Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

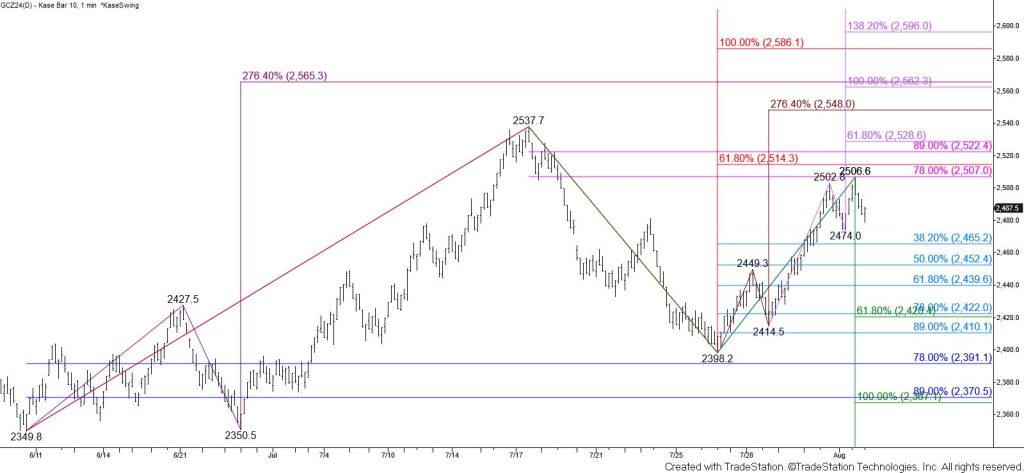

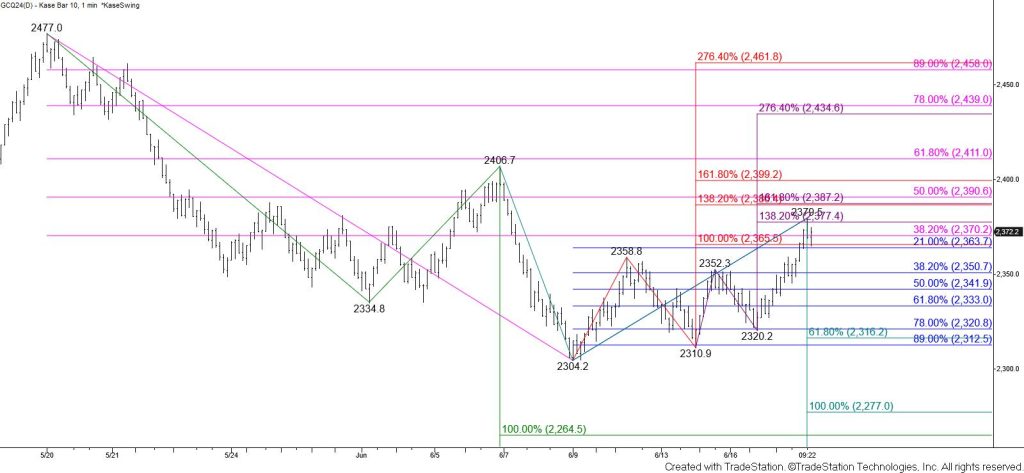

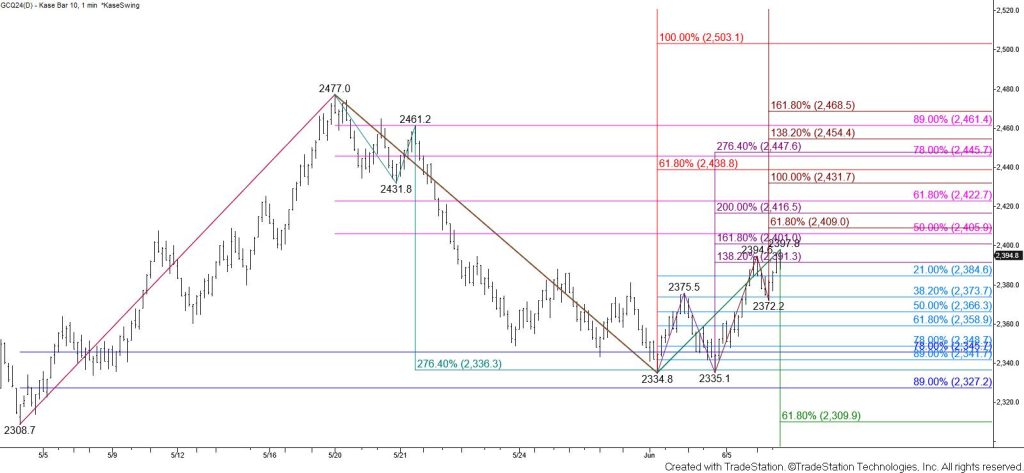

December gold held the 78 percent retracement of the decline from $2537.7 at $2507 before pulling back. Prior intra-day swing lows have held and the wave formation up from $2349.8 is still in a position to test $2514 smaller than (0.618) target of the primary wave up from $2349.8. Therefore, the near-term outlook leans bullish. Settling above $2514 will call for targets at $2529, $2548, $2564, and an eventual push to fulfill this wave’s $2586 equal to (1.00) target.

That said, the pullback from $2506.6 warns that a test of the 38 percent retracement of the rise from $2398.2 at $2465 might take place first. Taking out $2465 would call for the 62 percent retracement at $2440 and possibly a test of key near-term support at $2421. The $2421 level is the smaller than target of the wave down from $2537.7. Therefore, settling below this would shift the odds in favor of an eventual test of this wave’s $2369 equal to target.