Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

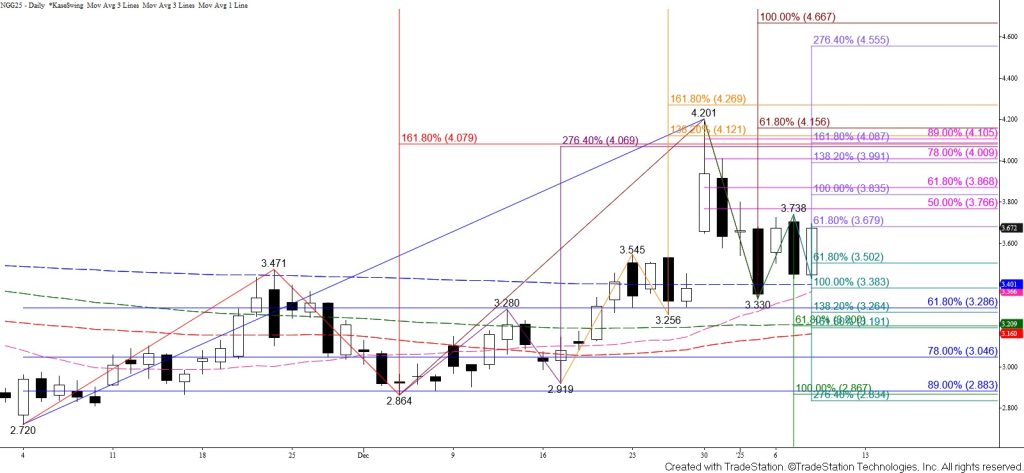

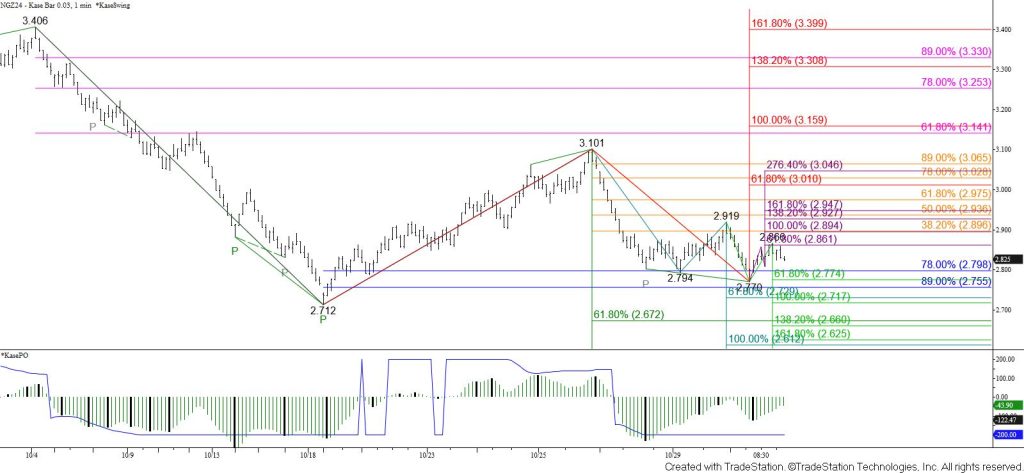

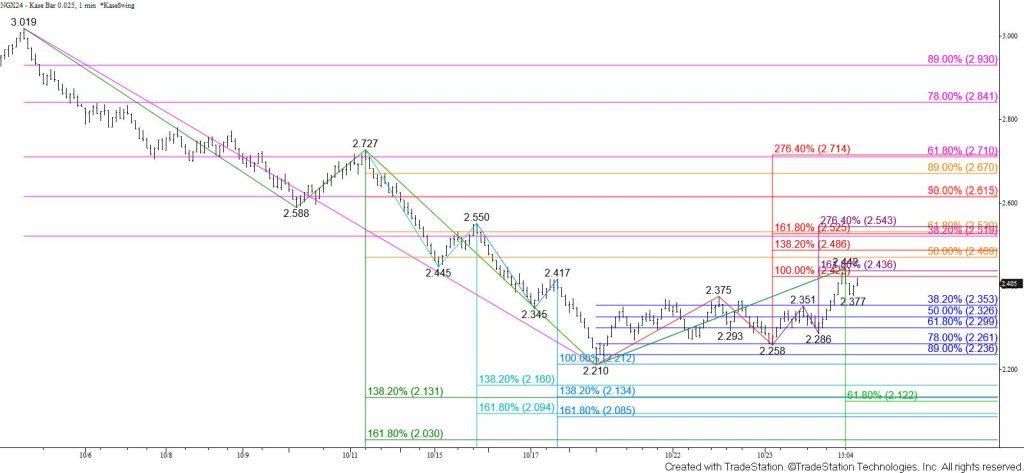

Volatility remains high for natural gas. Prices failed to test key near-term support at $3.39 today and instead rose to challenge the $3.68 smaller than target of the wave up from $3.330. The $3.68 target held on a closing basis, but today’s close above Tuesday’s midpoint and the 62 percent retracement of the decline from $3.738 implies that the move up will probably extend to at least $3.77 and then fulfill the $3.85 equal to (1.00) target of the wave up from $3.330 within the next few days. The $3.85 target is in line with the 62 percent retracement of the decline from $4.201. Settling above this will strongly suggest that the corrective move down is complete.

Trading has been erratic for the past few days so caution is warranted. Should prices fell below $3.52 look for another attempt to take out key near-term support at $3.39. This level is in line with a few projections of the intra-day waves down from $4.201 and is the equal to target of the wave down from $3.738. It also aligns with the 20- and 200-day moving averages. Closing below $3.39 will clear the way for a test of $3.28 and possibly $3.20.