of support might occur first. The wave down from $65.9 fulfilled its $64.2 smaller than target today. This wave connects to $63.5 as the equal to target, which is also in line with the smaller than target of the wave down from $66.08. Falling below $62.8 would call for a test of key support and this wave’s $61.8 equal to target. This objective is key because falling to $61.8 would take out the $62.0 swing low and invalidate the wave up from $58.4 which projects to $66.8 and higher.