Gold Technical Analysis and Near-Term Outlook

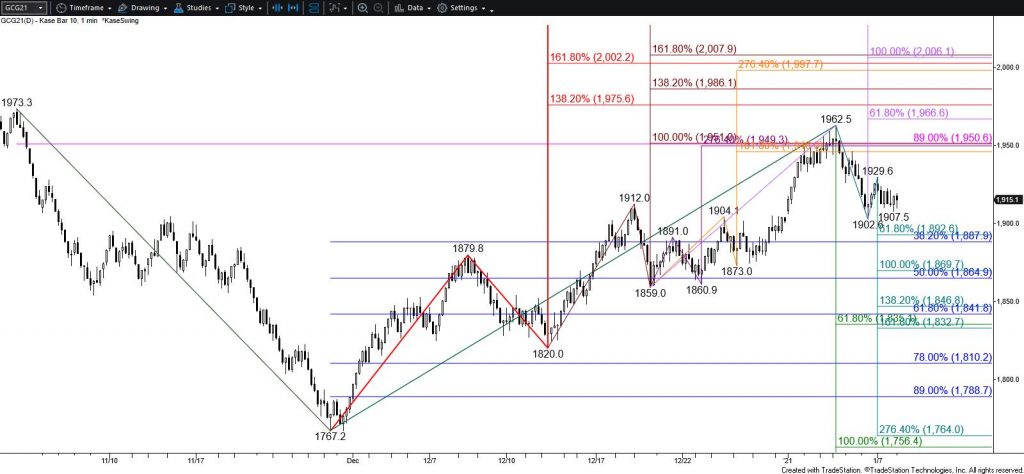

Gold retains a bearish near-term outlook after falling to the $1834 smaller than (0.618) target of the newly formed primary wave down from $1874.6. There is immediate support at $1829 still. However, barring any random influence from external factors, this wave down from $1874.6 is now poised to reach its $1817 equal to (1.00) target. Closing below $1817 will clear the way for $1802 and lower.

Nevertheless, the decline from $1874.6 has been quite choppy and might still prove to be corrective of a larger move up from $1800.8. Should gold overcome $1855 look for a test of $1874. This is the smaller than target of the wave up from $1800.8 and the barrier to a more significant test of resistance. Settling above $1874 would clear the way for $1902 and possibly $1926, the higher of which is the gateway to a bullish outlook.

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial