Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

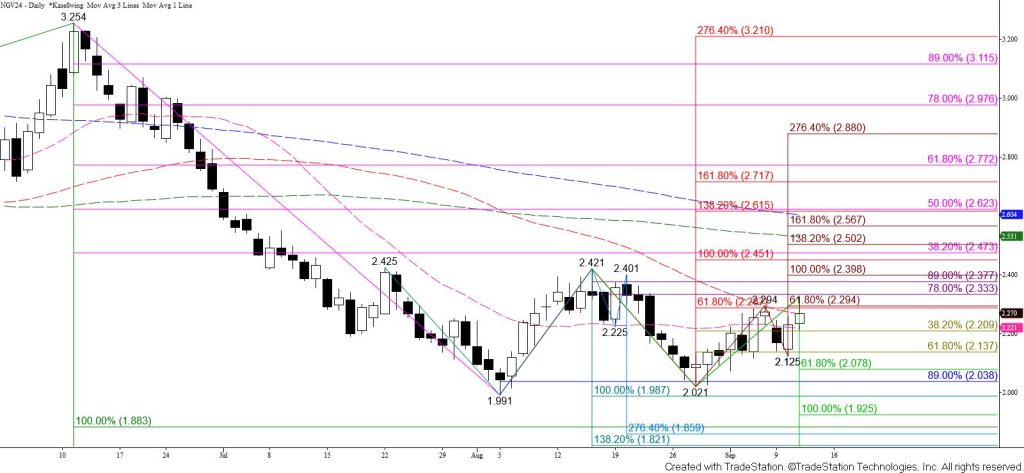

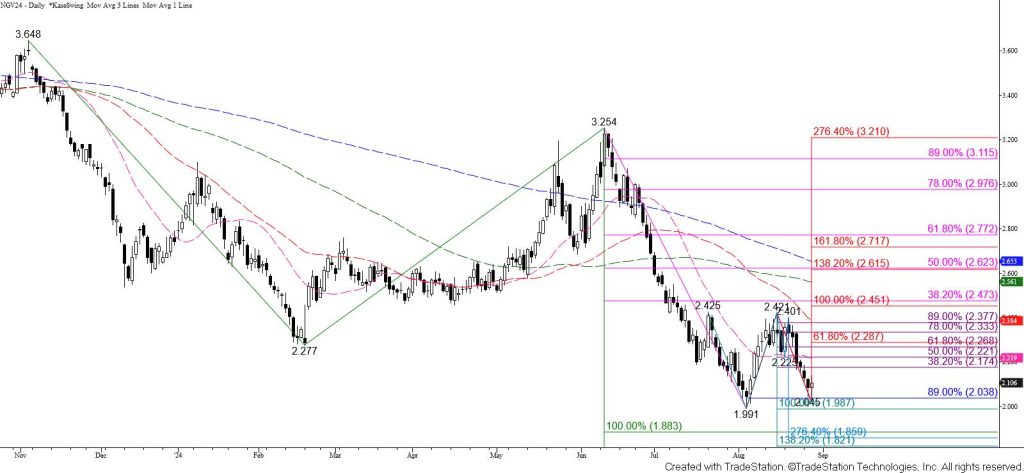

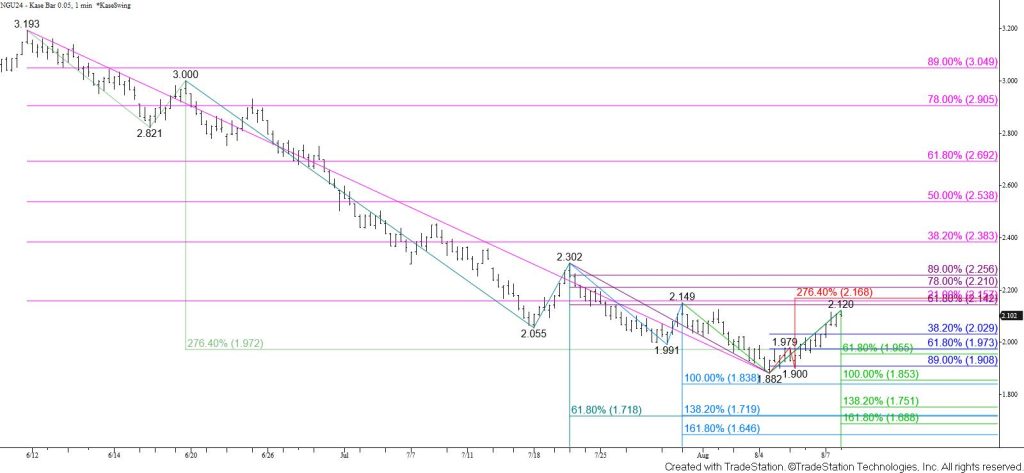

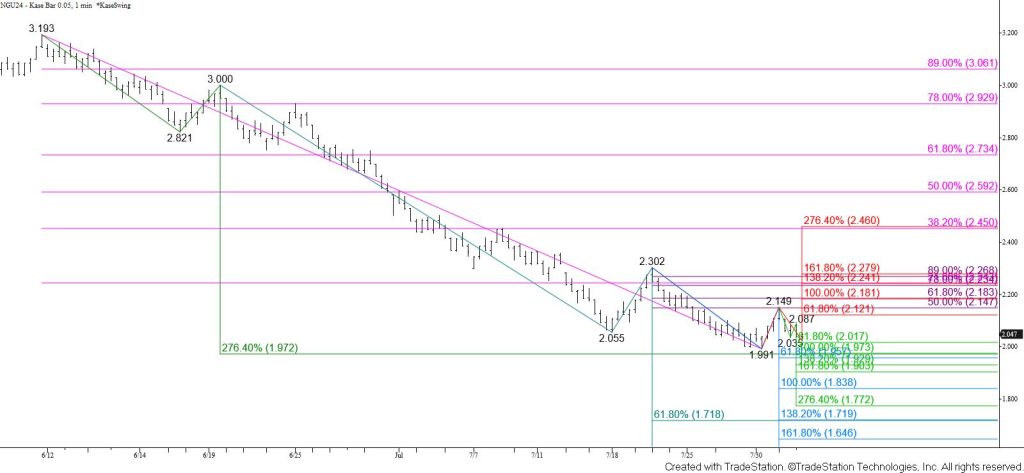

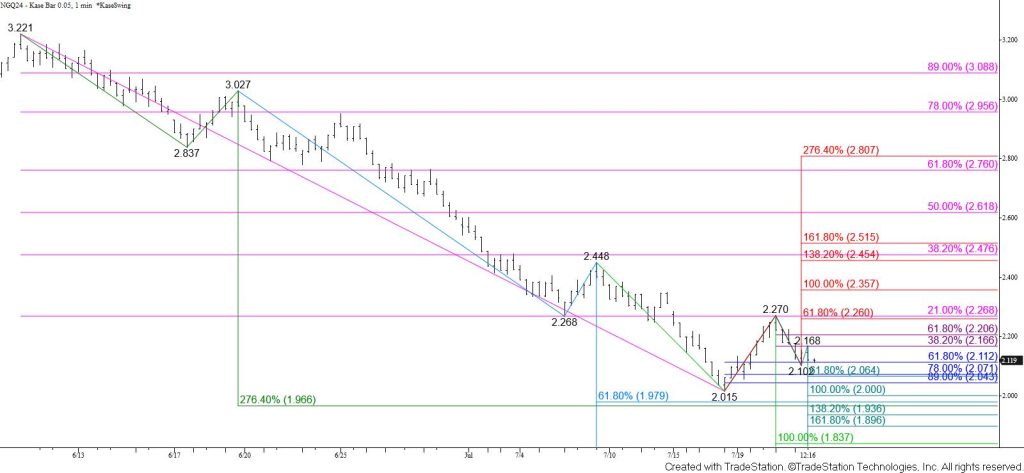

Natural gas has entered a period of consolidation in recent weeks that will likely lead to an eventual break higher. Today, the prompt month October contract tested and held a key level at $2.30 on a closing basis. This sits just above the smaller than (0.618) target of the waves up from $1.991 and $2.021 and is in line with the $2.301 confirmation point of a $1.856 double bottom on the continuation chart. Another test of $2.30 is anticipated within the next couple of days. Settling above $2.30 will open the way for a push to challenge $2.39 and likely $2.46.

Nevertheless, resistance around $2.30 has been resilient for the past few days. The late pullback from today’s $2.325 high warns that natural gas will continue to consolidate as traders wait for more evidence of bullish fundamentals and sentiment. A simple test of support should hold the 38 percent retracement of the rise from $2.021 at $2.21. Falling below this will call for an attempt to take out key near-term support and the 62 percent retracement at $2.14. Settling below $2.14 would put the near-term odds in favor of testing the $2.08 smaller than (0.618) target of the wave down from $2.421.