Natural Gas Technical Analysis and Near-Term Outlook

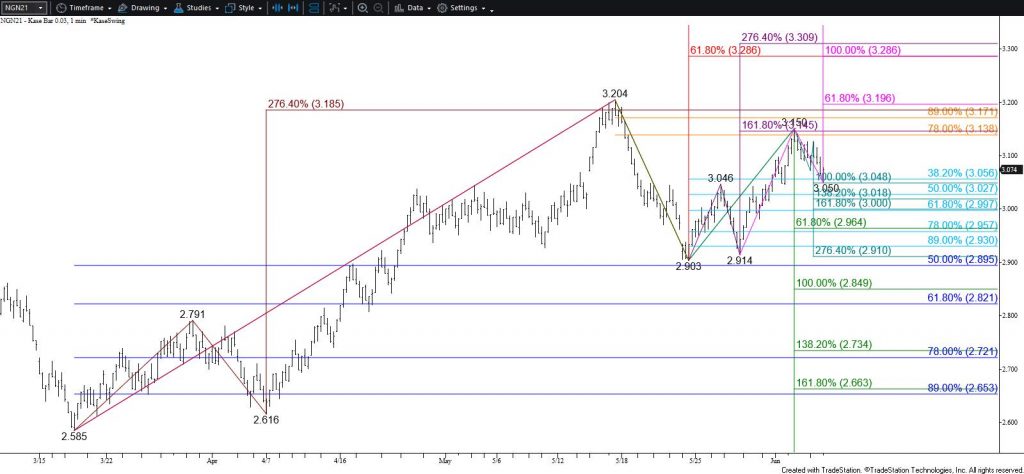

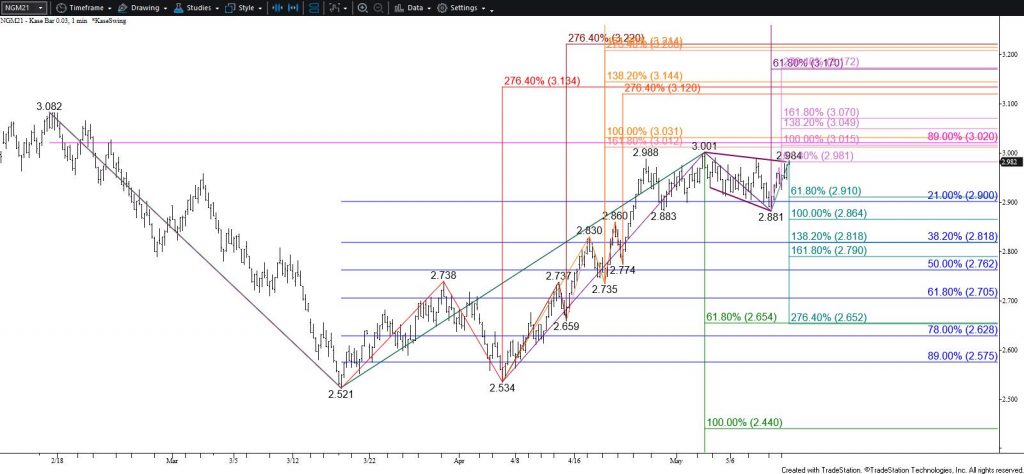

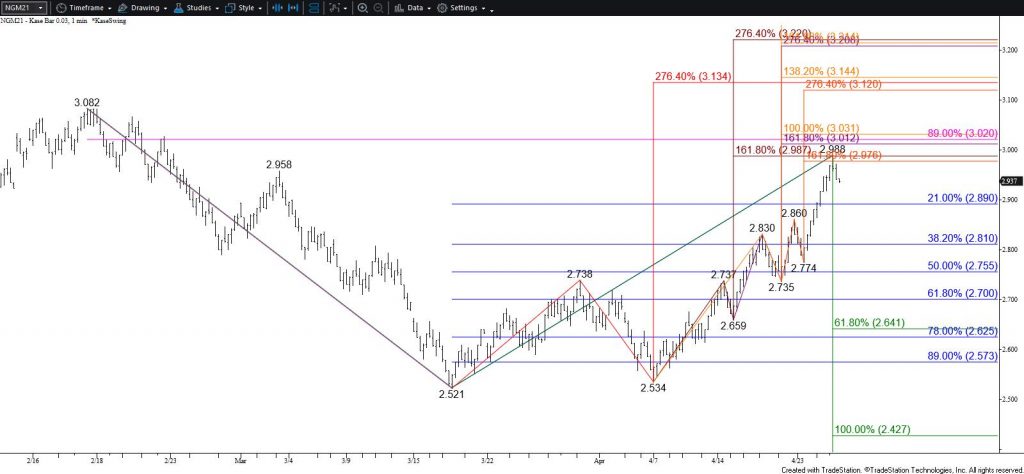

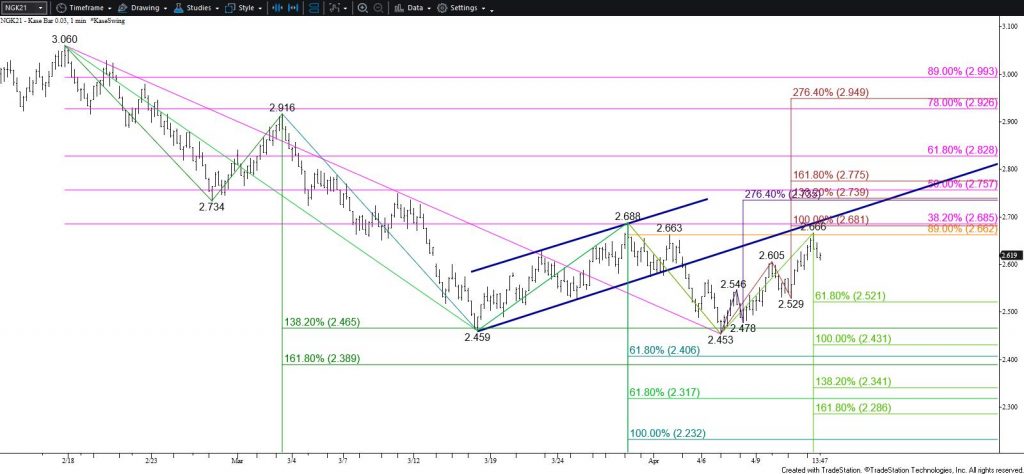

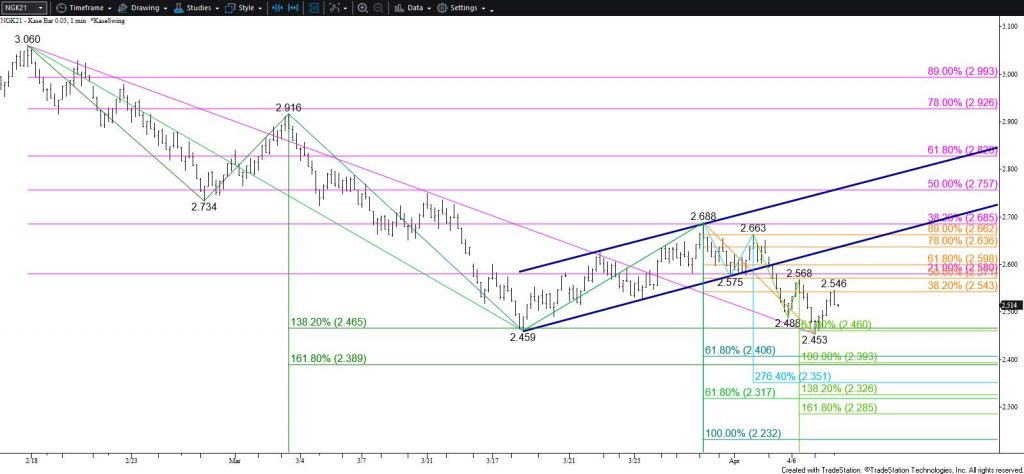

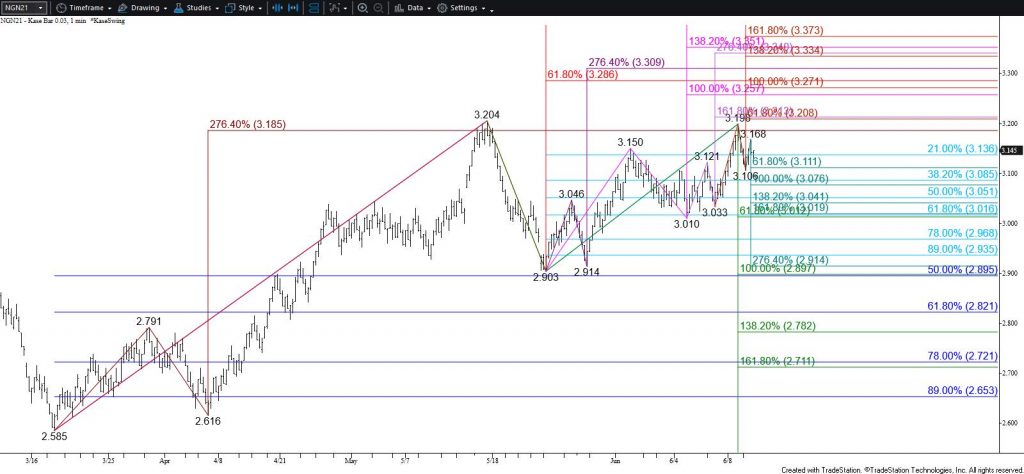

Natural gas held $3.17 resistance as expected in yesterday’s daily update before falling toward $3.11 again. The near-term outlook leans neutral-to-negative and a move below $3.11 early tomorrow will call for a test of $3.08. For the move up to retain a reasonable chance at rising above the $3.20 double top during the next few days, $3.08 must hold. Closing below this will call for a test of $3.05 and likely crucial support at $3.01. Settling below $3.01 is doubtful during the next few days but would call for natural gas to challenge the double top’s $2.903 confirmation point.

With that said, should natural gas overcome $3.17 before taking out $3.08 look for a test of $3.21. Settling above $3.21 would negate the double top and shift odds firmly back in favor of rising to $3.25 and $3.29.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.