Natural Gas Technical Analysis and Near-Term Outlook

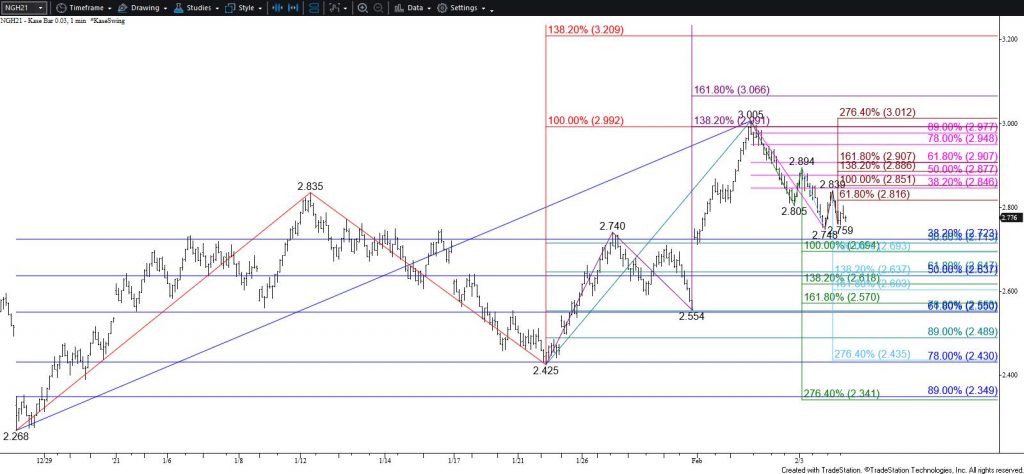

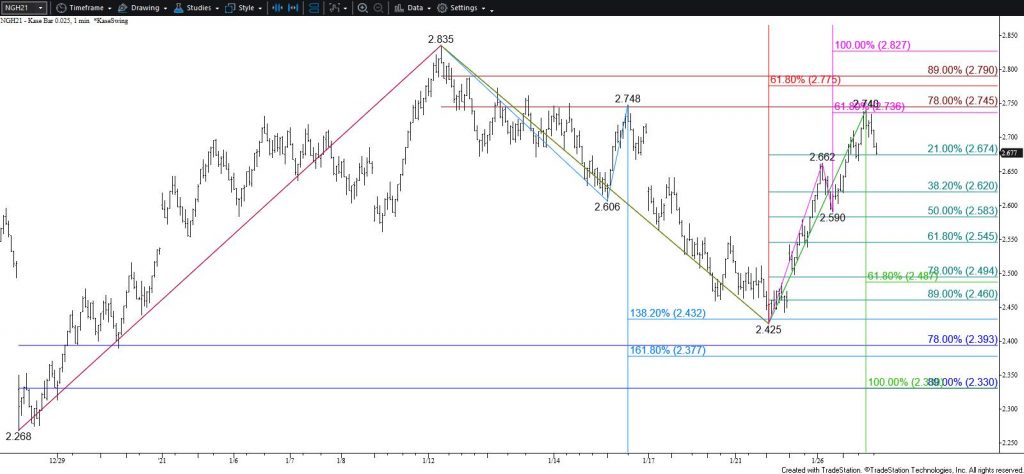

Natural gas briefly fell below $2.77 support before rallying above the 62 percent retracement of the decline from $3.057. The move up is poised to challenge the crucial $2.99 objective again early tomorrow. Based on today’s rise, odds favor a move above $2.99 and a test of $3.06. Settling above $3.06 will clear the way for $3.13 and likely $3.20 in the coming days.

There is little technical evidence that suggests the move up will stall again at $2.99. Even so, this has been a resilient threshold. Should $2.99 hold and prices begin to pullback again look for support at $2.89 and $2.83. Falling below $2.83 would imply that a head and shoulders pattern has formed. It is doubtful that this pattern will take shape, but such a move would reflect a bearish shift in external factors (e.g., weather) and sentiment. Closing below $2.78, the smaller than (0.618) target of the newly formed wave down from $3.057, would call for the $2.73 neckline of the head and shoulders to be broken and for prices to fall toward $2.65 and likely lower.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.