by Dean Rogers

by Dean Rogers

Read on TraderPlanet

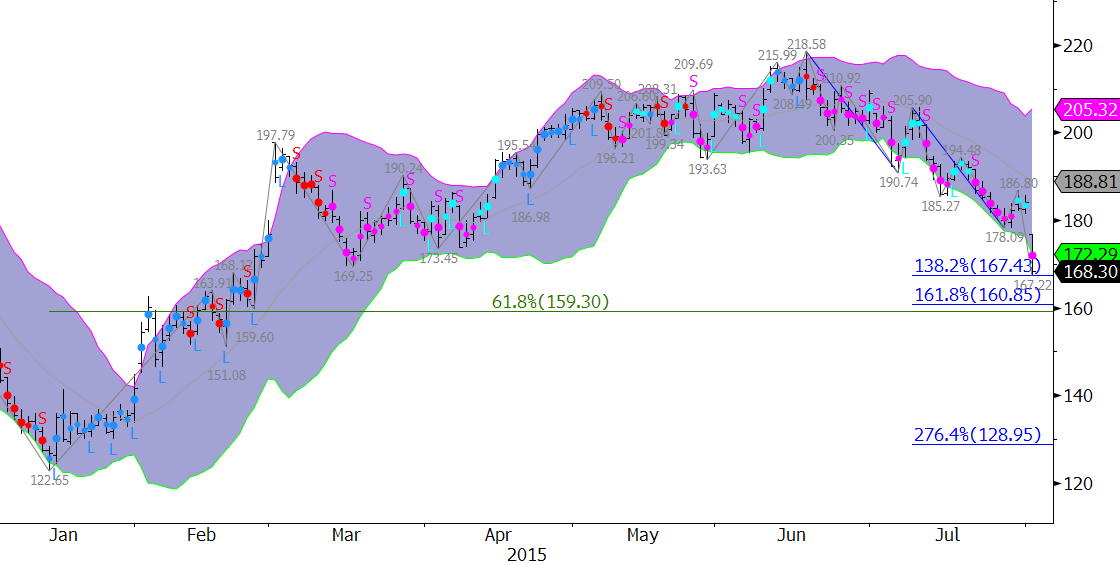

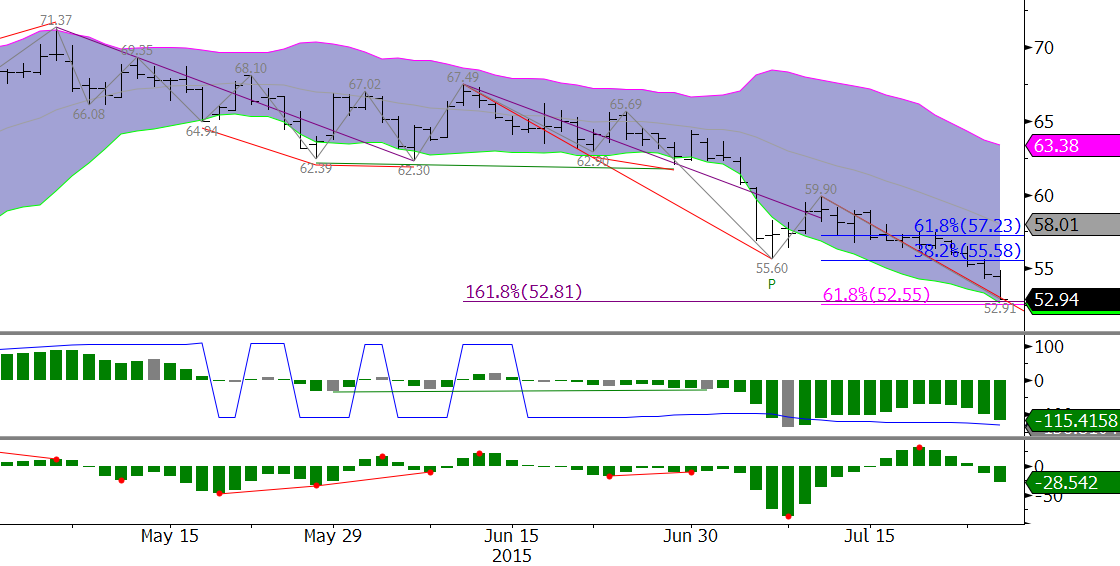

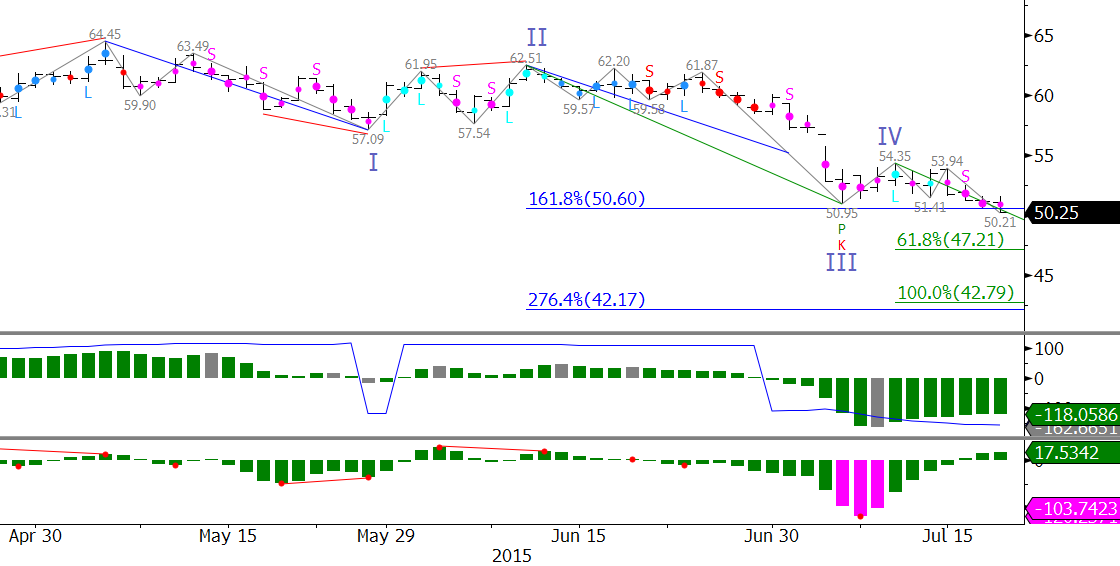

The recent Chinese stock market downturn and depressed economic outlook by many economists for the second quarter and through year’s end for China’s economy has commodity prices backpedaling. Many components of the Thomson Reuters Core Commodity CRB Index, and the Index itself, have either fallen to new lows or are poised to test lows that were made earlier this year.

In addition, the nuclear deal with Iran also raises concerns about an increased oil supply glut, and energy is one of the most heavily weighted components in the CRB Index. In fact, on March 18, 2015 the CRB index fell to 206.13. This coincided with WTI Crude Oil’s $42.03 low. Both are on the teetering edge of challenging this year’s lows.

The question is: Will commodity prices and the CRB Index fall to a new low for 2015?

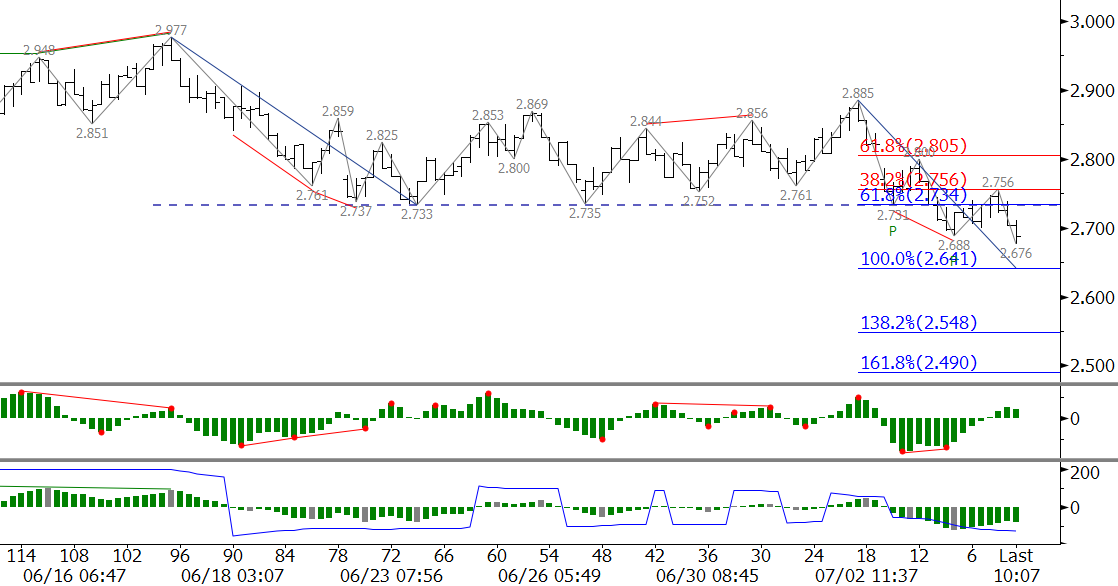

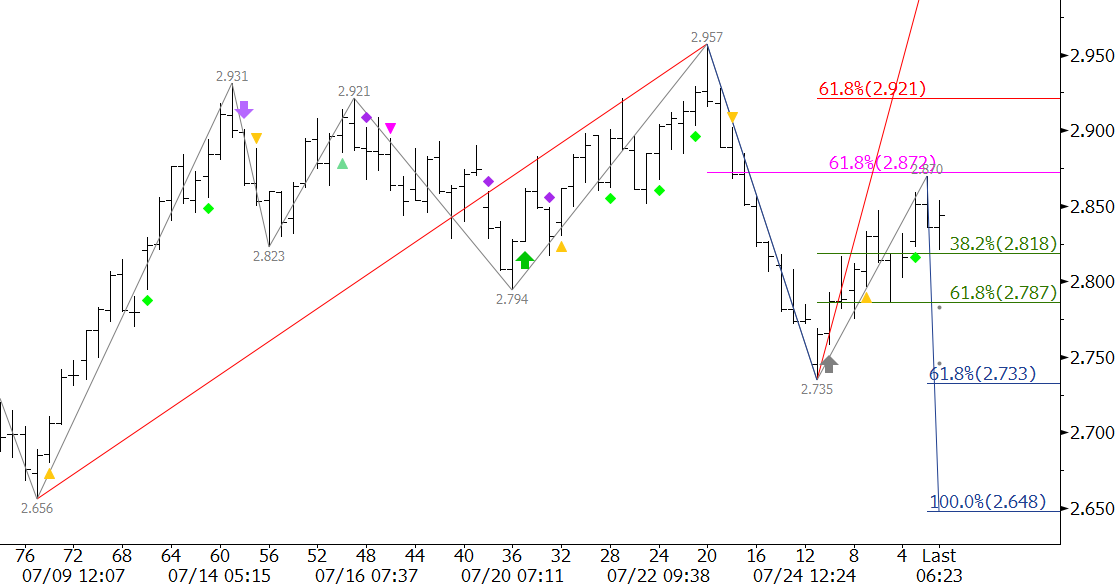

The gap lower from 224.107 on July 6th was the catalyst for the decline to 213.107. The wave 233.531 – 218.917 – 229.328 met its 1.00 projection at 213.107. This was also the 1.618 projection for the wave 229.328 – 221.095 – 227.473, and just below the 62 percent retracement from 206.813 to 233.531. The confluence of wave projections and retracements at 213.107 make it a decision point for a continued decline.

Taking out 213.107 would call for 203.5. The aforementioned waves down from 233.531 and 229.328 project to 203.5 as the 1.618 and 2.764 targets, respectively. This is also the 1.00 projection for the wave 227.473 – 213.107 – 219.898, and most importantly, the 0.618 projection for the large-scale wave 473.91 – 200.16 – 370.72. The importance of 203.5 make it a likely stalling point.

A sustained close below 203.5 would be the result of a deeply negative outlook for the global economy. In this case, the next targets would be 192.0 and 178.6.

Charts created using TradeStation. ©TradeStation Technologies, Inc. 2001-2015. All rights reserved. No investment or trading advice, recommendation or opinions are being given or intended.

That said, the move up from 213.107 is testing resistance at 220.9. This is the 38 percent retracement from 233.531, near the bottom of July 6th’s gap, and the midpoint of April’s candlestick. A close over 220.9 will call for 227.5. This is key resistance because 227.5 is in line with the 227.473 swing high, the top of the gap at 224.107, the 62 percent retracement of the decline from 233.531, and the 0.618 projection of the wave 206.813 – 233.531 – 213.107. A close over 227.5 would open the way for 238.1 and 248.1.

The upward correction was preceded by daily bullish divergences on the KaseCD, MACD, and slow stochastic. In addition, a bullish morning star setup and hammer has formed on the weekly chart. These factors indicate the upward correction might extend to fill the gap and test 227.5 before the decline continue. Overall though, with all factors considered, 227.5 is expected to hold and odds favor a decline to 203.5.

Send questions for next week to askkase@kaseco.com, and for our weekly energy forecasts visit www.kaseco.com/services/energy-price-forecasts/.

by Dean Rogers

by Dean Rogers